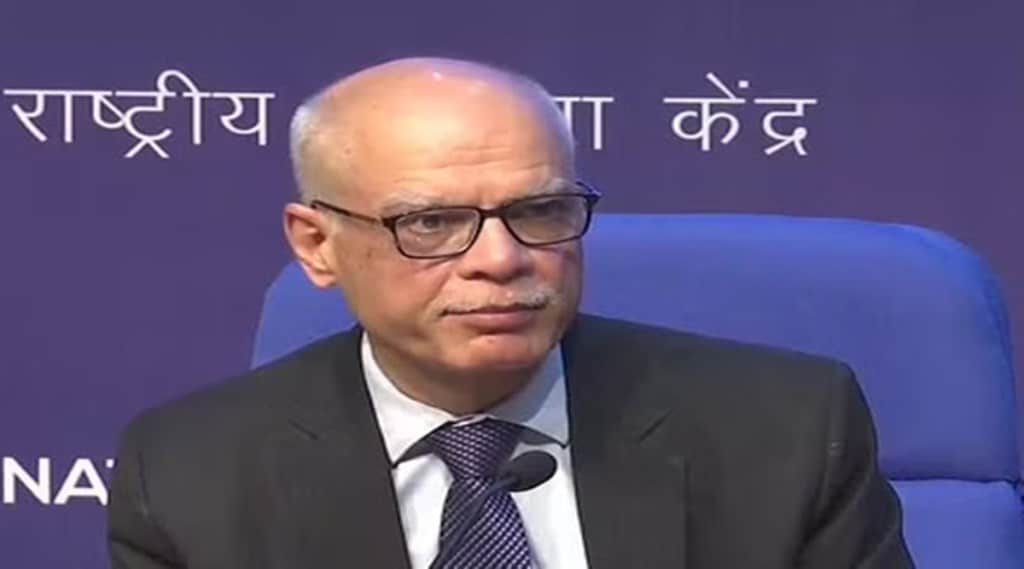

The government will only withdraw its windfall tax introduced on Friday for oil producers and refiners if global crude oil prices dropped as much as $40 a barrel from the current levels, Reuters reported quoting revenue secretary Tarun Bajaj.

The new taxes will be reviewed every 15-days factoring in the rupee-US dollar exchange rate and global crude prices, among other things, Bajaj told reporters on Monday. “It is a complex thing (when to remove the new taxes)…it will depend on what is dollar to rupee, what is the international price for crude, what is the domestic cost of crude, etc,” Bajaj said.

The government has imposed taxes on exports of petrol, diesel and aviation turbine fuel (ATF), and more than doubled the levy on domestic crude and capped exports from non-SEZ units this fiscal. The move is aimed at stemming the rupee’s free fall, increasing domestic availability for consumption and corner a share in the “windfall profits” reaped by some of the domestic firms on the back of elevated global oil prices.

Brent crude futures slipped on Monday to about $111.27 a barrel, as fears of a global recession weighed on the market even as supply remains tight amid lower Opec output, unrest in Libya and sanctions on Russia .Upstream oil producers — state-run ONGC, Oil India and Vedanta’s Cairn & Gas — have benefited from the surge in global oil prices since they follow import-parity pricing. ONGC, for instance, reported a 31.5% increase in the net profit for Q4FY22 to Rs 8,860 crore, the highest-ever quarterly number.Similarly, exports of refined products from India surged 161% in FY22 to $67.5 billion and the key beneficiaries were RIL and Rosneft-backed Nayara Energy.

According to analysts, the crack spreads on diesel and petrol for private refiners stood at $60 and $40 per barrel, respectively, in Q1FY23 while the Singapore gross refining margins for the period was $22 per barrel leading to a windfall gain for the companies. Moreover, the companies have managed to secure Russian crude at a discount of $35/ barrel to the international crude price of $118/barrel.

The Indian rupee hit a new all-time low of 79 against the dollar on Friday, amid unabated FPI outflows from equities and a broad risk-averse sentiment. The new taxes and curbs on fuel exports would also help mitigate current account deficit and, in turn, support the rupee.