-

They have a friendly appearance and seem like helpful, kind angels in our life. Yes, I am talking about the credit cards. And if you are nodding in agreement to that description, then hold on! There is more to it than meets the eye. Credit cards have a harsh but real side. Which, when revealed, can push one in a debt trap which will feel like quicksand. On the other side, one cannot deny the benefits credit cards have to offer. First step out of this problem is to hold no fear in your mind. Here we show you how to use credit cards effectively. (Image Source: Reuters)<br>Source: </strong> <a href="http://www.creditvidya.com/"><strong>Credit Vidya</strong></a></br>

-

1. The credit card has a mind of its own</br> Most credit cards come laced with fancy offers. Discounts, perks, rewards and numerous other spending baits. It’s almost like the card knows where it has to be swiped. But hold on! It’s your money and your decision. Don’t let the card company take the wheel and steer your car to the place they have chosen, to spend on things they want you to! Outsmart the credit card spend smart – on things that matter to your life rather than on frivolous expenditure. (Image Source: AP) <br>Source: </strong> <a href="http://www.creditvidya.com/"><strong>Credit Vidya</strong></a></br>

-

2. Limit the number of credit cards you hold Credit card companies silently encourage you to sign up by being persistent, efficaciously so. They throw in offers which prima facie appear tempting and we start thinking, there is nothing to lose so why not! That little voice of resistance inside is silenced when they add that there is no annual fee applicable. Now, this is not just another credit card sitting pretty in your wallet. It is debt you are willing to take on. Definitely not worth it when not required. One or two credit cards is all you need to have. (Image Source: Reuters)<br>Source: </strong> <a href="http://www.creditvidya.com/"><strong>Credit Vidya</strong></a></br>

-

3. Nobody will tell you this, except the credit card statement </br> Fine print information, fees, charges et al cost real money. This information is scattered and hence often ignored. Before signing up for a credit card, it is important to know the rate charged and other applicable charges to run an effective comparison and pick the one that suits you best. Also, study the monthly statement in detail. Any charge, the header of which you do not understand or which was not discussed before, must be questioned. Awareness is the key. (Image Source: Reuters)<br>Source: </strong> <a href="http://www.creditvidya.com/"><strong>Credit Vidya</strong></a></br>

-

4. Credit card discipline is a must</br> Credit card is debt. So every time the card is swiped, the meter starts ticking and stops when the balance is cleared. As long as we bear this in mind and clear monthly dues diligently, all will be well. The trouble begins when payments are missed. Interest rates on credit cards are exorbitant and it is best to steer clear of that zone. Also, cards offer the facility of clearing a minimum monthly balance. Though it may seem convenient to walk down that road, do not forget that the ticking meter is calculating interest on the balance amount, every single day. (Image Source: Reuters)<br>Source: </strong> <a href="http://www.creditvidya.com/"><strong>Credit Vidya</strong></a></br>

-

5. Credit car money is real</br> The feeling that one gets every time we make a payment in cash is different than swiping that credit card. Spending cash hits harder, feels more real. The truth being, the real impact is the same. May turn out to be even harsher, in the case of credit cards – it is more expensive and hence demands more prudence while spending. (Image Source: Reuters)<br>Source: </strong> <a href="http://www.creditvidya.com/"><strong>Credit Vidya</strong></a></br>

-

Now that it is all revealed to you in black and white, make those credit cards work for you. Maximize the benefits as per your spending style and usage. Credit card is no angel or devil. Spending habits and personal finance management make it what it appears to be. Let there be no illusion, think real, be wise.(Image Source: Reuters)<br>Source: </strong> <a href="http://www.creditvidya.com/"><strong>Credit Vidya</strong></a></br>

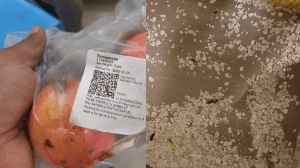

‘76 kg of expired articles, misleading labels’: Warehouses of Zepto, Blinkit, Swiggy and 5 others inspected in Telangana