Large and mid-sized public sector banks are expected to continue growing their micro, small and medium enterprises (MSME) loan book in the current financial year, even though these loans account for the highest sectoral non-performing assets (NPAs) for them.

Sanjay Agarwal, senior director at CareEdge Ratings, said the key factor driving MSME loan growth is the profitability of such products. Agarwal says banks receive higher yields on MSME loans than corporate loans, and the segment is lucrative as banks can offer various services related to cash flow management, forex business and payments business to the MSMEs.

Also read: 55% of MSMEs use mobile hotspots to connect to the internet for daily activities: Report

“The MSME business is also geographically expansive in nature as businesses are spread across the country. Why banks are comfortable with MSMEs more than corporates is that the loans are granular and have lower ticket sizes,” Agarwal said. Unlike a Rs 500-crore large corporate loan, the MSME loan ticket size typically ranges between Rs 2 crore and Rs 25 crore, which makes it easier for lenders to create provisions and write off accounts in case of delinquency.

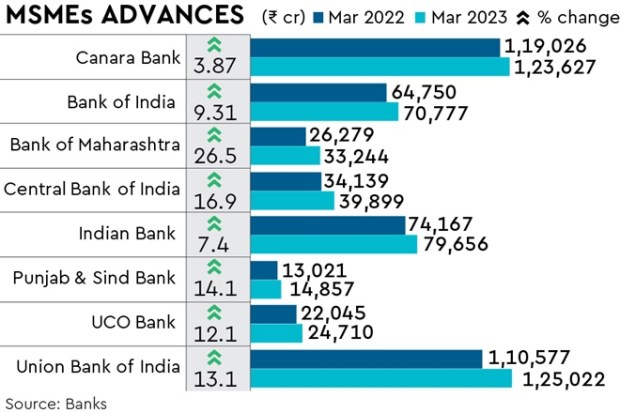

As per data compiled by FE, public sector banks, on an average, grew their MSME loans between 4% and 27% on a year-on-year (YoY) basis during Q4FY23. Canara Bank’s MSME advances rose 3.9% YoY to Rs 1.23 trillion as on March 31, while Union Bank of India’s MSME loans grew 13.1% YoY to Rs 1.25 trillion during the same period. Bank of India, Bank of Maharashtra and Central Bank of India, meanwhile, saw their MSME advances rise by 9.3% YoY to Rs 70,777 crore, 27% YoY to Rs 33,244 crore and 16.9% YoY to Rs 39,899 crore, respectively, as on March end. And the trend is likely to continue in FY24.

K Satyanarayana Raju, managing director and CEO at Canara Bank, said the bank has been able to sanction Rs 10,000 crore of MSME loans in the last one quarter. The bank has created area-wise products for tapping MSME loans of above Rs 2 crore to Rs 25 crore, with competitive pricing, he added.

Also read: Bidding on GeM Portal: How to apply for govt tenders; check detailed online step-by-step process

“Wherever receivables were ring-fenced, we were not so particular about collateral, but wherever ring fencing was not proper, partial collateralised rundown has been introduced and there we have seen that traction is very good. In the above Rs 2 crore segment, in the last one quarter, we could give Rs 10,000 crore of new sanctions for MSMEs. For low-ticket size loans also, we are digitising day by day,” the MD told FE. As per the Reserve Bank of India’s (RBI) latest sectoral deployment of credit data, banks’ loans to MSMEs grew 5.7% YoY to Rs 33.36 trillion as on March 24.

Higher NPAs

Despite lenders’ comfort with growing their MSME books, such loans contribute to a large number of NPAs for most banks. For instance, Union Bank of India saw Rs 1,077 crore of fresh MSME slippages in Q4FY23, second only to agriculture sector slippages, which stood at Rs 1,171 crore during Q4. The bank’s overall MSME advances stood at Rs 1.25 trillion as on March end, of which 12.5% of the advances have turned into NPAs, the highest amongst any other sectors.

Similarly, out of Canara Bank’s Rs 1.23-trillion MSME loan book, 9.62% advances have turned into NPAs, the highest of all other products. During a post-earnings call, the bank’s MD had said that out of the total Rs 11,895 crore of MSME NPAs, approximately Rs 1,500 crore-2,000 crore is secured by the government-backed credit guarantee scheme for MSMEs. The MD said on an overall basis, the lender has improved its underwriting standards for MSMEs, and in future the slippages from this sector could be lower as small-ticket size MSME loans, which typically show higher default rates, have largely been digitised with better monitoring standards.

According to Agarwal, overall MSME funding has increased over the past years as NPAs are moderating and delinquent accounts are being written off. “Since written-off accounts have been largely provided for, there is not much impact on bottomline,” he said.

MV Rao, MD and CEO at Central Bank of India, said the bank’s MSME loan book is not pure “24 carats”. “It continues to be under 18 carats only, but we have enough grip on the collections. And also, wherever any stress is there, we are really going into the issue. If some help is required, we are providing it. Otherwise, we are leaving the account to become an NPA,” the MD said during a post-earnings call.