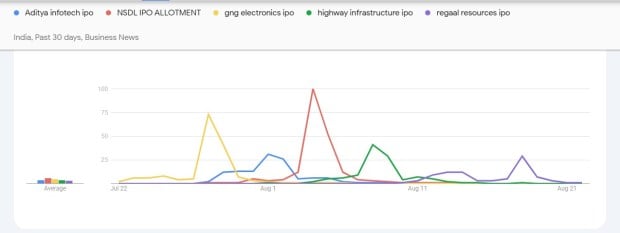

July and August have been buzzing with blockbuster IPOs. From Aditya Infotech’s record-breaking debut to NSDL’s swift subscription and the massive oversubscriptions of GNG Electronics, Highway Infrastructure, and Regaal Resources—here’s a roundup of the public issues that made headlines over the past month.

Aditya Infotech: Rs 1,300-crore issue delivers best 2025 debut

Aditya Infotech made a stellar debut on July 2025, listing at Rs 1,018 on the BSE and Rs 1,015 on the NSE—about 51 per cent above its IPO price of Rs 675. This marks the best mainboard listing of 2025 so far, surpassing GNG Electronics’ 49.8 per cent premium last month.

The Rs 1,300 crore IPO (Rs 500 crore fresh issue + Rs 800 crore OFS) was subscribed 100.7 times, led by QIBs at 133.2 times, followed by NIIs at 72 times and retail investors at 50.9 times. Funds will be used mainly for debt repayment and corporate purposes.

NSDL: IPO fully subscribed within hours of launch

NSDL (National Securities Depository) saw its Rs 40 billion ($458 million) IPO completely subscribed within just a few hours of launch on July 30, 2025. Exchange data showed bids were received for approximately 36 million shares, slightly exceeding the 35.1 million shares available.

The offering was priced at the top of its Rs 760–Rs 800 band, with Rs 12 billion already raised via anchor investors, including the Life Insurance Corporation of India and Capital International. The IPO, comprised entirely of an Offer for Sale by existing stakeholders, carried a P/E valuation of about 47x for FY25 earnings.

GNG Electronics: IPO subscribed 150 times, lists nearly 50% higher

On July 30, 2025, GNG Electronics’ IPO, valued at approximately Rs 460.43 crore (Rs 400 crore via fresh issue + Rs 60.44 crore via offer-for-sale), made a spectacular debut on the stock exchanges. The shares listed on the NSE at Rs 355, delivering a 49.8 per cent premium over the Rs 237 issue price, and on the BSE at Rs 350, marking a 47.7 per cent gain.

The IPO drew overwhelming investor demand, being subscribed 150.21 times overall. Broken down by investor category: QIBs subscribed 266.21 times, NIIs at 226.44 times, and retail investors at 47.36 times.

Highway Infrastructure: IPO subscribed over 300 times

The three-day IPO of Highway Infrastructure from Aug 5- Aug 7, valued at Rs 130 crore, drew extraordinary investor attention, garnering bids worth Rs 33,759 crore—a staggering 300.61 times subscription rate.

Institutional investors, in particular, led the charge, placing bids worth Rs 25,202 crore, while applications for 4,82,27,63,700 equity shares were received against just 1,60,43,046 shares on offer. The IPO was priced within a Rs 65–70 per share band.

Regaal Resources: IPO sees nearly 160 times subscription, strong listing

Regaal Resources’ Rs 306-crore IPO, launched between August 12–14 at a price band of Rs 96–102, saw overwhelming demand with bids 159.88 times the issue size. NIIs subscribed 356.73 times, QIBs 190.97 times, and retail investors 57.75 times.

The stock made a strong debut on August 20, listing at Rs 141.80 on the BSE and Rs 141 on the NSE—about 39 per cent above the issue price of Rs 102.