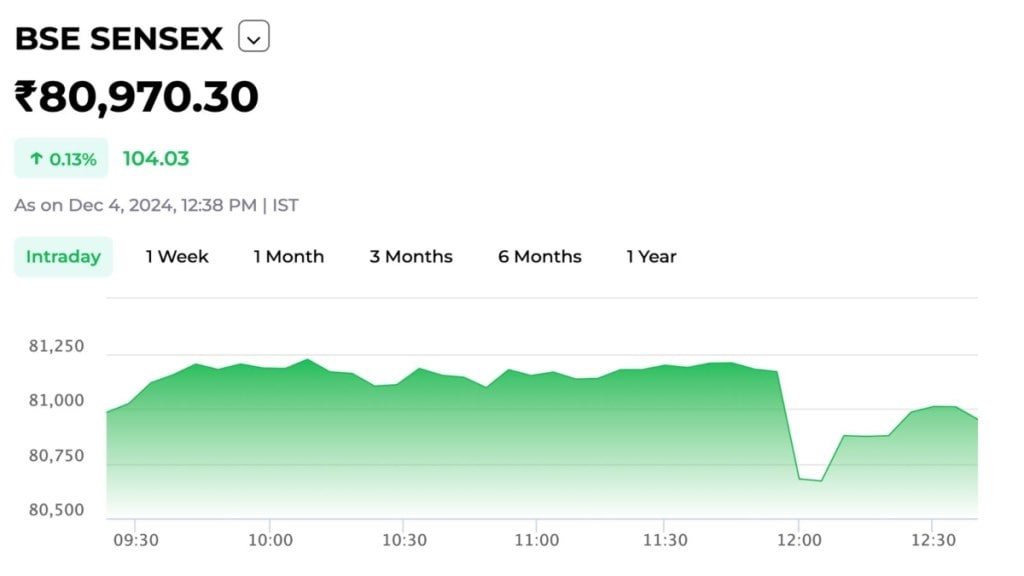

The Indian equity indices saw sharp selling after rallying on D-Street for the third day. The Sensex slipped 0.75% to a low of 80,630.53 after reclaiming the 81,000 level in early trade for the first time since October-end. The Sensex was buoyed by broad-based buying and the absence of any significant negative trigger. The benchmark index comprising 30 stocks jumped 400 points. It rose as much as 0.5% to 81,245.39. Meanwhile, the Nifty 50 fell 0.8% to 24,366.30 after surpassing the 24,500 mark. The 50-stock index rose 0.47% to 24,573.20, an intra-day high as of 1000 IST on December 04.

The broader markets too have participated. The Mid and the Smallcap indices have clocked significant gains and the breadth is evenly poised in favour of the advances. The early rally was led by tech, financials and select blue chips. Defence stocks too have seen a significant uptick on the back of the Rs 21,772 crore defence acquisition to boost Navy and coastal security.

Deepak Jasani, Head of Retail Research at HDFC Securities said, “The market momentum seen over the last few days is continuing and broader markets are also reflecting the trend. FII selling seems to have abated for the time being. This is one of the key sentiments driving upward movement. That apart from US-President Elect Donald Trump’s comments seem to signal favourable trends for Indian markets.”

Akshay Chinchalkar, Head of Research at Axis Securities outlined a near-term outlook and the key levels to watch out for on the Nifty- “The Nifty’s advance yesterday activated a head-and-shoulders bottom that targets an immediate hurdle in the 24600 – 24800 zone followed by a larger objective of 25500. On the downside, 24240 is immediate support followed by 24000. Notably, the percentage of stocks in the NSE500 above the 200-DMA has reached the highest since early November – the reading is currently at 59%. If it were to get past 64%, it would trigger a larger bullish thrust for stocks.”

What’s helping the rally?

Here is a quick look at all the factors that are helping the market movement at the moment –

1. Expectation of favourable monetary policy action

The RBI MPC meeting is starting today. The two-day meeting will culminate with the announcement from RBI on December 6. While the street is not expecting any significant rate action, there is hope for a CRR hike. This will boost liquidity in the market and the move would be considered favourable in the current backdrop of elevated inflation and slowing growth. According to Gaura Sengupta, Chief Economist of IDFC First Bank, “Some measures will also be needed to address liquidity tightness with weighted average call rate near the MSF rate over the last few days. System liquidity has turned negative due to the balance of payment outflows (FPI outflows and widening trade deficit). In response, RBI has net sold dollars worth $27 billion from October to November 22, resulting in a drain on rupee liquidity. Core liquidity surplus has reduced significantly to Rs 1.2 trillion as of November 22 from peak levels of Rs 4.6 trillion, as of September 2024. This indicates that liquidity tightness could persist if BoP outflows continue.”

2. Positive global cues- Trump’s comment seen as positive

The markets are also watching out for key data from the US including the US Payrolls data on Friday along with comments from US Federal Reserve Chair Jerome Powell on insights about the US rate trajectory.

Siddhartha Khemka, Head – Research, Wealth Management, Motilal Oswal Financial Services highlighted that the “Market will watch out for US Jobs data, November services PMI data of India and US. We expect markets to gain some momentum in the near term on the back of positive global cues, optimism around enhanced government spending and favourable monetary policy changes by the RBI.

3. FII selling abetting

The pace of FII selling has slowed down slightly after the Whopping outflows in October and November. So far, FIIs have net bought Rs 3400 crores in December. But if we tally the FII trend for the year so far, they have sold 2.96 lakh crore worth of equities.

4. Broad-based participation

The other key positive about the current rally is the broad-based participation in the market. The Nifty Midcap 100 Index is up 2.7% for the week and the Nifty Smallcap is also up by a similar percentage in the same period.