Page 485 of Money

6 things to keep in mind before going for a gold loan

Gold loan seekers need to keep a few things in mind to maximize the loan amount and ensure that the…

Achievability of Irdai target to depend on demand, growth, inflation

This is for the first time that Irdai has prescribed premium growth guidelines for individual companies. It has caused surprise…

Motor insurance: The dangers of driving a car with a lapsed policy

Renew the policy online via net banking or debit/credit card or by dropping a cheque at the branch office of…

Your queries: Income Tax- Can claim home loan interest deduction when filing return

Any excess of TDS over the final tax liability shall be refunded after processing of the return.

Stock Market Investment: Should you invest in penny stocks?

Let us understand the nuances related to penny stocks, how it is beneficial, the risks associated and factors to be…

Managing currency risks: Go for global funds to offset losses

Diversify your portfolio by taking global exposure through the international funds and ETFs launched by Indian fund houses

Happy Parents Day! This 50-30-20 rule can make your kids money-wise and wealthy

Parents Day: Instilling the habit of saving money from a very young age will help them differentiate that earning money…

5 investments where senior citizens can invest up to Rs 1.5 lakh to save tax

As far as tax savers for senior citizens are concerned, most of them yield a fixed return.

Is this the right time to invest in an under-construction property?

Here is the lowdown on why this may be the best time to invest in an under-construction property.

Prompt grievance redressal of taxpayers top priority: CBDT chairman Nitin Gupta

“However, we cannot rest on our laurels and need to keep working hard to maintain this momentum,” he said.

National Parents’ Day: Protect your parents with health insurance

With all the chaos and unprecedented times prevailing across the globe for the past few years, one’s first and foremost…

Income Tax Intimation Letter Under Section 143 (1): What is it? Password, Importance, Details Explained

The Income Tax Intimation notice is sent to the registered email ID of the tax filer under Section 143(1) of…

Rupay credit card linkage to UPI may become operational in couple of months: NPCI

The RBI in June allowed linking of credit cards on the UPI platform, with the platform being linked only with…

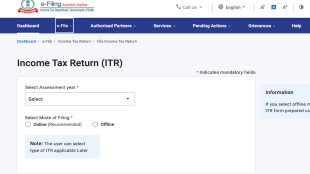

‘Extend Due Date Immediately’ trends as Income Tax Return Last Date for AY 2022-23 Nears

The Income Tax Return deadline for Assessment Year 2022-2023 is July 31, 2022.

Is your lender asking you to buy insurance while taking home loan?

Ideally, one should have a life insurance coverage of at least ten times of one’s annual take home income.

ITR due date extension not happening. Can you set off stock market losses against salary?

ITR filing 2022: If you incurred a loss in intra-day trading, it could be adjusted only against speculative income from…

Planning to buy a new car? Compare cheapest car loans ahead of festive time

With the festive time approaching, most of you may be planning to buy a new car. Here is what you…