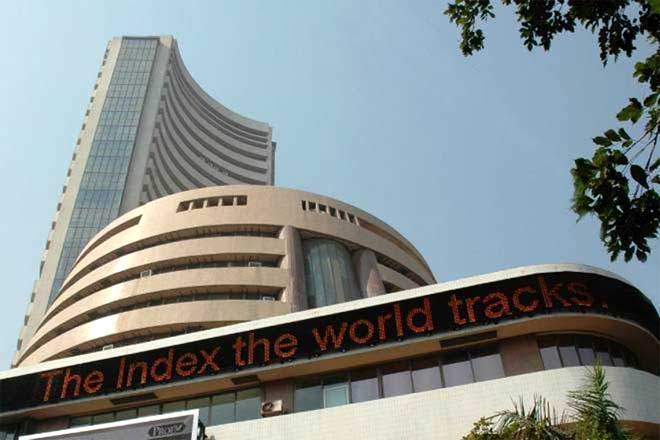

India’ stock market crashed on Monday losing over 2,000 points or close to 6% mirroring the weakness in global markets as heightened US-China tension left investors skittish.By Urvashi Valecha

India’ stock market crashed on Monday losing over 2,000 points or close to 6% mirroring the weakness in global markets as heightened US-China tension left investors skittish. The extension of the lockdown in India, albeit with some major relaxations failed to enthuse investors. Banking stocks were pulverized as analysts believe the impact of the inactivity in industry could continue for a while causing huge cash flow pressures and possible defaults to lenders. The PMI for manufacturing collapsed to 27.4 in April, from 51.8 in March, reflecting a steep deterioration in the business environment.

The rupee depreciated sharply on Monday losing some 64 paise to close at Rs 75.73 to the dollar.

Markets across the world are nervous following apprehensions of a renewed trade war between the US and China that could badly hurt the recovery process following the outbreak of the Covid-19 pandemic. US secretary of state Mike Pompeo on Sunday said there was “a significant amount of evidence” that the coronavirus emerged from a Chinese laboratory. Pompeo’s comments came after US President Donald Trump last week threatened that he will slap new tariffs on China over the Covid-19 pandemic. The US economy contracted by 4.8% in the March quarter, data released last week showed. Foreign Portfolio Investors (FPIs) pulled out $181.59 million on Monday, provisional data showed while local institutions sold stocks worth $219.61 million. FPIs withdrew $8.3 billion in March but just $30.5 million in April when the markets staged a smart 30% recovery from their March 23 lows.