At latest futures, FY22-FY23e Brent is 5-4%, FY23e deepwater and APM gas prices are 40-60% and FY22e LPG price is 22% above our estimates. Net impact of this, upside to NRL’s FY22e GRM and downside to ONGC’s FY22-FY23e gas sales, is upside to FY22-FY23e EPS of ONGC of 8-27%, OIL of 14-17% and GAIL of 27-6%.

APM gas price surge may pose challenge to Gujarat Gas (GGL), MGL and IGL as CNG price may need to be hiked by 49-53% in Oct’21-Oct’22 to pass on gas cost rise and maintain margins. Spot LNG surge may push GGL in the red in FY22e if there is no further price hike; downside to FY22e EPS would be 21% if further price hike lifts margin to Rs 4.5/scm (Rs 5.5/scm in base case).

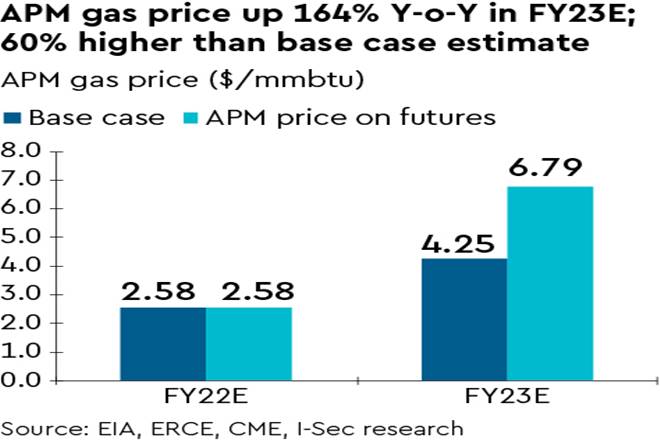

Upside to our FY22e-FY23e Brent, deepwater and APM gas at latest futures: On futures as of 8-Sep’21, FY22e-FY23e Brent at $70.7-67.5/bbl are 5-4% above our estimates. At HH and NBP gas prices based on latest futures, FY23e APM gas price at $6.8/mmbtu would be 60% higher than our estimate. Deepwater gas price at spot LNG futures as of 8- Sep’21 at $11.8/mmbtu is 40% higher than our estimate.

8-27% upside to ONGC & OIL’s FY22e-FY23e EPS: Factoring in Brent and LPG ($659/t) based on latest futures, NRL’s FY22e GRM at $37/bbl but lower than estimated gas sales volumes for ONGC, we estimate upside to FY22e EPS of ONGC at 8% and to that of OIL at 14%. Upside to FY23e EPS of OIL and ONGC is estimated at 17-27%.

27-6% upside to GAIL’s FY22e-FY23e EPS: At Brent and HH futures as of 8-Sep’21, GAIL’s FY22e-FY23e gas marketing Ebitda at Rs 19.4-27.4 bn is 30% below our estimates. However, company commentary in last two earnings calls suggests: (i) 20% of HH-linked US LNG would be sold at spot prices in FY22-FY23; (ii) 52.5-27.5% of US LNG in FY22e was tied up and hedged when Brent futures were at $54.3-65.7/bbl; and (iii) 50-15-15% of US LNG in FY23e was tied up when Brent futures were at $63.4-68.2/bbl. In this scenario (most likely), FY22-FY23e gas marketing Ebitda at Rs 52.2-48.6 bn is estimated to be 89-24% above base case.

21-107% downside to GGL’s FY22e EPS if gas cost rise is not fully passed on: At latest Brent and spot LNG futures, GGL’s delivered gas price for industrial consumers is estimated at $14.3-17/mmbtu in Q2-Q4FY22e. We estimate Ebitda margin at Rs 0.75/scm in Q2 and Rs 0.4/scm in FY22e if no further price hike is made. Further 38-47% price hike is needed on 1-Dec’21 for FY22e Ebitda margin to be at Rs 4.5- 5.5/scm. Downside to FY22e EPS would be 107-21% if margin is at Rs 0.3-4.5/scm.