Budget 2024 Highlights: In another five days, the much-anticipated Union Budget 2024-25 will be presented in the Lok Sabha by Union Finance and Corporate Minister Nirmala Sitharaman on July 23. Expectations have started flowing in from several sectors, including retail, real estate, Fintech, education, healthcare, edtech and others demanding tax reforms as well as more allocation for respective industries.

Finance Minister Nirmala Sitharaman is set to announce the Union Budget 2024-25 on July 23. Ahead of this event, healthcare industry leaders are stressing the urgent need to enhance quality healthcare in India.

Anil Matai, Director General of the Organisation of Pharmaceutical Producers of India (OPPI), expressed appreciation for the government’s efforts to enhance healthcare quality in India. He highlighted optimism about ongoing reforms aimed at fostering innovation and streamlining regulatory processes. Looking ahead to the upcoming Union budget, Matai emphasized the potential positive impact on the healthcare and pharmaceutical sectors. He urged the government to consider measures such as R&D expense deductions, research-linked incentives for multinational corporations (MNCs), and corporate tax concessions to spur R&D and innovation initiatives further.

As India prepares for Budget 2024, leaders from diverse sectors are advocating for policies that could transform the nation’s economic landscape. In the financial sector, there is a strong call to address disparities and improve operational efficiency. Akshay Sarma, Chief Financial Officer of axio, highlights key areas of concern

Ahead of the upcoming budget, it is crucial to tackle challenges in the finance sector. Resolving tax treatment disparities between banks and NBFCs is paramount. Granting TDS exemption under section 194A to NBFCs would ease liquidity strains. Additionally, enabling NBFCs to carry forward accrued losses in cases of amalgamation or demerger, similar to banks under section 72A, will support consolidation efforts in the sector.

"While the last budget heralded the highest ever allocation for education, a skilled workforce remains the cornerstone of India's growth story. The upcoming July 23rd budget must build on this momentum. Tax breaks for education loans, not just for higher education, but also for crucial vocational and skill-based programs, could empower millions. Imagine the impact if this budget incentivized educational institutions to improve their infrastructure, especially in technology and AI. This, coupled with stricter regulations to combat fly-by-night training operators who exploit social media, could revolutionize India's education and skilling landscape," Gaurav Bhagat, Founder, Gaurav Bhagat Academy.

The price of Indian rice exports fell even lower this week on expectations that New Delhi might ease export restrictions following a record surge in stocks. Meanwhile, Thai rates dropped to an 8-month low due to softer demand and higher supply. “Buyers are delaying purchases due to higher freight rates and expectation that India might lift some restrictions on rice exports, which is expected to bring down prices globally,” said a Kakinada-based exporter in India’s Andhra Pradesh state.

According to Ashwajit Singh, Founder and Managing Director, IPE Global (international development consulting firm), this will be a very important budget as it is time for the government to come in and continue the work. He stated that the government might focus on:

The Income Tax Calculator is a simple-to-use tool that is designed for all registered as well as unregistered e-filing users. It enables the users to calculate taxes according to the provisions of the Income Tax Act, Income-tax rules, and relevant notifications. Updated in line with the income tax changes proposed in the Union Budget for the 2024-2025 fiscal year, this online tool assists in estimating taxes accurately based on current income guidelines.

Taxation remains one of the hottest topics every time before the budget announcement as this is the most important topic that impacts a large number of taxpayers who timely pay their taxes to the government. This time is no different. To highlight how the tax slabs should be arranged based on inflation and what has happened in the past, Bankbazaar.com has come up with a study suggesting new tax slabs to rationalise the taxes in the country.

Dr. P N Arora, Chairman of Yashoda Super Speciality Hospitals, Kaushambi, said, “An essential component of healthcare requirements focuses on the accessibility and affordability of services. The industry promotes the idea of subsidies or complementary health screenings, particularly for women and children, in order to enhance preventive care and early disease detection. Furthermore, there is a movement towards providing incentives and assistance for the local production of medical equipment to decrease dependence on imports and align with the 'Make in India' initiative."

He further added that non-communicable diseases (NCDs) such as diabetes, cardiovascular diseases and cancer pose significant health challenges in India. There is a necessity for increased budgetary allocations to prevent, treat and manage NCDs, which includes backing research, public awareness campaigns, and making treatment options more readily available. The sector also stresses the significance of training and upskilling healthcare professionals to meet the changing healthcare needs with the help of new technologies.

In terms of health insurance, stakeholders are advocating for financial reforms to establish a more comprehensive and sustainable healthcare coverage model. This entails reevaluating GST rates on healthcare services and products to ensure affordability and accessibility for all socioeconomic groups. Moreover, there is a demand for insurance coverage for preventive healthcare measures, not just reactive medical treatments.

On July 23, Finance Minister Nirmala Sitharaman is scheduled to introduce the Union Budget 2024–25 in the Lok Sabha.

Yogesh Mudras, Managing Director, Informa Markets in India, said that the 2024 Interim Budget presented a strategy for a more comprehensive and prosperous India. The increased funding for the infrastructure sector to Rs. 11.11 lakh crores in the interim budget demonstrated the government's focus on developing the infrastructure of the future.

"In the upcoming general budget, we anticipate the funding for the infrastructure sector to exceed the amounts allocated in the interim budget. In order for the Indian economy to become the third largest in the next three years, the capital expenditure push across roads, railways, airports, and modern infrastructure upgrades will play a critical role in this. With a significant allocation for railways of Rs 2.52 lakh crore, following last year’s historic allocation of Rs 2.4 lakh crores, these funds are earmarked for the development of three major economic railway corridors and various modernisation projects,” Mudras added.

Tax receipts refer to the total amount of revenue collected by the government through various taxes imposed on individuals, businesses, and other entities within a specific period, typically a fiscal year. These receipts are crucial as they constitute a significant portion of government revenue, funding public services, infrastructure projects, social welfare programs and other essential expenditures. India’s tax receipts data reveal higher collections from direct taxes compared to indirect taxes over the past decade.

Through tax breaks, policy changes and subsidies, the Indian budget affects the industrial sector. An ongoing focus on increasing domestic manufacturing is anticipated this year, particularly in light of the 'Make in India' campaign. Most likely, the budget would strengthen and prolong the current tax benefits and subsidies to encourage the expansion of industry. For example, tax incentives for capital investments might be raised, and subsidies on energy and raw materials costs could be increased.

"In 2023, the manufacturing sector saw a 12 per cent growth in output, driven by policy support. With additional budgetary measures, we anticipate a further 15 per cent growth in 2024. These initiatives aim to increase domestic production, reduce import dependency, and create more jobs in the sector. The budget will likely reinforce subsidies and tax incentives, fostering a robust manufacturing environment and promoting economic growth," Gaurav Bhagat, Managing Director, Consortium Gifts, added.

In the face of economic inequality and growing food costs, Prime Minister Narendra Modi wants to mend fences with voters in the next budget by emphasising job growth and income increases. TDP and JD(U), two of Modi's regional partners, provide him with assistance because his party did not win a majority in the most recent election.

On July 23, Finance Minister Nirmala Sitharaman will unveil the union budget, which may include policies to boost local manufacturing, lower personal income taxes for some, and boost subsidies for food and housing in rural areas. It's anticipated that increased spending will leverage a record $25 billion payment from the Reserve Bank of India without increasing the deficit.

"India needs to become rich before getting old. Hence, Education remains critical to reaping demographic dividend and realising vision of viksit bharat. Overall, the focus of the Budget should be on 'Padhega India, Tabhi Toh Badhega India'," Abhishek Gupta, CEO, Rau’s IAS Study Circle, said.

Have a look at the top priorities for education sector:

1. Consistent increase in budgetary allocation to education is a welcome step. Budget should lay down a roadmap to increase expenditure on education to 6 per cent of GDP in line with National Education Policy 2020.

2. A comprehensive programme (on lines of Poshan 2.0) to improve learning outcomes at Primary Education through Early Childhood Care and Education, Teacher Training, Redesigning Curriculum etc.

3. Address the problem of higher dropout rate, especially for girls, in secondary education through an integrated approach encompassing poverty alleviation, upgradation of school infrastructure, vocational training etc.

4. Focus on enhancing employability of graduates through comprehensive schemes encompassing Industry-academia collaboration, curriculum upgradation, incubation centres etc.

5. Explore making apprenticeship as legal right to improve skill set of youths.

-The Finance Minister affirmed the continuity of current tax rates for direct taxes in FY 2024-25. Additionally, individuals earning up to Rs. 7 lakh annually will bear no tax burden under the new tax regime.

-Existing domestic companies will continue to be subject to a corporate tax rate of 22%, while new manufacturing entities will enjoy a reduced rate of 15%.

-Direct tax collections have surged over the past decade, growing more than threefold. Concurrently, the number of tax return filers has increased by 2.4 times.

-There has been a significant improvement in tax return processing times, decreasing from 93 days in 2013-14 to just 10 days in 2023-24.

-Proposals by the Finance Minister include extending the duration for specific tax benefits aimed at start-ups and investments made by sovereign wealth funds and pension funds. Furthermore, a tax exemption initially set to expire on March 31, 2024, for designated units in International Financial Services Centres (IFSCs) has been extended until March 31, 2025.

Harsimarbir Singh, Co-founder, Pristyn Care, says, "One of the key expectations from the Union Budget 2024 is the enforcement of more efficient compliance standards for the healthcare sector. By simplifying compliance procedures, it will not only assist new enterprises but also create an environment conducive to revolutionary advancements in health technology.

Sustained tax benefits and financial incentives are essential for enhancing early-stage investments. Hence, it is imperative for the government to concentrate on introducing a fresh and uncomplicated tax and regulatory framework, in addition to facilitating ease of funding and regulatory relaxations to stimulate entrepreneurship in the country.”

Suresh Rajagopalan, CEO- Wibmo, a PayU company, says, "As we approach the upcoming budget, it is crucial to prioritize the growth of digital payments through enhanced security measures and the establishment of a fraud data consortium. With the rapid expansion of digital payments, substantial resources must be allocated to fortify security infrastructure, ensuring that consumers and businesses can engage in transactions with confidence. The creation of a fraud data consortium would enable financial institutions and payment service providers to share information about fraudulent activities, fostering a collaborative effort to combat fraud."

Harsha Solanki, VP GM Asia, Infobip, says, "Expect to see increased allocation for technologies such as AI, IoT, and cloud computing, which are crucial for India's global competitiveness. Additionally, we hope for initiatives that will enhance digital infrastructure, particularly in rural areas, to bridge the digital divide and unlock the potential of the country’s vast talent pool."

Eswara Rao Nandam, CEO and Founder, Polymatech Electronics, a semiconductor chip manufacturer, says, "The Government of India has demonstrably committed to establishing the nation as a leading semiconductor hub. However, to ensure the long-term success and global competitiveness of this domestic industry, a multifaceted approach is necessary. Strategic investments in infrastructure development are paramount, with a particular focus on uninterrupted electricity supply, readily available water resources, efficient transportation networks, and a skilled workforce."

"Consistent access to electricity directly translates to uninterrupted production lines, minimized operating costs, and ultimately, a more competitive domestic industry. Semiconductor chip manufacturing necessitates a steady supply of various gases such as AR, N and H. A well-developed and efficient transportation network is crucial for the smooth operation of the semiconductor industry. This ensures timely delivery of raw materials and finished products, further strengthening the industry's competitive edge. By prioritizing and strategically building this critical infrastructure, the government can mitigate potential risks and make the entire sector more resilient," Nandam adds.

Finance Minister Nirmala Sitharaman is scheduled to unveil the Union Budget for fiscal year 2024-25 on July 23, beginning her speech at 11:00 am in Parliament. The Financial Express will run a live blog on Budget day, featuring real-time updates, analyses, and reactions from Indian Inc. The budget presentation will be streamed live on the Finance Ministry's official website (http://www.finmin.nic.in) and broadcasted on Doordarshan and Sansad TV.

TDS provisions undergo regular updates to accommodate changes in the business environment, including emerging sectors such as digital platforms and online gaming. These provisions, spanning over 40 sections with rates varying from 0.1% to 40%, demonstrate their wide applicability, affecting both residents and non-residents. The frequent amendments to TDS/TCS regulations have heightened compliance complexities, particularly burdensome for MSMEs with limited administrative resources.

Read more: Budget 2024: Streamlining TDS / TCS provisions is the need of the hour – Here’s why

Anil Matai, Director General, Organisation of Pharmaceutical Producers of India (OPPI) highlighted that to accelerate R&D and innovation, we urge the government to explore methods to incentivize R&D investments, such as deductions on R&D expenses, research-linked incentives for MNCs, and corporate tax concessions. Sudarshan Jain, Secretary General, Indian Pharmaceutical Alliance said that 2024-25 budget should introduce policies that provide direct and indirect tax benefits to encourage research and investment in becoming global benchmark in quality.

Read more: ‘Need to introduce policies to provide direct and indirect tax benefits for R&D and investments’

The current standard deduction limit under both the new and old tax regimes stands at Rs 50,000. Typically, senior citizens utilize this deduction against their pension income. Given the rising cost of living, it would be advisable to consider increasing this deduction limit to Rs 1 lakh. Read more.

The Railway Budget is the annual financial plan of the Indian Railways, detailing expenditures to meet revenue goals and advance railway network expansion. It incorporates a detailed assessment of the previous year's financial outcomes, encompassing actual revenues and expenses. Read FAQs on Railway Budget.

Heeralal Doshi, Founder and Chairman at Kinjal Group, says, "As announcement of the Union Budget 2024-25 comes near, India's real estate sector awaits significant policy shifts under the Modi 3.0 govt. With growing demand for housing, offices, and commercial zones, we hope for tax incentives and infrastructure upgrades to improve urban living and boost growth in emerging areas. Granting 'industry status' to the housing sector could incentives growth and attract significant investment."

"Additionally, the introduction of a single window approval system for real estate construction would also streamline processes, reduce delays, and boost efficiency across the sector. The EPC sector in India needs more investments and clearer regulations to thrive. New tax rules can help EPC firms overcome challenges and innovate. The upcoming budget is also set to focus on smart cities, renewable energy, and high-speed rail, aiming to modernize infrastructure and drive economic growth," Doshi adds.

Kaushal Agarwal, Chairman, The Guardians Real Estate Advisory says, "With a rising demand for housing, we are hopeful for adjustments in tax policies and incentives aimed at both homeowners and developers. Initiatives such as the Credit-Linked Subsidy Scheme (CLSS) under PMAY, which promotes affordable housing, show potential for increasing demand in both urban and rural areas."

"As the budget approaches, the real estate industry seeks a comprehensive strategy that not only strengthens current efforts but also provides the framework for long-term and inclusive real estate development across the country," he adds.

According to the FICCI Economic Outlook Survey, the GDP growth for 2024-25 is forecasted at 7.0%, with CPI inflation projected to be 4.5%. Indian economy continues to standout, but global headwinds and inflation warrant caution, the report says, adding that the Budget 2024-25 should focus on taxation reforms, employment generation, innovation and sustainable development.

Milin Bakhai from N.A. Shah Associates highlights Modi 3.O's emphasis on job creation, promising "Modi Ki Guarantee" on employment. The administration plans reforms to foster labour-intensive growth in sectors like Infrastructure, Agriculture, Tourism, Healthcare, MSMEs, and Green Mobility.

Proposed amendments to Section 80JJAA of the Income Tax Act aim to raise the salary cap to Rs 50,000, adjusted for inflation since 2016. To aid capital-intensive industries with fewer hires, costs for training or upskilling employees may qualify for deductions. Flexible criteria for workforce increases could accommodate high attrition sectors.

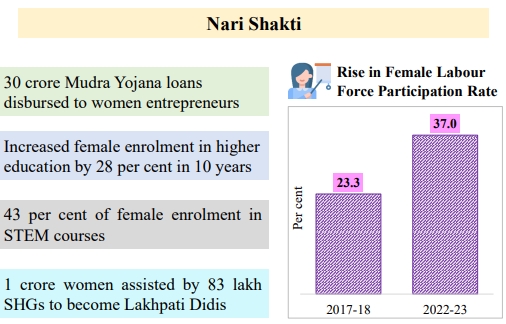

There has been a rise in female labour force participation rate. From 23.3% in 2017-18 to 37% in 2022-23, data from the interim Budget showed.

In the interim Budget, one of the focus areas was welfare of farmers. For that, the finance minister said that a direct financial assistance to 11.8 crore farmers under PM-KISAN scheme is given, crop insurance to four crore farmers under PM FASAL BIMA Yojana, and integration of 1,361 mandis under e-NAM supporting trading volume of Rs 3 lakh crore.

In the interim Budget, Finance Minister Nirmala Sitharaman had said that there has been increased allocation in PM-SHRI scheme from Rs 4,000 crore (BE) to Rs 6,050 crore (BE). The number of IITs increased from 16 in 2014 to 23 in 2023, while the number of AIIMS increased from 7 in 2014 to 22 in 2022.

From 723 universities in 2014, the number has increased to 1113 in 2023.