Everyone loves a solid dividend payout, because it’s a win for both sides. Shareholders get that nice, steady flow of extra cash without any additional effort, and it’s a very strong signal that the company’s doing good financially.

On the flip side, when businesses keep giving out dividends consistently, it shows they’re confident about making money down the road and they’re serious about keeping their investors happy.

Now add to this the company’s ability to make some solid profits on the money it invests as capital in the business and an enviable share price gain in over the years. Sounds like a great combination, right?

Here are two ‘Ratna’ awarded PSUs, backed by the Indian government that have delivered solid returns and dividends.

Coal India Ltd

Incorporated in 1973, Coal India Ltd is a ‘Maharatna’ company under the Ministry of Coal, Government of India with headquarters at Kolkata, West Bengal.

With a market cap of Rs 2,33,999 cr, Coal India Ltd is the single largest coal producing company in the world and one of the largest corporate employers.

The President of India holds 63% stake in the company through the Ministry of Coal, India. Life Insurance Corporation of India holds another 10% stake while the overall DII (Domestic Institutional Investor) stake is over 22% as of the quarter ending June 2025.

The company has a current dividend yield of 7%, which is the highest when compared to industry peers. The industry median dividend yield is just 3.6% (as per screener.in). In simple words, it means if the share price of the company is Rs 100, then Rs 7 is the dividend the shareholder receives for each share owned. Coal India has also maintained a strong dividend payout ratio of 46%.

Let us look at the other financials now.

The company’s sales were at Rs 96,080 cr for FY20 which has jumped to Rs 143,369 as for FY25. That is a compound growth of 8% in 5 years.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) for Coal India Ltd grew at a compounded rate of 17% from Rs 21,581 cr in FY20 to Rs 47,064 in FY25.

The net profits more than doubled from Rs 16,700 cr in FY20 to Rs 35,302 cr in FY25, logging in a compounded growth of 16%.

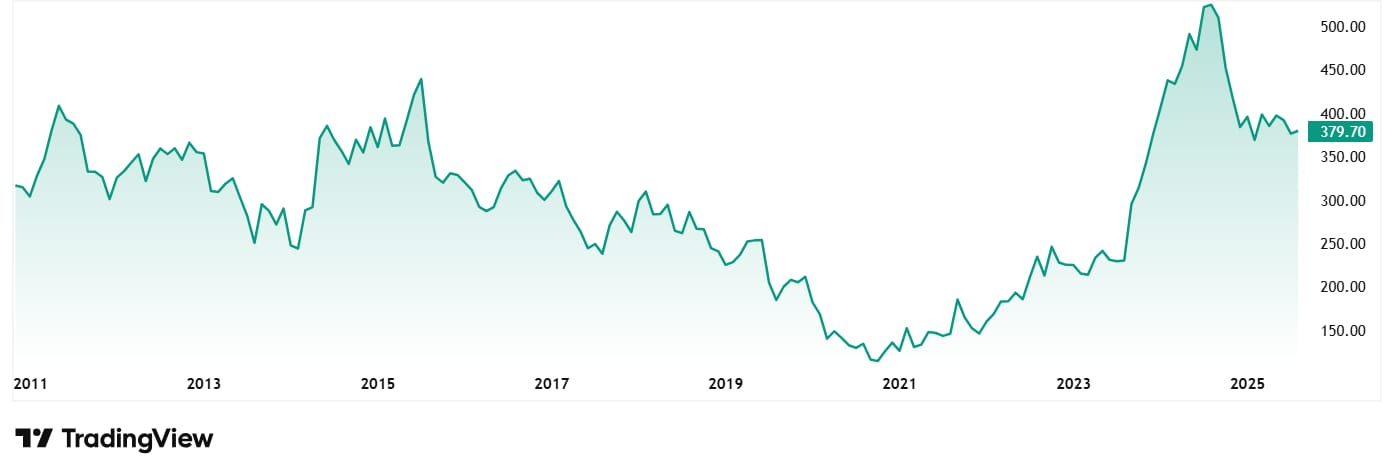

The share price of Coal India Ltd went from around Rs 130 in August 2020 (the pandemic period)to its price as of closing on 8th August 2025, which is Rs 380. That’s a jump of 192% in just 5 years.

If one had invested just 1 lac in the company 5 years back, it would today be over Rs 2.92 lacs today.

The current price of Rs 380 is over a 30% discount from the stocks all-time high price of Rs 545.

A Dividend Pillar with a Valuation Cushion

The company’s share is trading at a current PE of 7x, while the industry median is 12x. The 10-year median PE for Coal India Ltd is close to 8x.

When we look at Coal India, there are some things we must consider. Once the backbone of India’s energy sector, Coal’s demand saw a fast decline in demand over decades. This was a result of a mix of environmental, economic, and technological factors.

The global push for cleaner energy sources to control climate change put pressure on coal consumption significantly. India, which is a signatory to international climate agreements, actively started pursuing renewable energy alternatives like solar and wind. These green technologies slowly started eating away into coal’s economic advantage.

However, the transition to green energy is turning out to be a be a costly and complex process, requiring substantial investments in energy storage and grid upgrades. Add to it the need for rare earth minerals in their production, which makes it even more challenging to implement, especially developing countries like India.

Hence, countries like India are forced to turn their focus to Coal based power plants amongst others.

How this global leader will perform in the coming years will be a ride to watch.

National Aluminium Company Ltd

Incorporated in 1981, National Aluminium Company Limited (NALCO) manufactures and sells Alumina and Aluminium.

With a market cap of Rs 34,420 cr, this Navaratna Central Public Sector Enterprise under the Ministry of Mines, is one of the largest integrated Bauxite-Alumina-Aluminium-Power Complex in India and one of the largest integrated primary producers of aluminium in Asia.

The President of India holds a 51% stake in the company and the Life Insurance Corporation of India holds another 4%. Overall, FIIs (Foreign Institutional Investors) and DIIs (Domestic Institutional Investors) hold a little over 30% stake in the company as of the quarter ending June 2025.

NALCO has a current dividend yield of 4.3%, which is the highest when compared to industry peers (as per screener.in). The industry median dividend yield is just 0.11%. While NALCO’s dividend yield is lower than Coal India’s 7% number, the company makes up the gap with a solid share price performance. But first, let’s take a look at the financials.

The company’s sales have jumped from Rs 8,472 cr in FY20 to Rs 16,788 in FY25m which is a compound growth of 15% in 5 years.

EBITDA has seen an enviable jump Rs 487 cr in FY20 to Rs 7,508 in FY25, logging in compounded growth of a huge 72.5%.

The net profits grew at a compounded rate of 108% from Rs 136 cr in FY20 to Rs 5,268 cr in FY25.

Riding the Cycle: Unpacking NALCO’s Explosive Growth

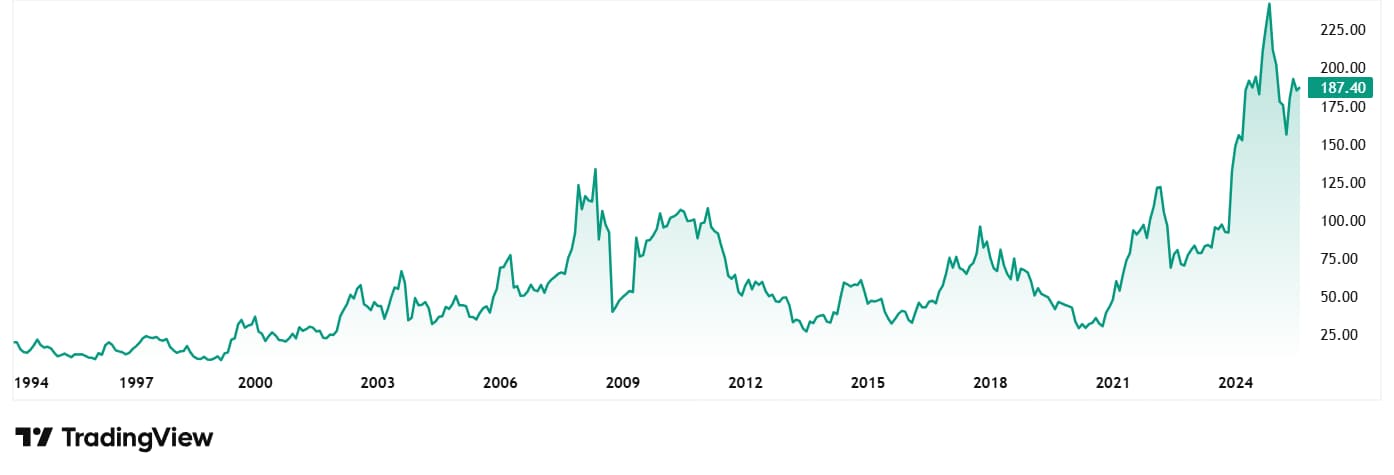

The share price of National Aluminium Company Limited was around Rs 35 in August 2020 (the pandemic period) which has grown to its current price of Rs 187 as of closing on 8th August 2025. This is a jump of around 434%. Rs 1 lac invested in the stock 5 years ago would have been around Rs 5.34 lac today.

At the current price of Rs 187, the company’s share is trading at a discount of almost 29% from its all-time high of Rs 263.

The share is trading at a PE of 6x while the industry median is almost 17x. The 10-year median PE of the company is 17x.

According to the company’s latest investor presentation from August 2025, Indian Aluminium consumption has grown at CAGR of around 9% in last 5 years and its demand is expected to grow at a CAGR range of 6.3 to 7.2 per cent till 2030.

However, the company is expecting some headwinds as Aluminium prices are likely to be affected due to uncertainty around economic developments and trade talks between US & China, India & Canada towards tariffs-reciprocal tariffs and timelines.

The Verdict: Should These ‘Ratnas’ Shine in Your Portfolio?

With their high dividend yields of 7% and 4.3% respectively, Coal India Ltd and National Aluminium Company Ltd should grab the attention of smart investors who are looking for making money from their investments, apart from the stock price gains. These stocks look interesting without doubt, but they do not come risk free.

Being in what we call a ‘Sunset Sector’, Coal India as we discussed earlier has faced issues in the past years due to the global push for green energy. It is however gaining its place back given the costs and other factors involved in the transition to green energy.

National Aluminium Company also has shown some super solid growth in the last 5 years but is not free from risk as the recent investor presentation says. The Tariff Wars that Trump has triggered might have an effect on Aluminium prices, which could break the company’s growth streak

For investors eyeing some passive income and growth, these 2 PSU’s have a mix of reward and risks. It should help to keep a vigilant eye on both stocks, follow their trajectories, consider the risks, and decide if want to add shine to your portfolio with these Ratnas.

Disclaimer:

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.