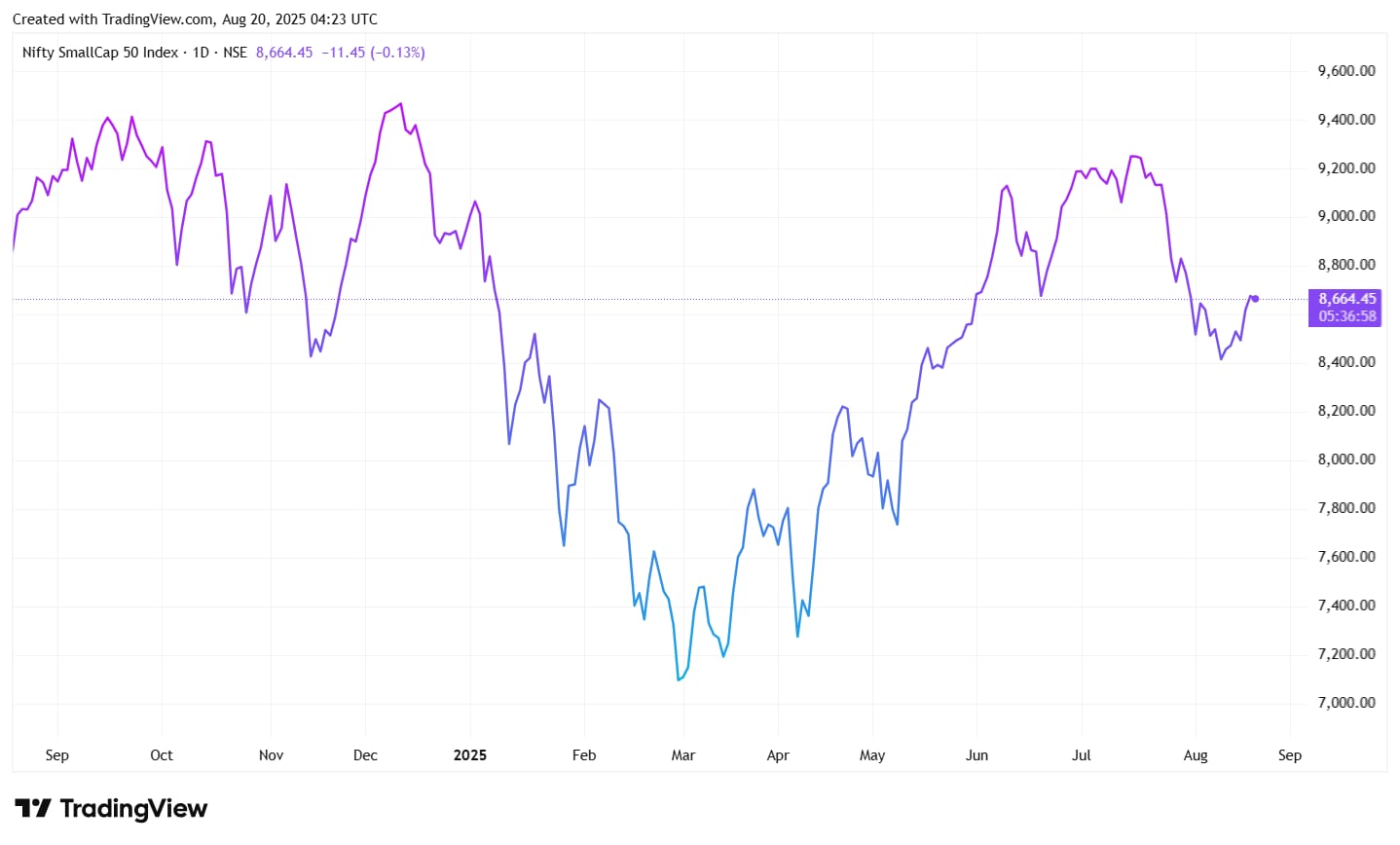

Over the last one year, smallcap stocks have been highly volatile. Its not surprising given the geopolitical events, economic downturn, weak corporate results, and more. The Nifty Smallcap 50 Index in fact declined by 1.6% over this period. Over the last 30 days, it has declined by around 5.3%. (Source: NSE)

Having said that, there are select stocks that have been drawing continuous attention not only from Domestic Institutional Investors (DIIs) but also getting equal attention from the Foreign Institutional Investors (FIIs). It is a rare occasion when both FIIs and DIIs come together to invest in the same stock in a big way. Digging through the June quarter shareholding pattern, however, we find there are 2 smallcap stocks that both DIIs and FIIs have placed big bets on.

So, what is making DIIs and FIIs invest in these smallcap stocks at this breathtaking pace? Let’s find out.

#1 KFin Technologies Limited (KFINTECH)

KFin Technologies Ltd. is a leading tech-first financial services provider that offers services and solutions to asset managers in the country. It renders multiple investor solutions to corporate issuers and asset managers, which include transaction origination, mutual fund processing, data analytics services, transfer agency services, and also private retirement schemes outside of India, such as in Hong Kong, Malaysia, and the Philippines. The company also offers services to alternative Investment Funds (AIF) and wealth investors’ solutions.

During Q1FY26, FIIs and DIIs raised their stakes in KFin Technologies by 5.25% points and 3.34% points, respectively. The total FIIs holding in the company stood at 27.81% and the DII holding at 23.71% at the end of the quarter.

Leading the Way

KFin Technologies is the largest registrar and transfer agent (RTA) in India, and they have been continuously in this position for a long period. This can be one reason for FIIs and DIIs getting attracted to this stock. As per management’s comments, the company has again outperformed the industry growth in the mutual fund segment and the issuer solutions segment in the June 2025 quarter.

It secured 3 out of 4 new AMC mandates, which came during the June quarter. KFin is holding around 39% of the market share when it comes to SIP inflows. It is an important indicator for future AUM share of the company, as per management’s comments.

In the Issuer Solutions segment, where the company plays the role of a Corporate RTA, it has witnessed a market share growth from 48% to 51% over the last 18 months. The corporate client roster is now around 9,000, and the company is targeting 10,000 clients by the end of FY26.

The company won 13 new international clients during the June quarter. It also witnessed market share in the Systematic Investment Plan (SIP) segment to grow from 34% to 37% during the quarter.

The MFCentral, which is an industry-wide mutual fund platform, is a product of KFin, and during the June quarter, it onboarded 230 new clients, a growth of 10% on a Quarter-on-quarter (QoQ) basis.

Coming to the financials…

Revenue of the company went from ₹238 crore in Q1FY25 to ₹274 crore in Q1FY26, growing at 15.4% Year-on-Year (YoY). The Earnings before Interest, tax, depreciation, and amortization (EBITDA) went up from ₹99 crore to ₹114 crore during the period.

The net profit of the company increased from ₹68 crore to ₹77 crore during the period, growing 14% YoY. The Average AUM grew 23% YoY during the quarter, compared to the industry average growth of 22.3%.

The stock is trading at a Price Earnings (PE) ratio of 56.4x, which is at par with the industry median; however, the Price Earnings to Growth (PEG) ratio is lower at 1.9, while the industry median is 2.9.

One-Year Share Price Chart

#2 PNB Housing Finance Limited (PNBHOUSING)

PNB Housing Finance Ltd. is a leading home loan provider in the country. It offers retail customers both housing loans and non-housing loans. As of 30 June 2025, the company had AUM of ₹82,100 crore, which makes the company one of the top three housing financial companies in India.

The FIIs and DIIs raised their stake by 2.7% points and 8.1% points, respectively, in this stock during the June quarter. The total holding by FIIs in this stock stood at 24.2% and DIIs’ holding stood at 38% at the end of the quarter.

Solid Growth During June Quarter

PNB Housing Finance’s strong product mix can be one of the reasons for both FIIs and DIIs increasing their stakes in this company. The company services over 3,40,000 live loan accounts as on 30 June 2025.

The loan assets of the company grew by 18% YoY from ₹65,157 crore in Q1FY25 to ₹76,923 crore in Q1FY26. Out of this, affordable housing finance products grew the most at 143 on % YoY basis, from ₹2,361 crore to ₹5,744 crore.

From the disbursement perspective, total disbursement of loans grew from ₹4,363 crore in Q1FY25 to ₹4,980 crore in this June quarter.

The overall Gross Non-performing asset (GNPA) declined from ₹906 crore in Q1FY25 to ₹825 crore in Q1FY26. The gross NPAs declined from 1.35% in June 2024 to 1.06% in this June quarter. Similarly, the Net NPA dipped from 0.92% to 0.69% during the period.

As per the management, the company is now more focused on the Emerging Markets Segment, and they expect this segment to offer 35 to 40 basis points (bps) of higher incremental yield when compared to the other segment, known as Prime.

Coming to the financials…

The revenue of PNB Housing Finance grew from ₹1,813 crore in Q1FY25 to ₹2,064 crore in Q1FY26, registering a 13.9% YoY growth. The net profit increased from ₹439 crore to ₹532 crore during the same period, which is a 21% YoY growth.

PNB Housing’s valuation may also have attracted both FIIs and DIIs to invest simultaneously. The stock is trading at a PE of 10.4x, way lower than the industry median PE is only 20.9x. The PEG ratio of the company is also lower than the industry median. The PEG ratio of the company is 0.31, while that of the industry is 0.55.

One-Year Share Price Chart

The stock price has sharply declined in the past month. This is primarily a result of the sudden resignation of the company’s Managing Director (MD) and Chief Executive Officer (CEO), Mr. Girish Kousgi. On August 1st, the stock fell sharply by 17%, post the announcement of the resignation. The sudden change in the leadership led to investors’ concern, and in turn massive selloff was seen.

Wrapping up

It is quite rare when FIIs and DIIs invest in the same stock, especially when the stocks are of smallcap companies. However, the two stocks mentioned above witnessed a significant rise in their FII and DII shareholding owing to strong growth prospects, financials, and fair valuations. Now it will be interesting to see whether this joint interest of FIIs and DIIs continues for these select stocks in the future or not.

Disclaimer

We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Maumita Mitra is a seasoned writer specializing in demystifying the world of investment for a broad audience. She has a keen eye for detail and a knack for explaining complex financial concepts in the simplest manner possible.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.