IT firm Mindtree on Tuesday said it has formed a panel of independent directors to look into the unsolicited open offer by engineering major Larsen & Toubro and give its recommendations.

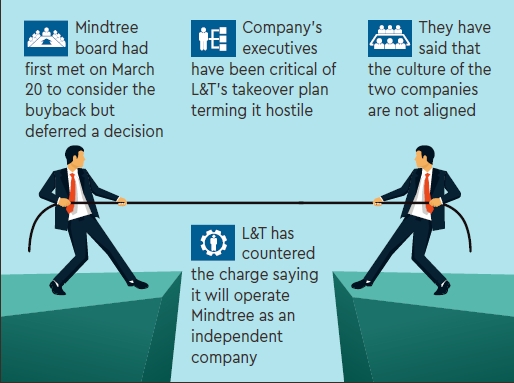

The firm’s board has also decided it will not move ahead with its share buyback plan.

The board formed a committee of independent directors under lead independent director and President, Jagran Prakashan Ltd., Apurva Purohit to provide its recommendation on unsolicited offer made by L&T, the firm said in a regulatory filing. “The board of directors of the company, at it meeting held on March 26, 2019, has decided not to proceed with a buy-back of equity shares of the company,” it said.

Also read| Sequoia-backed Stanza Living takes venture debt route to scale; competes with OYO Life

L&T has made an open offer to acquire over 5.13 crore shares, accounting for 31% stake, of Mindtree for Rs 980 per share aggregating to Rs 5,030 crore. “After detailed deliberations and discussions, the board in its meeting on Tuesday, decided to immediately constitute a committee of independent directors in the interest of all stakeholders to provide their reasoned recommendation in respect of the unsolicited offer by L&T for the consideration of the shareholders,” the filing said.

The IDC will consider and evaluate all aspects of the unsolicited offer, taking into account all relevant facts, circumstances, data related to the company and industry and the interest of all stakeholders involved.

As is known, Mindtree co-founders have opposed the bid of L&T to acquire it. “The committee will discharge the legal obligations placed on the independent directors under the prevailing regulations with respect to providing reasoned recommendations on the unsolicited offer by L&T,” the filing said.

The panel will have support of independent legal and financial advisors to help it with its deliberations, it added. L&T made an offer to buy up to 66% stake in Mindtree for around Rs 10,800 crore.

Besides the open offer, L&T has entered into a deal to buy Cafe Coffee Day owner VG Siddhartha’s 20.32% stake in Mindtree and has also placed an order with brokers to pick up another 15% of the company shares from the open market. The total transaction value for L&T is estimated to be around Rs 10,800 crore.

The L&T’s offer’s opening date will be May 14, 2019 and the closing date will be May 27, 2019. The last date by which a committee of independent directors of Mindtree is required to give its recommendation to the shareholders of the IT company is May 10, 2019, while last date for upward revision of the offer price and/or the offer size by L&T will be May 13, 2019, according to the filing on the exchanges.