By Yoosef KP & Shashank Dipankar

The auto sector seems to have turned a corner with investors lapping up the heavily beaten stocks.

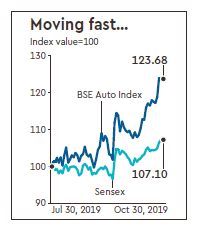

The BSE Auto Index, which had underperformed the benchmarks for nearly two years, has made a comeback in the last three months to emerge as the best sectoral index on the BSE after surging by over 24%.

As several auto companies announced that there was a rebound in demand during the festive season, the stocks continued their upward movement. Lower corporate tax rates and better-than-expected quarterly results from companies such as Tata Motors and Maruti Suzuki also supported the sentiment.

Interestingly, Maruti Suzuki, Bajaj Auto and Tata Motors topped the list of best performers on Sensex in the last three months with gains between 28.8% and 37.2%. Shares of Hero MotoCorp rose 18.8% during the same period.

Analysts at Dolat Capital say, though the festival cheer has given some boost to the sector, it is still early to call this a recovery. “The H2FY20 is likely to be difficult, with inventory clean up likely to gain steam with emphasis on bringing down inventory and BS6 transition, which may weigh down volume growth and pricing power,” it said in an investor note.

The recent rally has pushed up Maruti Suzuki’s m-cap by Rs 61,831 crore to Rs 2.3 lakh crore at the close of Wednesday. While Bajaj Auto saw its market value surging by Rs 22,015 crore to Rs 93,215 crore, the market capitalisation of Eicher Motors increased by Rs 17,345 crore in the last three months to Rs 61,440 crore.

A Tata Motors spokesperson said: “We are happy to share that the customers have responded well to our festive offers as reflected in 50% more retail during the Diwali period. Additionally, to double this joy, the day of Dhanteras alone saw a retail growth of 49%. Looking at the increasing interests of the customers, we are cautiously optimistic to expect some more growth while the offers last.”

While Tata Motors narrowed its September quarter loss to Rs 217 crore, Maruti beat the Street expectation with a net profit of `1,359 crore against the

Bloomberg consensus estimate of Rs 1,030 crore. Mahindra & Mahindra reported deliveries of 13,500 vehicles on Dhanteras, while Mercedes reported sales of 600 units on the same day.

Jaguar Land Rover (JLR), the luxury arm of Tata Motors, was back in the black, thanks to cost-cutting efforts undertaken by the company and a recovery in China. The JLR unit beat estimates by posting a strong Ebitda growth, with margins improving by nearly 1,000 bps sequentially, led by increased volume growth in China.

The stock of Tata Motors has rallied over 35% after the Q2 results.