After facing a strong hurdle at the weekly resistance levels and unable to close past them, the indices dropped into an intermediate downtrend in the last week and have closed near the important weekly support level of 5,030 for the Nifty and 16,895 for the Sensex. If these indices continue to stay below this weekly support level in the coming week, we are likely to see lower levels towards the next support of 16,000 for the Sensex and 4,745 for the Nifty or even lower.

The weekly MACD indicator for the indices has been exhibiting a negative divergence suggesting a loss of momentum at higher levels. This was indicated by me in my earlier articles. In the last two weeks, the daily momentum indicators were also exhibiting a negative divergence and with the indices now dropping into an intermediate downtrend in the last week, we could see lower levels once the Sensex stays below the weekly support of 16,895 and the Nifty below 5,030. If this support holds, than we could see a minor rise towards the 20 DMA which is at 17,450 for the Sensex and 5,210 for the Nifty. However, with both the weekly and the daily momentum indicators exhibiting a negative divergence, and with the downside momentum quite strong as we saw in the last week, the possibility of the indices drifting lower are higher.

Scores of stocks have dropped into a fresh intermediate downtrend in the last week and the targets for the Sensex and the Nifty to get back into a fresh intermediate uptrend is at 17,713 and 5,292.50 respectively. The equivalent level for the CNX Mid Cap index to get back into an intermediate uptrend is at 7,885.35.

All the indices ended in red in the last week as the Sensex lost 3.96% and the Nifty ended 4.12% lower. Among the sectors, the BSE Realty sector was the largest loser ending 7.97% lower and was followed by the BSE Capital Goods sector which lost 6.51%. On the stronger side, the indices which registered the least loss were the BSE Auto sector which lost 0.55% and was followed by the BSE Consumer Durable index which lost 0.91%.

Many stocks have already dropped below their weekly supports and are headed lower while a few stocks have even broken below their monthly supports and are weak and could be shorted after a minor rise in the coming week.

Investors must wait for the current intermediate downtrend to end before looking for long positions. Look for sectors and stocks which exhibit a higher relative strength and use the current decline to switch from weak stocks and get into strong stocks.

One of the sectors which is looking weak is the realty sector and investors must look to stay away from this sector. Use any minor rise in the coming week to look for short positions in this sector. I will discuss a few stocks today which will give traders a good opportunity on the short side.

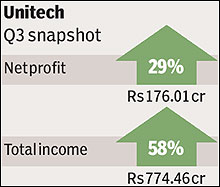

Unitech is in an intermediate downtrend and has been witnessing a large swing between 72 and 92 in the past few months. The stock has been staying below its 20 WMA while the indices and majority of the stock are staying above this weekly moving average. The weekly and the daily momentum indicators are in the sell mode and once the stock drops below 72, lower levels are expected. The support is at 69 and once the stock closes below 69, it will head towards the next support which is quite far away and is at 27. Use minor rise towards the resistance of 85 to take up short positions. Book partial profits at the support of 69 and if the stock continues to drop below this support hold on to the short position.

India Bulls Real Estate is another stock which has been exhibiting a bearish relative strength suggesting that the stock has underperformed in the current bull run. Like Unitech, the stock has been trading below its 20 WMA for a while and is near the second weekly support of 184. A close below this support will result in the stock heading towards the next support which at 106. As the stock has seen a strong decline in the past few days, position traders must wait for a minor rise in the coming week before looking for short positions. The daily and the weekly momentum indicators are below their trigger lines and suggest more weakness.

DLF is also exhibiting a bearish relative strength and investors must make sure that they hold on to only strong relative stocks and switch over from weak relative strength stock. The stock is also below its 20 WMA and is closer to the final support on the weekly chart which is at 326. A close below this level suggest lower levels towards the next support of 190. If the indices continue to decline, weak relative strength stocks will outperform on the short side and traders must look for shorting these stocks. However, wait for a minor rise in these stocks in the coming week.

For more details contact mayur_s@vsnl.comp