The widespread use of OTTs by even the common man has remarkably transformed day-to-day living and enhanced the quality of life in general. We could not have pulled through the pandemic as well as we did if it had not been for the OTT content flowing through the telecom pipes. TRAI has issued a comprehensive consultation paper dated July 7, 2023 on OTT services and it is interesting to study the data provided therein. OTTs effectively started appearing in India in a significant way around 2014, and TRAI did its first consultation in 2015. Therefore, to examine the economic impacts of OTTs, it would be appropriate to compare the telecom average revenue per user (ARPU) in 2022 to that in 2013. Such a detailed analysis is available in TRAI’s consultation paper’s table 2.1, titled ‘Composition of ARPU per month—Wireless Service’. ARPU is a key metric for gauging the financial viability of the telco.

From TRAI’s analysis, it can be seen that the data revenue has gone up from Rs 10.02 per user to Rs 125.05 per user—an increase of about Rs 115 per user, a 12-fold growth. During the same period, revenue from calls reduced by about Rs 58 and revenue from SMS by about Rs 3.76. However, the revenue increase from data usage has more than compensated for the reduction in call and SMS revenue and has provided a residual surplus. Not connected with OTTs, rental revenue has reduced from Rs 19.5 to Rs 8. However, as already noted, all reductions have been wiped out by the boom in data revenues, leaving a healthy overall gain—the net ARPU having risen from Rs 111.45 to Rs 141.14, which is an increase of 27%.

The analysis of the TRAI data clearly illustrates a finding of the International Telecommunication Union (ITU)—“By creating value for consumers, global apex telecom body, OTTs stimulate demand for broadband networks and services… availability of OTTs create a virtuous cycle that increases the value of broadband network services and thereby drives further take-up and adoption of higher value data plans…OTT applications drive the demand for internet connectivity services thus increasing traffic and, consequently, the revenue of telecommunication service providers.” (ITU-D Report, 2021).

It is important to appreciate that mobile tariffs are left to open market forces and TRAI follows the forbearance approach. Hence, telecom operators are free to set the tariffs as per their desire whether it be for calls, data, rentals, value-added-services, or roaming. While dealing with tariffs, one is naturally compelled to also examine costs. ITU findings in this respect are interesting. While internet traffic growth has been healthy, relevant unit costs for key-traffic-dependent items of equipment have declined year after year and more than offset any increase in equipment required to carry network traffic. For the mobile network, the combined effect of increased traffic-dependent equipment volumes and declining unit cost appears to be in line with the increase in monthly price paid by consumers (ARPU). The conclusion by ITU is that “In neither case are there indications of market failure.”

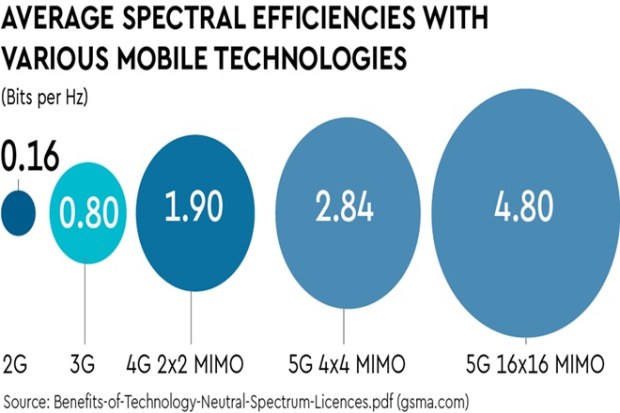

There is the added big bonus of vastly improved spectrum efficiencies over the years. It is an established fact that average spectrum efficiencies have risen plain vanilla GSM 0.16 Hz through 3G’s 0.80 bits per Hz, 4G’s 1.90 to 5G’s 16×16 MIMO—a stupendous 30-fold increase.

Obviously, we can expect a substantial trickle-down effect from the greater spectral efficiencies to the network cost reduction. Similarly, there have been large efficiencies in the backbone networks, generally based on optic fibre, as a result of which bandwidth costs have declined substantially. For example, 10 GigE prices fell 18% and 100 GigE by 30%, compounded annually from 2018 to 2021.

As ITU points out, consumers see OTT services as offering better price/performance, or as offering higher consumer welfare. It should be remembered that societal welfare is the sum of producer and consumer welfare. For OTT services, the relevant benefits to producers are also high since their coffers are flowing plentifully from increased overall consumption of network services as well as an increased number of subscribers due to greater attractiveness of the services.

European regulator BEREC’s findings in 2022 are similar to ITU’s—network traffic is “caused” by telco customers, driving the demand for broadband. They further found no evidence of “free riding” and that the costs for internet connectivity are typically covered and paid for by the telco customers. No regulatory intervention is necessary. Over the years from 2015-2022, in India too, both TRAI and DoT have, with reasoning, refrained from intervention.

Clearly, network operators owe much to OTTs for their data revenues upsurging and overall ARPU rising. As cited by TRAI, ITU has also found that both sectors “engender benefits for each other in a symbiotic, complementary and mutually reinforcing manner…and…both sectors have invested heavily in the infrastructure to support it.” In such a scenario, one wonders about the wasteful arguments and pointless hostility.

The writer is honorary fellow, IET (London), and president, Broadband India Forum

Views are personal