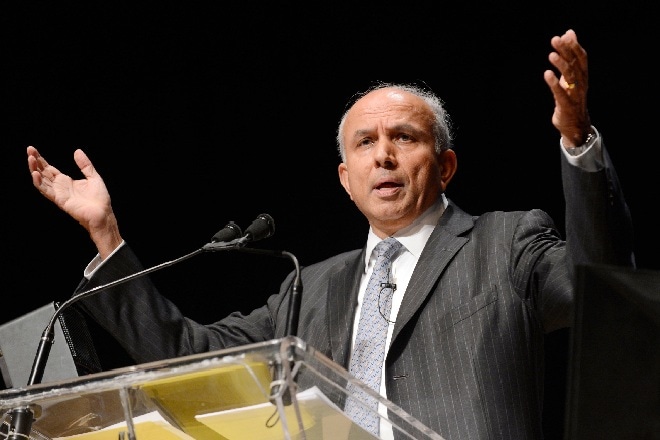

IRDA has turned down India-born Canadian billionaire investor Prem Watsa’s proposal to acquire the two-year-old reinsurance firm ITI Reinsurance from Sudhir Valia-owned The Investment Trust of India Ltd, due to some fundamental problems that violate the current regulations. Sudhir Valia is brother-in-law and an associate of Sun Pharmaceuticals promoter Dilip Shanghvi.

Watsa’s Go Digit General Insurance Ltd had signed the deal to acquire ITI Reinsurance Ltd from Fortune Financial Services of Sudhir Valia in June 2018 and had sought IRDA (Insurance Regulatory Authority of India) approval for the deal. Total deal value for 100% stake in ITI Reinsurance was pegged at about Rs 545 crore.

The insurance regulator is yet to inform the two parties the exact reason for rejecting the deal. However, sources told The Indian Express that ITI Reinsurance had received a license in 2016-end and has not done any business in the past two years. Therefore, Valia’s deal with Watsa would have been just a trading of license, which is not allowed under the regulations.

ALSO READ: IRDA proposes changes in registration norms for insurance marketing firms

Sources told the newspaper that the deal was signed months ago, but there was no monetary transaction as yet between the two until now. Also, the insurance regulator is unlikely to renew ITI Reinsurance’s license since the company has not done any business since it received the license.

On the other hand, Watsa is expected to review its plan to launch reinsurance company in India, the official added. It may be noted that Watsa had earlier applied for a reinsurance license in India under the name of Valueattics Re. However, he withdrew the application after the acquisition of ITI Reinsurance. In the first eight months of the financial year 2018-19, GO Digit General Insurance mobilised a premium of almost Rs 360 crore.