New Labour Codes: Wages will now primarily include three things — basic pay, dearness allowance, and retaining allowance under the new labour laws. If these three make up less than 50% of your total salary, then enough of the remaining components will be added back to reach the 50% mark, suggests the new law. This ensures a standard formula for calculating gratuity, pension, and other social security benefits.

“Wages now include basic pay, dearness allowance, and retaining allowance; 50% of the total remuneration (or such percentage as may be notified) shall be added back to compute wages, ensuring consistency in calculating gratuity, pension, and social security benefits,” the government notification said clarifying how it will calculate gratuity and other retirement benefits.

Clarity needed on ‘Basic Pay’ calculation

The government, however, will soon come out with detailed rules, as there is some confusion because most private-sector organisations do not have components like dearness allowance or retaining allowance. It remains to be seen whether, in such cases, companies will be required to make basic pay 50% of the total remuneration. This clarity will come once the government issues detailed guidelines.

What does 50% wage formula mean for companies and employees?

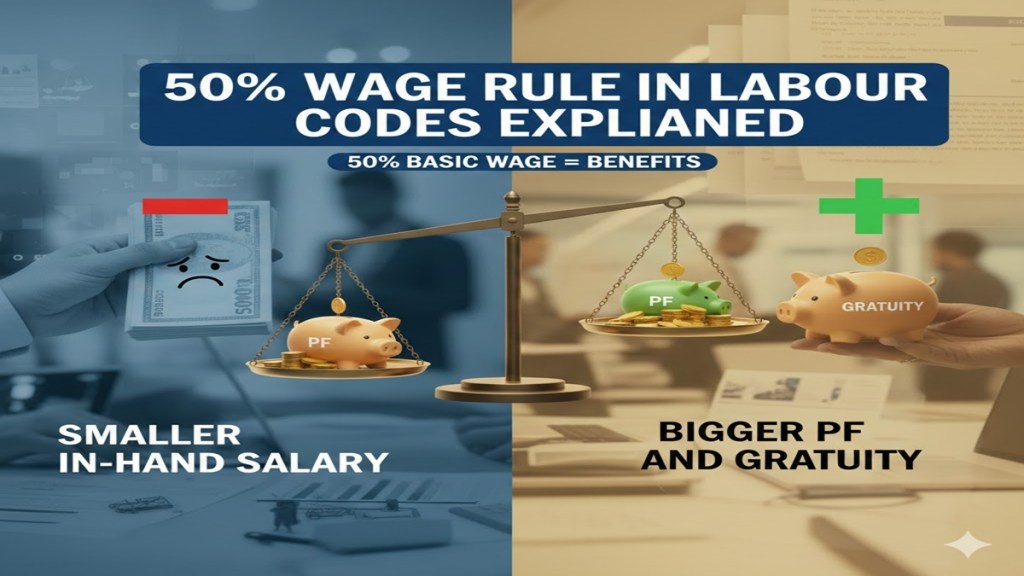

It can be interpreted in another way that your basic pay, dearness allowance and retaining allowance must together make up at least 50% of your total salary. This means many companies will have to increase the basic pay portion and reduce allowances.

As a result, employees may see a lower take-home salary, because a higher basic means higher PF contributions.

But the flip side is positive: your PF, gratuity, pension and other retirement benefits will grow faster and become more predictable. This single change forms the foundation for stronger social security for all workers — and it will directly reshape salary structures across India.

How the new wage rule changes everything else

A stronger base for PF, gratuity and pension

With wages now defined uniformly, the benefits linked to it become stronger and more predictable. Earlier, companies could keep basic pay low and split salaries into multiple allowances, which reduced PF, gratuity and pension payouts.

Now, since wages must be at least 50% of your overall pay: Your PF contribution will increase, your employer’s PF contribution will increase, gratuity will be calculated on a higher base, and future pension benefits will improve.

In short, you may lose a little today in take-home pay but gain much more in long-term wealth and retirement security.

Know more about 4 new Labour Codes that came into effect November 21

The Centre announced that the four Labour Codes – the Code on Wages, 2019, the Industrial Relations Code, 2020, the Code on Social Security, 2020 and the Occupational Safety, Health and Working Conditions Code, 2020 have been made effective from 21st November 2025, rationalising 29 existing labour laws.

“By modernising labour regulations, enhancing workers’ welfare and aligning the labour ecosystem with the evolving world of work, this landmark move lays the foundation for a future-ready workforce and stronger, resilient industries driving labour reforms for Aatmanirbhar Bharat,” the labour ministry said in a statement.

Key highlights related to wages under the Labour Codes:

- Universal minimum wages:

Now, every worker — whether in the organized or unorganized sector — has the right to minimum wages. Earlier, this applied only to certain listed jobs, covering just about 30% of workers.

- Introduction of a floor wage:

The Central Government will set a basic “floor wage” based on the cost of living. States cannot fix minimum wages lower than this. This ensures workers across India get at least a basic, fair income.

- Gender equality:

Employers cannot discriminate based on gender — including transgender identity — when hiring people, paying wages, or deciding work conditions for the same type of work.

- Universal rules for wage payment:

Rules for timely salary payment and restrictions on unfair deductions will now apply to all employees, regardless of how much they earn. Earlier, they applied only to those earning up to Rs 24,000 per month.

- Overtime payment:

If employees work beyond normal working hours, employers must pay at least double the regular wage rate for the overtime hours.

Summing up…

The ‘Uniform Definition of Wages’ sits at the centre of India’s new labour reform. By making wages consistent and transparent, the government has strengthened every other part of the social security system.

Yes, take-home salaries may reduce for many employees, but the trade-off is clear: higher PF, higher gratuity, better pension, better social security and stronger protection for workers and their families.

These changes aim to build a modern, fair and future-ready labour framework—one that balances ease of doing business with long-term financial security for every worker.