Diffusion Engineers Ltd GMP 2024 Highlights: The Diffusion Engineers IPO allotment will be finalised on October 1. All eyes are on that key data. IPO allotment for retail investors is mostly via a random lottery on the computer. This is because the shares on offer are significantly less than the application received. At the end of day 3 on September 30, the Diffusion Engineers IPO was subscribed 114 times. The retail segment alone is subscribed to 85x.

The Diffusion Engineers IPO is commanding a GMP or Grey market premium of Rs 60. This essentially means a premium of over 35% and the counter is expected to list at Rs 228 (upper limit of issue price at Rs 168 + today’s GMP of Rs 60).

Diffusion Engineers Ltd 2024 Highlights: Check Listing, GMP, Review, Subscription Status

Diffusion Engineers IPO finalised its share allotment on October 1. The issue opened on September 26 and the IPO closed on September 30. The company aimed to raise Rs 158 crore through a sale of 9.4 million fresh shares. It has been subscribed 114x as of the last update. The allotment status for your application can checked on the website of the registrar.

Read more: Diffusion Engineers IPO Allotment: Here’s how to check allotment status through a simple guide

"India’s heavy engineering capital goods industry is estimated to be Rs 3,100-3,200 billion as of fiscal 2024 and is projected to clock a CAGR of 7.5-8.5% over fiscals 2023- 27 to reach Rs 3,800-3,900 billion. Diffusion Engineers plans to take advantage of this growth-fueled environment by focusing on a strategic expansion into nickel, cobalt, and iron-based powder manufacturing for an enhanced welding consumables portfolio. The company also intends to expand its geographical reach and increase its exports through its subsidiaries and joint ventures. Further, the company is focusing on diversifying its Anti Wear Solutions and Heavy Engineering Equipment business into new industries and providing customized solutions for the same across various industries. Investors looking to invest can invest in the IPO for the medium to long term," said Master Capital Services in an IPO note.

The grey market premium (GMP) for Diffusion Engineers’ initial public offering (IPO) remains strong as the subscription period concludes today, September 30, 2024. Unlisted shares of the company are currently trading at a premium of Rs 58, indicating a 34.52% increase over the IPO’s upper price band of Rs 168, according to sources monitoring grey market activity.

Diffusion Engineers IPO allotment will be finalised today the counter will be listed on the exchanges on October 3.

Ador Welding and AIA Engineering are some of the closest peers of Diffusion Engineering.

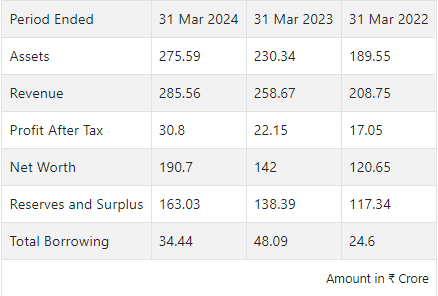

A comparison of the financials of the three highlight that Diffusion Engineering operates on a significantly smaller scale but the returns are similar or at par

Solar photovoltaic (PV) module manufacturer Vikram Solar has filed its draft red herring prospectus (DRHP) with SEBI to raise up to Rs 1,500 crore through an initial public offering (IPO). The IPO includes a fresh issue of shares worth Rs 1,500 crore and an offer for sale (OFS) of up to 17.45 million equity shares by the promoter group.

Vikram Solar, an integrated solar energy solutions provider, specializes in manufacturing solar PV modules and offers engineering, procurement, and construction (EPC) services, along with operations and maintenance (O&M) services.

The Company intends to allocate the net proceeds from the IPO for the following purposes:

1. Expansion of Manufacturing Facility: Funding capital expenditures related to the expansion of the existing manufacturing facility located at Khasra No. 36, 38/1, 38/2, 38/3, Khapri (Uma), Nagpur-441 501, Maharashtra, India.

2. Establishment of New Manufacturing Facility: Setting up a new manufacturing facility at Plot Nos. 33-B/1/1/ & 33-B/1/1/Part, MIDC, Hingna, Sonegaon District, Nagpur-440 016, Maharashtra.

3. Working Capital Requirements: Addressing the company’s working capital needs.

4. General Corporate Purposes: Supporting various general corporate initiatives.

Diffusion Engineers has appointed Unistone Capital as the sole book-running lead manager for its IPO, with Bigshare Services acting as the registrar for the public offering.

As of September 30, 2024, at 6:19:08 PM (Day 3), the Diffusion Engineers IPO has been subscribed 114.50 times overall. The subscription details are as follows: 85.61 times in the retail category, 95.74 times in the Qualified Institutional Buyer (QIB) category, and 207.60 times in the Non-Institutional Investor (NII) category.

"Diffusion Engineers specialises in manufacturing welding consumables, wear plates and heavy machinery for core industries. It provides repair and reconditioning services for heavy equipment and trades in wear protection powders and welding machines. Over the coming years, the company plans to enhance its service delivery by robust growth and operational efficiency. At the upper price band, the company is valuing at a P/E of 20.4x with a market cap of Rs 629 crore post-issue of equity shares and a return on net worth of 18.5%. On the valuation front, we believe that the company is fairly priced. Thus, we recommend a “Subscribe” rating to the IPO," said Anand Rathi Research in an IPO note.

The share allotment was finalised on October 01 after which credit of shares in D'Mat accounts will be on October 03. Following this, the refund will be initiated by the registrar on October 03.

Diffusion Engineers IPO allotment will be finalised today the counter will be listed on the exchanges on October 3.

Ador Welding and AIA Engineering are some of the closest peers of Diffusion Engineering.

A comparison of the financials of the three highlight that Diffusion Engineering operates on a significantly smaller scale but the returns are similar or at par

Diffusion Engineers will be listed on October 04 on NSE and BSE, as per the tentative schedule. Shares of Diffusion Engineers were fetching a premium of almost 36%, indicating a positive listing for the company's stocks.

Diffusion Engineers has exhibited consistent financial growth over the past few years, with revenue increasing from Rs 87.84 crore in FY 2013 to Rs 257.13 crore in FY 2024, reflecting a CAGR of 10.26% over the last 11 years. Profit After Tax (PAT) also grew from Rs 7.32 crore to Rs 23.40 crore, marking a CAGR of 11.14% during the same period.

Notably, Diffusion Engineers outperformed many industry peers with a 21% CAGR in operating income between FY 2021 and FY 2024, ranking third in the industry. Furthermore, the company achieved an impressive 38% CAGR in profit after tax and a 33% CAGR in EBITDA during this period, highlighting its strong profitability and efficient cost management.

Diffusion Engineers is expanding its international footprint, exporting products to over 25 countries, including Singapore, the United Arab Emirates, the United States, and Germany. The company has established overseas subsidiaries in Singapore, Turkey, and the Philippines, and has joint ventures in the United Kingdom and Malaysia, creating a diversified revenue stream and reducing reliance on the domestic market.

This global expansion is crucial for long-term growth, particularly as developing nations increase their demand for industrial products and infrastructure. In FY 2024, export sales contributed 10.2% to the company’s total revenues, underscoring the significance of international markets in its overall business strategy.

The grey market premium (GMP) for Diffusion Engineers initial public offering (IPO) remains robust as the subscription period closes today, September 30, 2024. Unlisted shares of the company are trading at a premium of Rs 58, reflecting a 34.52% surge over the IPO’s upper price band of Rs 168, according to sources tracking grey market activity.

The initial public offering (IPO) of Diffusion Engineers Ltd was subscribed 45.73 times by the third day of the bidding process, as of 11:24 IST, according to BSE data. The IPO received bids for 30.17 crore shares against the 65.98 lakh shares on offer.

Retail investors oversubscribed their portion by 50.21 times, while non-institutional investors subscribed 95.34 times. The qualified institutional buyers (QIBs) section saw a 51% subscription, and the employee portion was oversubscribed by 52.81 times.

Step 1: To check your allotment status, visit the official website of the issue's registrar. For Diffusion Engineers, Bigshare Services India is handling this responsibility. Open your browser and search for "Bigshare Services India."

Step 2:Once on the Bigshare Services website, locate and click on the "IPO Allotment Status" option, usually found on the left side of the homepage.

Step 3:On the next page, you will be prompted to choose one of three available servers. After selecting a server, enter the required details: either the company’s name, your application number, beneficiary ID, or PAN number (only one of these is needed).

Step 4: Complete the captcha verification and hit the search button. Your allotment status will then appear on the screen. If the shares are allotted, they will be credited to your Demat account by October 3. If not, the refund will be processed to your bank account on the same day.

As of September 30, 2024, at 6:19:08 PM (Day 3), the Diffusion Engineers IPO has been subscribed 114.50 times overall. The subscription details are as follows: 85.61 times in the retail category, 95.74 times in the Qualified Institutional Buyer (QIB) category, and 207.60 times in the Non-Institutional Investor (NII) category.

Diffusion Engineers Limited reported a 10% increase in revenue and a 39% rise in profit after tax (PAT) for the financial year ending March 31, 2024, compared to the previous year ending March 31, 2023.

Prashant Garg, Nitin Garg, and Chitra Garg are the company promoters.

For those looking to verify their allotment status, details will be available from October 1, 2024. The IPO allotment status for Diffusion Engineers is currently unavailable and will be provided once finalized. Investors can check their allotment by entering their PAN number, application number, or DP Client ID on the designated platform. If your allotment is successful, equivalent shares will be credited to your Demat account.

KRN Heat Exchanger wrapped up its IPO on September 28, while Diffusion Engineers is set to close its IPO on September 30. If you didn't receive an allotment for either of these issues and are considering purchasing them in the secondary market after listing, here's a comparison of both IPOs to help you make an informed decision on listing day. Read Here

Step 1:

You can check the allotment of shares on the website of the issue’s registrar. For this issue, Bigshare Services India is responsible for managing the registrar functions. Open your browser and search for Bigshare Services India.

Step 2:

Visit the Bigshare Services website and click on the "IPO Allotment Status" box located on the left side of the homepage.

Step 3:

Choose one of the three available servers, which will take you to a new page requesting details. Enter the required information—either the company’s name, your application number, beneficiary ID, or PAN number (you only need one of these).

Step 4:

Complete the captcha verification and click the search button. The allotment status will then be displayed on your screen. Successful allottees will have shares credited to their Demat accounts on October 3. If shares are not allotted, a refund will be processed to your bank account on the same date.

As of 11:24 IST, the initial public offering (IPO) of Diffusion Engineers Ltd has been subscribed 45.73 times by the third day of the bidding process, according to data from the BSE. The IPO attracted bids for 30.17 crore shares, significantly surpassing the 65.98 lakh shares available.

Retail investors demonstrated strong interest, oversubscribing their allocation by 50.21 times, while non-institutional investors subscribed at an impressive rate of 95.34 times. The qualified institutional buyers (QIBs) section saw a subscription rate of 51%, and the employee portion was oversubscribed by 52.81 times.

Diffusion Engineers is broadening its global reach, exporting products to more than 25 countries, including Singapore, the United Arab Emirates, the United States, and Germany. The company has set up overseas subsidiaries in Singapore, Turkey, and the Philippines, and formed joint ventures in the United Kingdom and Malaysia. This strategy not only diversifies its revenue streams but also lessens dependence on the domestic market.

This international expansion is vital for sustained growth, especially as developing countries increase their demand for industrial products and infrastructure. In FY 2024, export sales accounted for 10.2% of the company's total revenues, highlighting the importance of international markets in its overall business strategy.

The Anand Rathi Research Team commented on the valuation and outlook for Diffusion Engineers Limited, noting the company's specialization in manufacturing welding consumables, wear plates, and heavy machinery for core industries. In addition to producing these items, Diffusion Engineers offers repair and reconditioning services for heavy equipment and trades in wear protection powders and welding machines. Looking ahead, the company aims to improve its service delivery through significant growth and enhanced operational efficiency.

As the subscription period for Diffusion Engineers' initial public offering (IPO) ends today, September 30, 2024, the grey market premium (GMP) remains strong. Unlisted shares are trading at a premium of Rs 58, representing a 34.52% increase over the IPO’s upper price band of Rs 168, according to grey market sources. Read More

Diffusion Engineers has appointed Unistone Capital as the sole book-running lead manager for its IPO, with Bigshare Services acting as the registrar for the public offering.

Diffusion Engineers IPO includes a total offering of 94,05,000 shares, allocated as follows: 18,71,000 shares (19.89%) reserved for Qualified Institutional Buyers (QIB), 14,03,250 shares (14.92%) for Non-Institutional Investors (NII), 32,74,250 shares (34.81%) for Retail Individual Investors (RII), 50,000 shares (0.53%) for employees, and 28,06,500 shares (29.84%) for Anchor Investors.

Bigshare Services Pvt Ltd

Phone: +91-22-6263 8200

Email: ipo@bigshareonline.com

Website: https://ipo.bigshareonline.com/ipo_status.html