Bank stocks came under pressure on Wednesday, with the Nifty PSU Bank Index falling to its lowest level in eleven years. The PSU Bank index closed 0.81% lower at 1,865.90 points. Shares of private banks were hammered as foreign portfolio investors continued pare holdings in a risk-off trade.

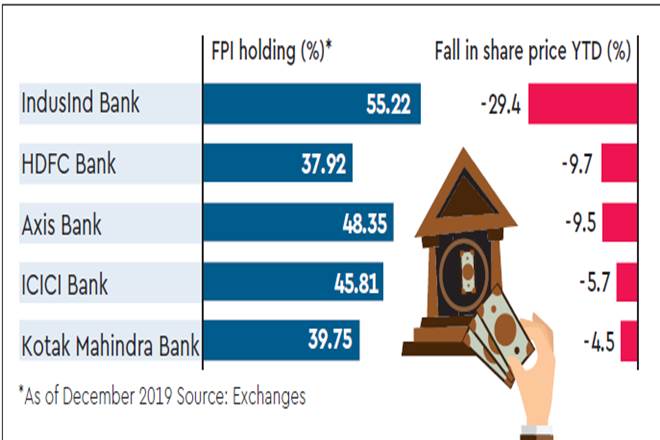

Foreign portfolio investors have sold shares worth $2.3 billion in the last eight sessions through Wednesday. Private banks stocks, where foreign investors have large holdings, fell the most amid concerns over slowing growth and sky-high valuations.

HDFC Bank, the largest private lender by market capitalisation in which foreign portfolio investors (FPIs) hold 37.9% of equity, plunged 4.12% – the highest intraday fall in the past one-and-a-half years. The stock recovered to settle at `1,148.85, down 2.8%.

The case was not different for other private lenders like ICICI Bank, Kotak Mahindra Bank, Axis Bank and IndusInd Bank. The combined market value of FPI holding in these five banking stocks stood at `6.5 lakh crore as on Wednesday’s close. Overseas investors hold 45.41% of equity in these five private lenders (as of December 2019).

Shares of IndusInd Bank, in which FPIs hold more than half of the equity, slumped to over three-year low on Wednesday as investors continue to worry over worsening asset quality and smooth transition to the new leadership of the bank.

Further, analysts also raised concerns on its exposure to stressed sectors like telecom and real estate. Deepak Jasani, head-retail research, HDFC Securities, is of the view that there could be two reasons that could explain the fall in private lenders. “Given that growth momentum is weak and credit growth is also slowing, investors may be of the view that the high valuations commanded by some of these stocks may not be justified. Also, the fresh sources of NPAs are expected to emerge.

The other factor could be that after the selling seen in the last few sessions, the weightage of private lenders may have gone up and, as a result, the FPIs are reweighting their portfolio.” He further said that if reweighting finishes, then they may stop selling. In the middle of February, global rating agency Moody’s Investors Service cut IndusInd Bank’s outlook to ‘negative’ from ‘stable’, citing a risk of further deterioration in asset quality.

The recent correction in these private lenders has brought their valuations down. For instance, the one-year forward price to book value (P/BV) of IndusInd bank declined to 2.2x from its five year average of 4.5x. Similarly, the P/BV of HDFC Bank came down to 3.7x from its five year average of 4.6x, Bloomberg data showed.

AK Prabhakar, head of research at IDBI Capital Market Services, said: “The coronavirus has created a panic selling across the board. Those stocks which were in the momentum and had run up a lot in the past are losing their track. The valuation of many of these stocks has turned reasonably well and give a great opportunity to enter.”