By Suhel Khan

Foreign Institutional Investors (FIIs) have been on a selling spree quite some time now when it comes to Indian stocks. According to Economic Times, FIIs sold Indian stocks worth over Rs 35,000 cr in early January 2025.

At such a time, a few companies have managed to grab the attention of some FIIs and not in a small way. The FII holding in these companies have seen a jump like we might have never seen.

What makes these picks even more interesting is that FIIs are often seen as sophisticated investors with access to extensive research and global market insights. Their decision to buy amidst widespread selling could signal confidence in the stock’s underlying fundamentals or potential for recovery, offering a contrarian perspective.

Plus, such actions may indicate broader macroeconomic trends or sector-specific opportunities that retail investors might overlook.

Which makes knowing about these rare picks even more important.

Here are the companies that have done the unusual in the last quarter.

#1 Indiabulls Enterprises Ltd (IEL)

IEL is in the business of Construction equipment renting, and leasing a range of construction, infrastructure, manufacturing, and mineral handling equipment. This includes various types of machinery, and turnkey solutions to Engineering Procurement & Construction Companies.

The company was listed in December 2022 and has a current market cap of Rs 422 cr.

If we look at the FII holding for the company for the last year, here is how it looks:

| FII Holding Pattern | Dec-23 | Mar-24 | Jun-24 | Sep-24 | Dec-24 |

| 5.65% | 5.66% | 5.59% | 0.17% | 17.23% |

As you can see, there is a huge jump in the FII holding between the quarters ending September 2024 and December 2024, respectively.

ACM Global Fund VCC, bought a 17.09% stake in the company

Now here comes the surprising part. The company’s sales have seen a drop from Rs 104 cr in FY22 to Rs 56 cr in FY24. For FY25, From April to December 2024, the sales are at 44.5 cr.

The Profit after tax (PAT) is also an area of concern as the company has yet to see a good profits. In FY22, IEL faces losses of Rs 103 cr. In FY23 however, it did see a profit of Rs 4 cr.

But come FY24, the company once again saw losses of Rs 25 cr.

EBITDA (earnings before interest, taxes, depreciation, and amortization) saw a jump between FY22 and FY23, when it jumped from Rs 6 cr t o Rs 33cr. However, in FY24 it once again fell to 7 cr.

The current share price is Rs 20.8 which is a 39% jump over its listing price of Rs 15.

Indiabulls Enterprises Ltd Price

The stock is trading at a negative P/E and hence the same is not available on screener.com. However, the industry average is currently at 31x.

Earlier this year in April 2024, the company entered a joint venture pact with Japanese auto. In FY24, the company approved a merger plan with Yaari Digital Integrated Services Limited, which will lead to the company being dissolved. As part of this plan, the real estate division, Land Hotels Mumbai Private Limited (ILHMPL), will be separated and moved to Indiabulls Pharmacare Limited.

Right now, Indiabulls Pharmacare is fully owned by the company, but after the merger, it will become fully owned by Yaari.

#2 One Point One Solutions Ltd (OPOS)

Next up we have One Point One Solutions Ltd, a company that specializes in Customer Lifecycle Management, Business Process Management, and Technology Services.

OPOS provides solutions to a wide variety of industries including Banking and Finance, Telecom, Insurance, Consumer Durables and FMCG, E-commerce, Retail, etc. It has an average 5,500+ employees who offer services in 12+ regional languages. It has 6 delivery centres with 500+ seats.

The company has a current market cap of Rs 1.284 cr and was listed in December 2017.

Let’s look at how the FII investments have moved for OPOS in the last year:

| FII Holding Pattern | Dec-23 | Mar-24 | Jun-24 | Sep-24 | Dec-24 |

| 1.13% | 2.02% | 5.13% | 3.19% | 16.53% |

As you can see, the investments saw a big jump for the quarter ending December 2024.

Here is a list of the FII’s that have picked a stake in the company in the last quarter with the stake percentage:

| FII Name | Holding % |

| North Star Opportunities Fund | 2.04 |

| Ebisu Global Opportunities Fund Limited | 1.93 |

| Coeus Global Opportunities Fund | 1.91 |

| Forbes EMF | 1.88 |

| Ovata Equity Strategies Master Fund | 1.73 |

| LC Pharos Multi Strategy Fund VCC | 1.73 |

| LEGFL – Multi Opportunity | 1.45 |

The company’s sales grew at a compounded rate of 2% from Rs 153 cr in FY19 to Rs 170 cr.

Net profit also grew at a compound rate of 16% in the same period from Rs 10 cr to Rs 21 cr.

EBITDA went from Rs 29 cr in FY19 to Rs 51 cr in FY24, which is a CAGR of 12%.

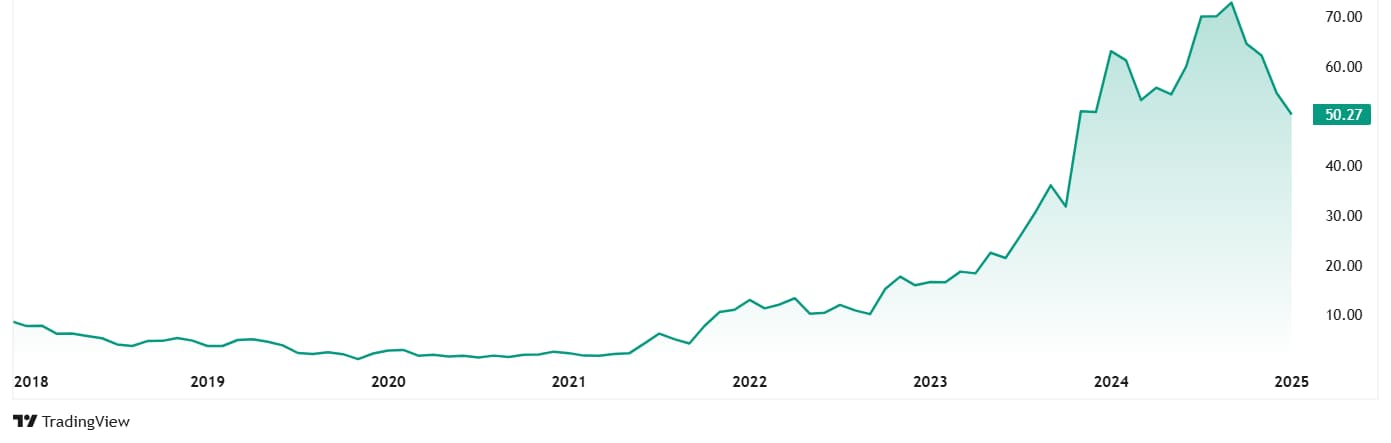

The company’s share is currently trading at a price is Rs 50 (as on 28th January closing) which is huge 2.045% jump over the 5-year-old price which was around Rs 2.33.

One Point One Solutions Ltd Share Price

The company’s shares are trading at a PE of 45x, which is a bit higher than the industry average when compared to peers, which is 38x. The 10-year median PE for OPOS is 35x, while the industry median for the same period is 26x.

Follow The FII Lead or Step Away?

The markets have been in a bearish mode for some time now and portfolios of investors are seeing some serious red. Market pundits and experts are predicting a crash or a huge correction soon. Which makes it imperative for investors to tread with caution.

Not to forget that FIIs have decided to move their money out of India and have been doing so for the last few months. But at times like these, the 2 stocks we saw today have managed to garner solid interest from FII’s. So, adding these to your watchlist would not be a bad decision.

Because unlike domestic investors who might focus primarily on local factors, FIIs analyse Indian companies through a global lens, comparing them with international peers and identifying those poised performance in line with global giants.

How these stocks will do in the near or longer future, only time will tell. In the meanwhile, keeping an eye on them to see if you too can ride the wave along with the FII’s could be the way to go.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.