We have always heard the saying “Jal hi Jeevan hai” — water is life. Today, that proverb has a new context. Besides supporting life, water is now being decomposed to generate hydrogen, a clean fuel that could facilitate India’s twin aspirations of energy independence by 2047 and net-zero emissions by 2070.

Green hydrogen, generated by the electrolysis of water using renewable power or through biomass gasification, is a clean and sustainable substitute for fossil fuels. It has applications in mobility, steel, fertilizers, and as a backup to renewables. India has put hydrogen at the center of its energy transformation by launching the National Green Hydrogen Mission in January 2023, supported by Rs 19,744 crore with a production target of 5 MMT per annum (million metric tonnes per annum).

For investors, the industry is becoming increasingly impossible to overlook. It is where energy security, industrial decarbonisation, and international trade intersect. Early movers are placing themselves to guide an industry in its early stages — where performance, not hype, will be determining winners. This piece highlights five actual movers in India’s hydrogen scene and mentions their ambitions moving ahead.

#1 NTPC

National Thermal Power Corporation (NTPC) along with its subsidiaries/ associates & JVs is primarily involved in generation and sale of bulk power to State power utilities. Other businesses of the group include providing consultancy, project management & supervision, energy trading, oil & gas exploration and coal mining.

NTPC has made considerable advances in the hydrogen domain. In November 2024, it dedicated the world’s highest green hydrogen refuelling station at Leh, Ladakh. Fuelled by a 1.7 MW solar power plant and an alkaline electrolyser, the scheme generates approximately 80 kg of hydrogen per day to fuel five city buses. It is also India’s first PESO-certified 350 bar dispensing station.

The company has initiated a number of pilots. It operates green hydrogen microgrids at Dadri and Greater Noida. Hydrogen is being added to piped natural gas at Kawas. A one-tonne-per-day plasma gasification facility at NETRA and a seawater-based facility at Simhadri are under way and commissioning anticipated in FY26.

NTPC is also connecting hydrogen with carbon capture. It has a plant at Vindhyachal that makes 3,000 tonnes of methanol per year from CO₂ and hydrogen, demonstrating how the emissions can be converted into valuable products.

Looking forward, NTPC’s largest move will be the US$ 21 bn investment in a Green Hydrogen Hub at Pudimadaka, Andhra Pradesh. To be developed as India’s first integrated hub, it will merge production of hydrogen with green methanol, ammonia, and electrolyser production. The company’s future will be about scaling up such pilots, electrolyser capacity building, and driving India’s hydrogen economy.

If NTPC’s plan come together, backed by strong execution, the company has the potential of becoming a significant player in this domain.

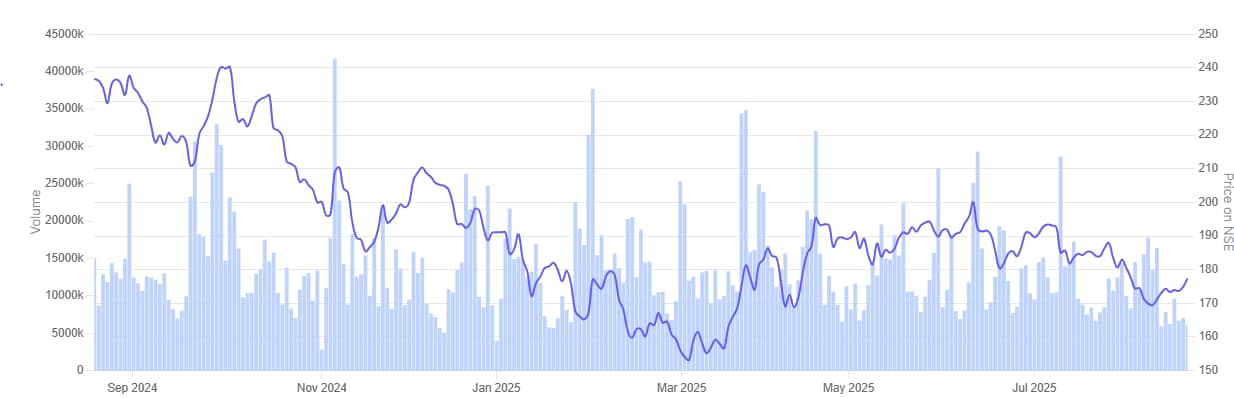

Over the last one-year NTPC share price corrected 16.5%.

#2 GAIL

Incorporated in 1984, GAIL, a Government of India undertaking, is an integrated natural gas company in India. It also has a joint-venture interest in Petronet LNG, Ratnagiri Gas and Power, and in the city gas distribution CGD business in several cities.

GAIL has wholly owned subsidiaries in Singapore and the US for expanding its presence outside India in the segments of LNG, petrochemical trading and shale gas assets.

GAIL has enhanced its Net-Zero ambition for Scope 1 and 2 emissions to 2035 from 2040. It is creating a sustainable value chain with emphasis on energy management, portfolio diversification, and project excellence.

The firm is also investing in renewable energy, hydrogen, Compressed Biogas (CBG), and other decarbonisation technologies.

One such significant milestone was the completion of its first Green Hydrogen Plant at Vijaipur, Madhya Pradesh. The 10 MW PEM electrolyzer unit has the capability to produce 4.3 TPD of high-purity hydrogen with the use of renewable power.

During FY 2024-25, the unit produced 120 MT of hydrogen, mixed with natural gas for captive consumption at Vijaipur. Arrangements are made to supply hydrogen to retail customers through high-pressure cascades. The plant is supported by a 10 MW solar venture at Vijaipur.

GAIL is also undertaking collaborative research. With BITS Pilani, it is formulating a chemical looping combustion (CLC) process for the production of high-purity hydrogen and minimizing CO₂ footprint. With IIT-BHU, it is implementing a compact, energy-efficient reforming unit with catalytic processes and membrane separation to make hydrogen from natural gas.

With CSIR-IIP Dehradun, it is researching Hydrogen Enriched Natural Gas (HENG) and its effect on home cooking burners, to allow for safe hydrogen blending in household gas.

These projects are in line with the National Green Hydrogen Mission and aid India’s shift towards a low-carbon economy. Again, while unlike NTPC, the company has yet to announce any massive investment, it is clear that GAIL is a serious player when it comes to this opportunity.

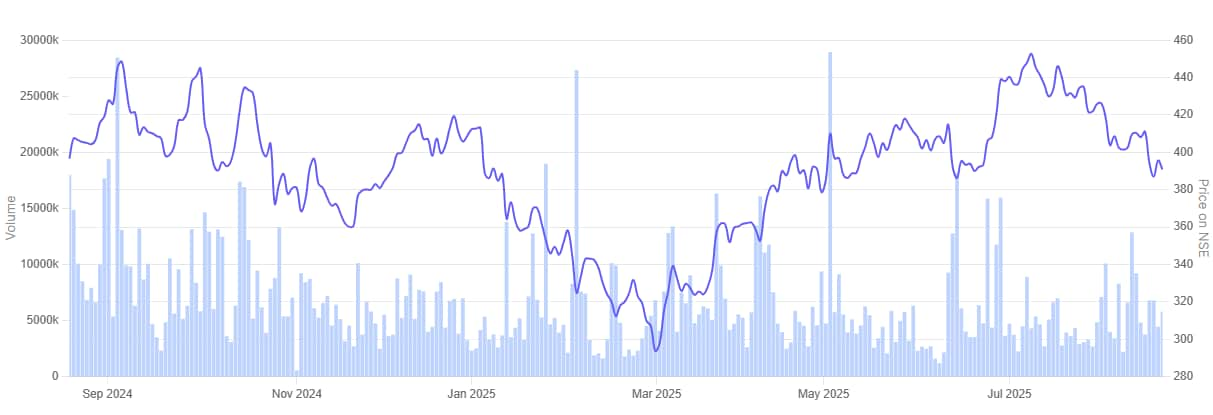

GAIL share price fell 24.8% in the past year.

#3 HPCL

Hindustan Petroleum Corporation (HPCL) is mainly engaged in the business of refining of crude oil and marketing of petroleum products, production of hydrocarbons as well as providing services for management of E&P Blocks.

HPCL has made aggressive moves in establishing its footprint in the hydrogen business. HPCL has already commissioned India’s first green hydrogen unit in a refinery at Visakh with a capacity of 370 TPA. For encouraging larger uptake, it has invited a global tender for purchasing another 5,000 TPA of green hydrogen and has promised to gradually ramp up hydrogen usage at its refineries.

The company’s long term target is to scale its green hydrogen production capacity to 16,870 TPA by 2027-28.

The growth of this portfolio is also funded through partnerships, such as feasibility studies with MAHAGENCO Renewable Energy. to build new hydrogen projects under its subsidiary, HPCL Renewable & Green Energy. These developments emphasize that hydrogen is being incorporated into operations as a long-term energy solution and not as a pilot activity.

This development is one of a series of HPCL’s efforts at its greater clean energy transformation, with hydrogen joining renewables and biofuels as one of its key pillars. The corporate goal is ambitious and involves reaching Net Zero Scope 1 and 2 emissions by 2040, ahead of national schedules, with hydrogen playing an important part in decarbonising activities and reconfiguring its energy mix for the future.

HPCL share price has fallen 1.4% in the past year.

#4 BPCL

Bharat Petroleum Corporation (BPCL) is a public sector company which is engaged in the business of refining of crude oil and marketing of petroleum products.

BPCL has taken concrete steps towards developing its hydrogen business. BPCL has already commissioned a 5 MW green hydrogen unit at its Bina Refinery to facilitate in-house production, and an integrated hydrogen unit and refuelling station at Kochi is close to commissioning. Additionally, it also has a 2 TPD pilot Green H2 project at Bina Refinery under construction.

In collaboration with BARC, BPCL is also installing India’s first indigenous alkaline electrolyser, with a 500 kW unit being installed at Kochi to facilitate local dispensing.

A key initiative is the adoption of Steam Methane Reforming (SMR) methods at the Mumbai and Bina refineries, now integrated with green hydrogen, which is expected to contribute nearly 15% of the company’s total emissions abatement.

Alongside, BPCL is developing biomass-based green hydrogen units at Kochi and Bina. It has also won a bid under SIGHT scheme for 2,000 TPA of green hydrogen under biomass pathway at INR 30/kg subsidy scheme.

To institutionalize its scaling up, the firm floated tenders for more hydrogen facilities and has also set up NeuEn Green Energy, a joint venture with Sembcorp, for renewable and hydrogen assets.

These steps put hydrogen as a key pillar of BPCL’s transition to clean energy, closely linked to its wider objective of developing a 10 GW (10,000 MW) green energy portfolio by 2035.

BPCL share price is down 8.5% over last one year.

#5 Adani Enterprises

Adani Enterprises has business interests in various economic areas such as mining, integrated resources management (IRM), infrastructure such as airports, roads, rail/ metro, water, data centres, solar manufacturing, agro and defence.

Adani Enterprises has proceeded decisively in the hydrogen domain, from idea to reality in a relatively short period. In June 2025, it launched India’s first off-grid 5 MW green hydrogen demonstration plant at Mundra, powered solely by renewables. This represents a key demonstration of cost-efficient, scalable hydrogen production.

With Adani New Industries (ANIL), the Adani group is establishing a complete hydrogen ecosystem. In FY25, ANIL won an order book for a 300 MW electrolyser plant and established an electrolyser test laboratory at Mundra.

Adani New Industries’ renewable energy segment — which includes integrated solar and wind manufacturing — recorded a 108% jump in earnings before interest, tax, depreciation, and amortisation (EBITDA) in FY25. This strong financial performance underpins the group’s ability to scale its green hydrogen ambitions.

In the future, Adani will increase electrolyser capacity over three giga-scale plants and couple it with gigawatt-scale renewables, under its USD 100 billion green investment initiative.

In brief, Adani has proceeded from pilot demonstration to manufacturing readiness, having a roadmap to scale up hydrogen production and commercial application in the next few years.

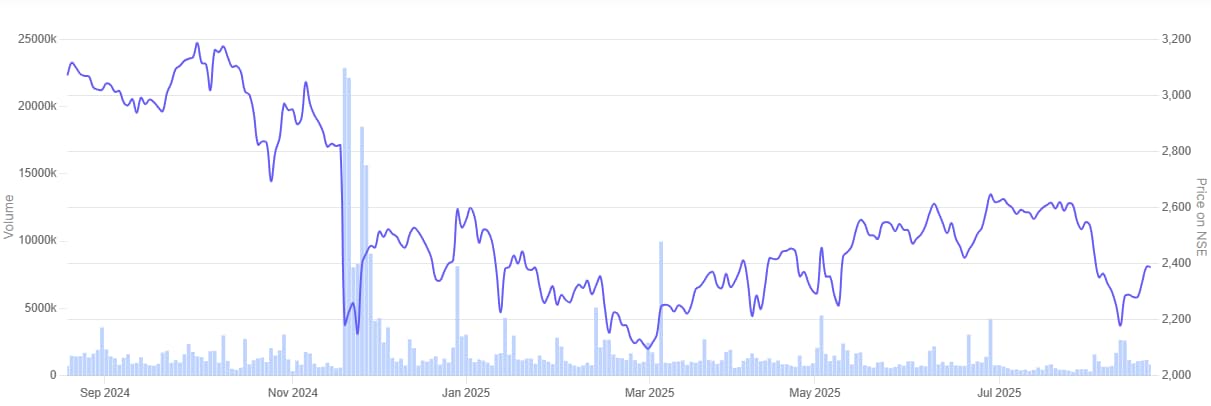

Adani Enterprise share price fell 22.1% in the last one year.

Adani Enterprise 1 Year Share Price Chart

Conclusion

Hydrogen could be the next big Indian energy story. The pilots and projects already in progress demonstrate that the intent is genuine, but intent and ambition do not make things happen. Scale, affordability, and steady execution will determine if hydrogen realizes its potential or becomes another niche pilot.

For those companies mentioned, hydrogen is merely a piece of a very big business puzzle. They are diversified energy players, and one cannot look at them from the hydrogen only perspective. In addition to tracking hydrogen developments, it is also necessary to consider valuations, financials, capital discipline allocation, and exposure to other businesses such as refining, petrochemicals, gas transmission, or renewables. It must also be said that the above list is not exhaustive there are several other companies that have started investing heavily in this space.

The potential is vast. If India is able to establish a competitive hydrogen economy, it can reduce emissions, lessen dependence on imports, and establish a new industrial base. But this is in the early stages, and the industry will push patience, capital, and technology to their limits. For now, hydrogen in India is a work in progress — and one that will require careful monitoring in the years to come.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.