Recently, the social media saw significant furore when Akshat Shrivastava, a finfluencer, claimed that “China’s net exports is almost 26% of India’s GDP.”

The first question that comes to mind is ‘really, is that so?’ That’s exactly why there needs to be a clear analysis of the metrics against which we can compare the GDP growth of both countries, with very different dynamics. Financial Express.com decided to reach out to a host of experts and understand the analogy.

India Vs China: Are the two economies on even keel?

Some of the leading economists and experts on the country’s economic growth highlighted the glaring anomaly in the comparison –

Nilesh Shah, MD – Kotak Mahindra AMC highlighted that , “India and China were of similar size in the 80s. Today China is 5 times bigger than India. Undoubtedly China has grown faster than any other economy including India in the last 4 decades. Their execution capabilities are unmatched as there is no room for dissent in China (Compare our Mumbai Sealink execution with China Hongkong Sea Bridge). Not only they built a hospital in 7 days in Wuhan but also ensured that Wuhan virus became Covid virus.China could recruit thousands of scientists and engineers (without worrying about quota and pay commission) from western world at attractive pay packages to manage chips sanctions of the US.”

The post on X mentions, “China is building next gen exports in robotics, semiconductor, AI etc. India: ? (not sure what exactly are we doing) Our biggest hope seems to be: export smart people to other countries. And, they send money back in the form of remittances.”

Gaura Sen Gupta, Chief Economist, IDFC First Bank seems to have a different take on this – “A large part of China’s rapid growth took place when global growth was strong and global demographics were better. Now to replicate the same growth model in a slower growing and aging global economy would be difficult.”

India Vs China: What’s the export picture like?

A recent projection by commerce and industry minister Piyush Goyal indicates that “India’s exports of goods and services may cross $800 billion in FY25, a record, keeping in view global economic uncertainties.” Just to compare the extent of growth, exports stood at $778 billion in the last fiscal – FY24 as per the data shared with the Ministry of Commerce and Industry.

Moreover, the Commerce Ministry data also indicates that India’s overall exports, including merchandise and services, grew 4.86% YoY reaching $393.22 billion between April- September or the first half of FY25.

Meanwhile, Chinese Govt data indicates that “exports grew 7.1% YoY to 25.45 trillion yuan (approximately $3.66 trillion) in 2024, while imports expanded 2.3% YoY to 18.39 trillion yuan (approximately $2.65 trillion). At a government press conference held in Beijing on January 13, GAC deputy head Wang Lingjun said that China’s foreign trade growth in 2024 was relatively fast – “China’s December 2024 imports and exports hit record monthly highs and “exceeded 4 trillion yuan (approximately $576.20 billion), up 6.8% YoY. Foreign trade jumped to 11.51 trillion yuan (approximately $1.65 trillion) in the fourth quarter of 2024, with the quarterly growth rate also quickening by 0.4 percentage points compared to that in the third quarter of 2024.”

India Vs China: Trade Deficit or Trade Surplus

China announced that its trade surplus reached almost $1 trillion in 2024. Meanwhile, the December trade deficit data for India shows significant narrowing down on a month-on-month basis. However, for the financial year so far, trade deficit has widened to $210.8 billion in FY25 (Apr-Dec) Vs $189.7 billion deficit in FY24. This is primarily on the back of higher crude imports. Crude oil imports from Russia currently account for 39% share in FYTD25 (in volume terms), similar to last year and the data indicates higher volumes and lower discount on imports from Russia contributed to the numbers.

Gaura Sen Gupta of IDFC First Bank pointed out that “India’s growth model has remained domestic demand driven and yes the share in global trade is limited. India’s merchandise exports account for 1.8% share globally and the share has stagnated here over the last few years. However progress has been made on services sector front with India’s share in global exports gradually rising to 4.3% from 3.4% five years back.”

She believes it is “better” instead to focus on domestic demand with India’s positive demographics which will last for more than 25years. On the export front, focus will be required to move up the value chain as domestic labour cost rise.”

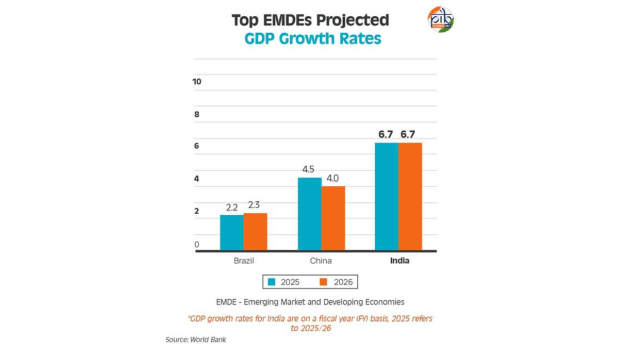

India to remain fastest growing Economy

India is set to dominate as the fastest-growing large economy for the next two fiscal years. This is as per the January 2025 edition of the World Bank’s Global Economic Prospects (GEP) report. This report projects India’s economy to grow at a steady rate of 6.7% in both FY26 and FY27, significantly outpacing global and regional peers. This is in comparison to projected global growth of 2.7% in 2025-26.

Complementing the World Bank report, the latest update from the International Monetary Fund’s (IMF) World Economic Outlook (WEO) also reinforces India’s strong economic trajectory. The IMF forecasts India’s growth to remain robust at 6.5% for both 2025 and 2026, aligning with earlier projections from October.

However, there have been some concerns about the pace of growth rate slowing from the earlier projected 7% plus numbers. Dipti Deshpande, Principal Economist, Crisil explained that,“India’s GDP growth rate slowed to 6.4% in fiscal 2024 led by a lower fiscal impulse and high interest rates and stricter lending norms weighing on urban demand. The Indian economy however continues to hold the position as the fastest-growing major economy. Private consumption, which lagged last year, picked up in the current fiscal lifted by rural demand. Meanwhile consumer price inflation is taking baby steps towards the central bank’s target. Despite the softening, food inflation remains elevated and has been a major hurdle for policy rate cuts.”

She added that “even as geopolitical uncertainty remains elevated, India’s growth remains domestically driven. Its external sector too displays resilience supported by a low current account deficit, adequate foreign exchange reserves, and a comfortable external debt situation.”

What can we conclude?

Discussions with experts and probing into several reports indicate that in pure number terms there might be merit in Akshat Shrivastava’s claims but may not be totally in current context. As Nilesh Shah of Kotak Mahindra AMC explained that the economic models of India and China are not strictly comparable given the political structure – “The economic model of autocratic China is very different from the rest of the world. It will be difficult for any democracy including India to follow the same. India has to grow within its culture and values. This is possible by allowing our entrepreneurs free hand. We have improved our ease of doing business but it needs to leap frog to compete with China.”

Ahead of the Budget, the focus needs to be on driving consumption and giving impetus to capex that significantly suffered in 2024. The inflation, especially the food inflation continuing around 9% levels is another niggling concern. That in many ways has been a restricting factor for the RBI in being more aggressive with rate cuts and pushing forth steps that can enable a jump start in consumption and capex levels.