By Brijesh Bhatia

The Union Budget has been unveiled and while the initial volatility in the market is settling down, a potential opportunity may arise from this period of uncertainty. When market fears dissipate, they often create avenues for investors to capitalize on potential growth.

As a savvy investor, one of the best ways to identify promising stocks is to track those that are showing consistent accumulation, evidenced by rising volumes and a corresponding upward price movement.

The concept of “rising price with volumes” is a critical indicator for identifying stocks with bullish potential. Before we head to the stock, let us understand the theory.

The rising price with volume theory

In technical analysis, the relationship between price and volume is paramount. Rising price with increasing volume is typically seen as a confirmation that the current trend is likely to continue. In other words, when prices move higher alongside a substantial increase in trading volume, it suggests strong buying interest and institutional participation.

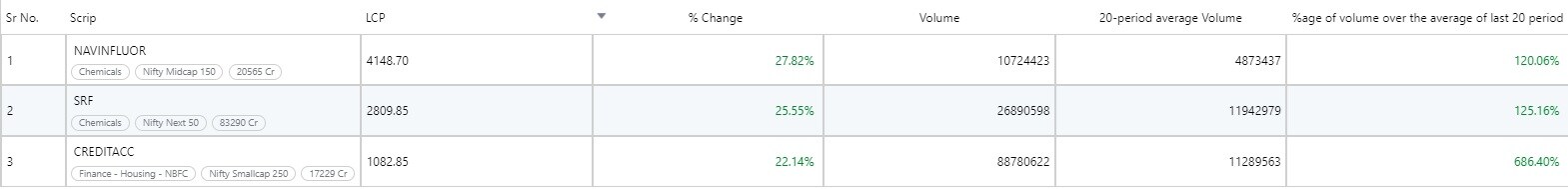

For this analysis, we focused on stocks that showed both a significant positive price moves and a spike in trading volume. Specifically, we identified stocks that had:

- A positive closing price of more than 20% in January

- Over a 100% increase in volume compared to their 20-month average trading volumes

By scanning for these criteria, we got three stocks that meet the conditions for a potential bullish trend based on the price-volume relationship.

Let us dive deeper into these stocks and explore what the charts reveal.

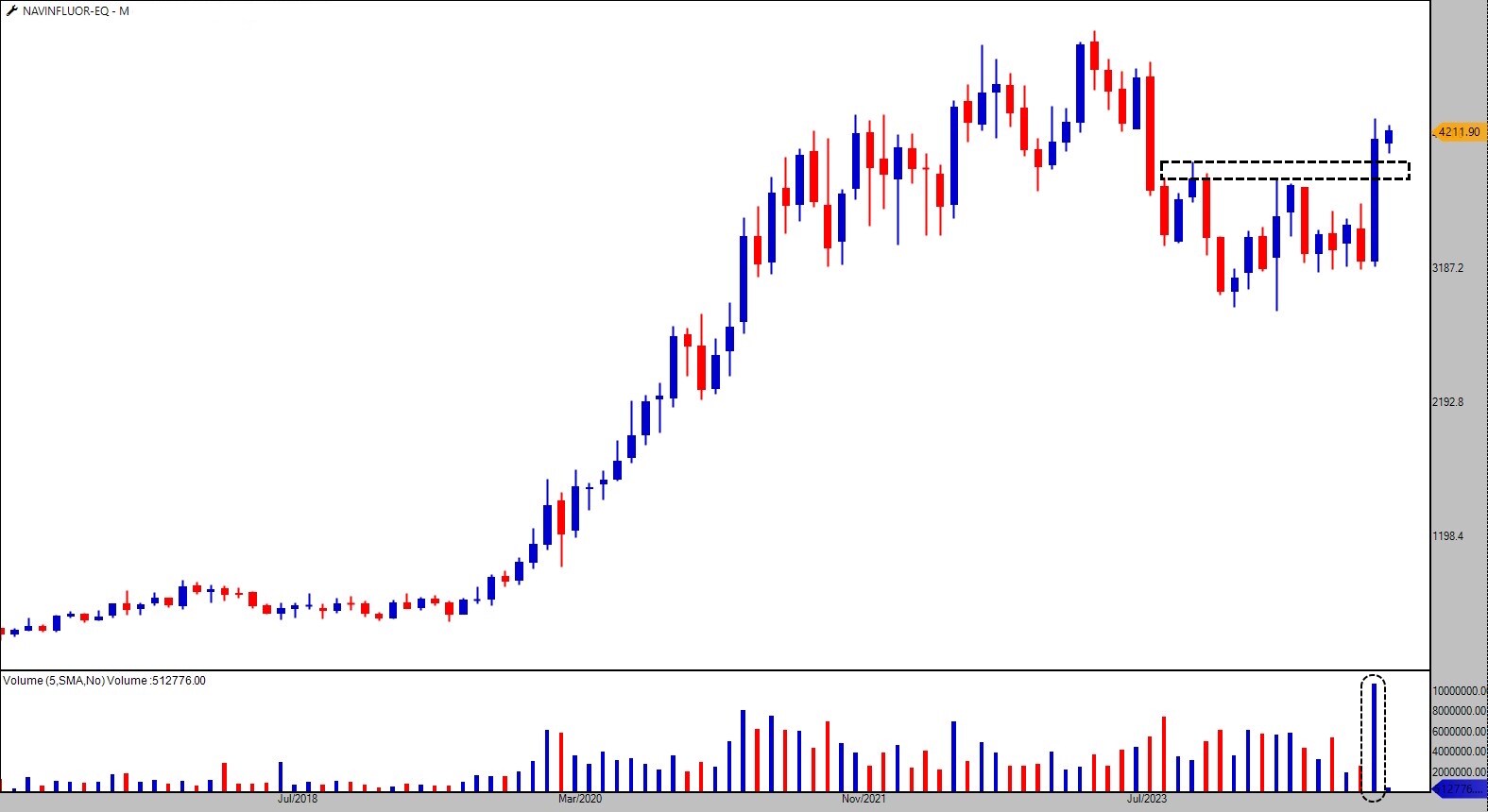

1. Navin Fluorine International Limited (NAVINFLUOR)

Navin Fluorine International Limited is a leading manufacturer of specialty chemicals and fluorochemicals in India. The company’s robust growth and strong market positioning have made it a significant player in the chemicals industry.

The stock price of Navin Fluorine rallied by 27.82% in January, accompanied by a remarkable 120% increase in trading volume compared to its 20-month average. The breakout was significant, as the stock price broke above a 14-month high, signalling a potential new phase of growth.

The breakout is accompanied by the highest monthly volume ever seen on the chart, a crucial sign that the price increase is supported by strong buying interest. This suggests that the stock could potentially continue its upward trajectory and possibly reach new highs in the near future, as the bullish trend is building momentum.

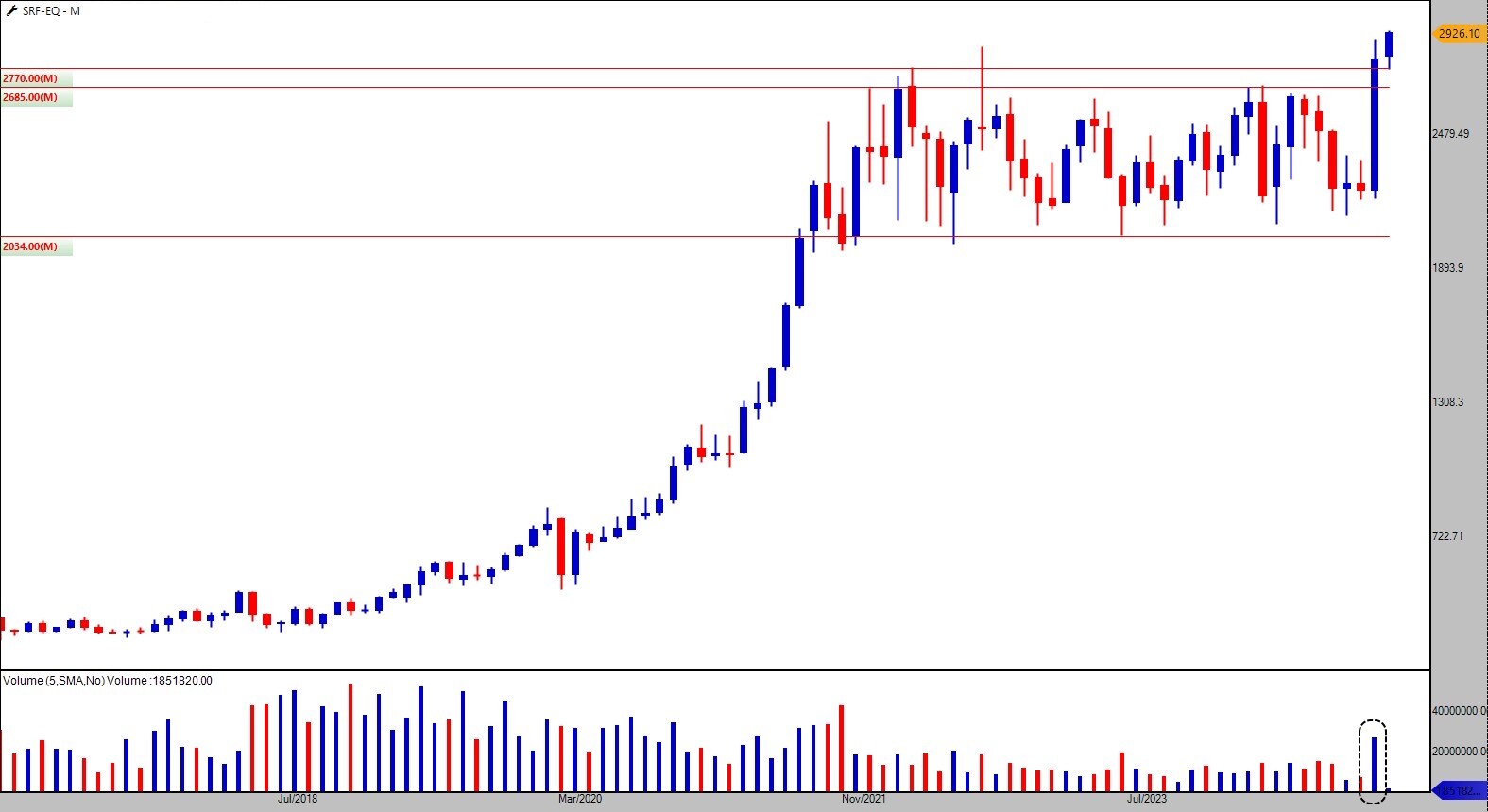

2. SRF Limited (SRF)

SRF Limited is a multi-business entity with a wide portfolio spanning across chemical, textile, packaging, and engineering sectors. As a leader in the specialty chemicals segment, SRF has consistently demonstrated strong financial performance and operational excellence.

SRF’s stock has hit new all-time highs and is breaking out of a four-year consolidation phase. The breakout is accompanied by the highest monthly volume since November 2021, suggesting that the stock is gaining fresh investor interest and is primed for larger moves in 2025.

This breakout after a prolonged period of consolidation indicates a shift in market sentiment. The increasing volume provides further confirmation that this trend could lead to significant upside potential. Investors should watch for continuation in the coming months as the stock tests new levels of resistance and possibly heads higher.

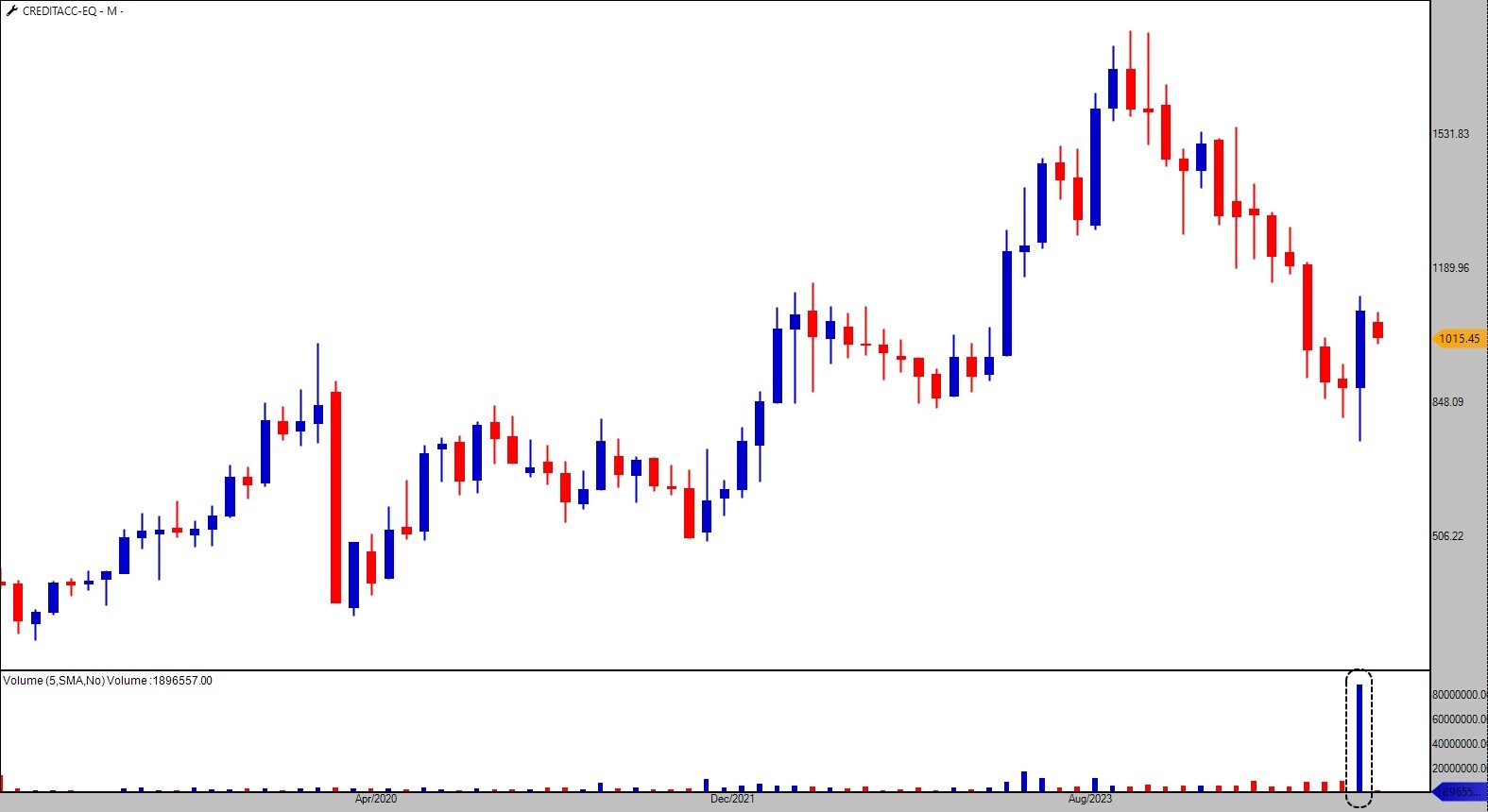

3. Credit Access Grameen Ltd (CreditAcc)

Credit Access Grameen Ltd is a microfinance institution providing financial services to rural households across India. The company focuses on empowering low-income groups by offering access to credit facilities, which has led to its growing influence in the micro-lending industry.

Credit Access Grameen Ltd experienced a strong reversal in January after five consecutive months of negative price action. The bullish reversal is highlighted by a bullish engulfing candlestick pattern, which signals a potential trend reversal above the key level of 1,125.

What makes this reversal even more significant is the surge in trading volumes. The stock saw a 686% increase in volume compared to its 20-month average, suggesting strong institutional interest and the likelihood of further price appreciation. This massive volume spike, along with the bullish candlestick pattern, multiplies the possibility that the stock could be potentially entering a new bullish phase, making it one to watch in the upcoming months.

A smart investor

The stocks highlighted above—Navin Fluorine International Limited, SRF Limited, and Credit Access Grameen Ltd—have demonstrated strong price performance and significant volume increases indicating the accumulation by the smart investors, positioning the stocks as potential candidates for continued upward movement. Investors looking for opportunities in a post-Budget market should keep a close eye on these stocks as they may potentially present attractive opportunities.

Disclaimer:

Note: We have relied on data from http://www.definedgesecurities.com throughout this article. Only in cases where the data was unavailable have we used an alternate but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Brijesh Bhatia has over 18 years of experience in India’s financial markets as a trader and technical analyst. He has worked with the likes of UTI, Asit C Mehta, and Edelweiss Securities. Presently he is an analyst at Definedge.

Disclosure: The writer and his dependents do not hold the Stocks discussed in this article. However, clients of Definedge may or may not own these securities.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The articles’ content and data interpretation are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.