After years of being a global market favourite, India’s stock market has faced a challenging 2025 so far. The MSCI India Index, a key benchmark tracking large and mid-cap Indian equities, has gained just 2.2% in US dollar total-return terms year-to-date.

This sharply underperforms the 25.9% rally in the MSCI AC Asia Pacific ex-Japan index and the 29.9% rise in the MSCI Emerging Markets index.

Amid this market weakness, penny stocks, often luring investors with low prices and the promise of quick gains, have witnessed steep corrections, reflecting heightened volatility and risk aversion.

In this editorial, we look at four penny stocks that are down by as much as 55% from their respective 52-week highs.

#1 Delta Corp

Next on the list is Delta Corp.

The company is an Indian company in the casino gaming and hospitality industry. It’s the only listed company engaged in the casino (live, electronic, and online) gaming industry in India.

Delta Corp also ventured into the fast-growing online gaming space through the acquisition of Gaussian Networks, which operates the online poker site ‘Adda52.com’.

On the financial front, its revenue has grown at a CAGR of 14.8%, while profit has seen growth of 67.3%.

Its three-year average ROE and ROCE stand at 11.6% and 15.6% respectively, and the company continues to operate with a debt-free balance sheet.

Delta Corp’s Financial Snapshot (FY23-25)

| Year | 2023 | 2024 | 2025 |

|---|---|---|---|

| Revenue (Rs in m) | 9,645.0 | 8,483.0 | 7,296.0 |

| Revenue Growth (%) | – | -12.1 | -14.0 |

| Net Profit (Rs in m) | 2,623.0 | 2,671.0 | 3,174.0 |

| Net profit margin (%) | 27.2 | 31.5 | 43.5 |

| Return on equity (%) | 12.0 | 10.8 | 12.0 |

| Return on capital employed (%) | 16.2 | 14.8 | 15.6 |

| Debt to Equity Ratio (x) | 0.0 | 0.0 | 0.0 |

Source: Equitymaster

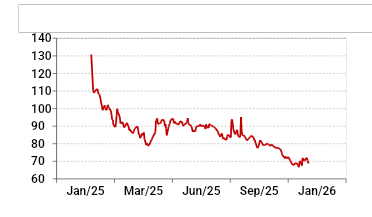

So far in 2025, up to 20 December, the stock has fallen from its 52-week high of Rs 130.8, recorded on 10 January 2025, to Rs 69.5, a decline of approximately 46.9%.

Delta Corp Share Price Since 52-Week High

Data Source: BSE

The fall can be attributed to the Goods and Services Tax (GST) Council approved a 40% tax on casinos, betting, and online gaming, which may significantly impact India’s gaming and casino companies.

Mutual funds have also been decreasing their stakes in companies. The mutual fund holding in the stocks have declined from 7.7% in March 2025 quarter to 2.6% in September 2025 quarter.

Going forward, according to the FY25 annual report, the company plans to invest approximately Rs 4.5 billion (bn) in a state-of-the-art vessel to replace Kings Casino. This investment is aimed at doubling capacity to around 4,000 positions, supporting the next phase of growth.

#2 HCC

Next on the list is Hindustan Construction Company (HCC).

It’s an engineering and construction company developing infrastructure projects including dams, tunnels, bridges, hydro, nuclear, thermal power plants, expressways and roads, marine works, water supply, irrigation systems, etc.

It has contributed to India’s 26% hydropower capacity, over 60% of its nuclear power generation capacity, 4,036 lane km of roads and expressways, 395 bridges, and 360 km of advanced tunnelling.

The company is India’s leading nuclear power plant constructor, with an unparalleled track record in the sector.

While HCC has a strong execution track record, the company’s recent financial performance remains weak, with declining revenues and volatile profitability over FY23–25.

By FY25, HCC’s debt-to-equity ratio at around 1.2 indicates balance sheet repair is underway, though leverage remains elevated for an EPC company.

HCC’s Financial Snapshot (FY23-25)

| Year | 2023 | 2024 | 2025 |

|---|---|---|---|

| Revenue (Rs in m) | 82,699 | 70,068 | 56,034 |

| Revenue Growth (%) | -22.5 | -15.3 | -20 |

| Net Profit (Rs in m) | -525 | 5,294 | 1,126 |

| Net profit margin (%) | -0.6 | 7.6 | 2 |

| Return on equity (%) | 7.4 | -313.9 | 12.4 |

| Return on capital employed (%) | 21.6 | 105.9 | 57.6 |

| Debt to Equity Ratio (x) | -6.8 | -9.9 | 1.2 |

Source: Equitymaster

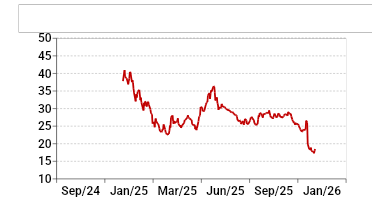

So far in 2025, up to 20 December, the stock has fallen from its adjusted 52-week high of Rs 37.8, recorded on 20 December 2024, to Rs 18.5, a decline of approximately 51%.

HCC Share Price Since 52-Week High

Data Source: BSE

The decline reflects investor reaction to the sizeable equity raise, which involves issuing nearly 800 m new shares to eligible shareholders.

In its recent exchange filing, the company outlined the final terms approved by its Securities Issuance Committee. The rights issue comprises 799,991,900 equity shares, aggregating to Rs 9.9 bn upon full subscription.

However, HCC remains focused on its long-term strategy of executing complex infrastructure projects, strengthening its financial position, and expanding its capabilities in emerging segments.

The company’s Engineering, Procurement, and Construction (EPC) expertise continues to underpin its operations across transportation, power, water, and urban infrastructure.

#3 NTPC Green Energy

Next on the list is NTPC Green Energy. It’s a is a subsidiary of NTPC, one of the largest power companies in India.

The company is engaged in the business of developing, owning and operating a diversified portfolio of renewable energy power plants in India. Its renewable energy portfolio encompasses both solar and wind power assets with a presence across multiple locations in more than six states.

The company is also expanding into green hydrogen, hydro, and energy storage systems.

On the financial front, for FY25 the company reported a 12.6% growth in revenue to Rs 22,096 m. Meanwhile the net profit rallied 38.2% to Rs 4,741 m.

Also, over the past three years, the company has delivered solid financial performance. Its three-year average ROE and ROCE stand at 3.9% and 3.8%, respectively.

NTPC Green Energy Financial Snapshot (FY23-25)

| Year | 2023 | 2024 | 2025 |

| Revenue (Rs in m) | 1,697 | 19,626 | 22,096 |

| Revenue Growth (%) | – | 1,056.60 | 12.6 |

| Net Profit (Rs in m) | 1,712 | 3,429 | 4,741 |

| Net profit margin (%) | 100.9 | 17.5 | 21.5 |

| Return on equity (%) | 3.5 | 5.5 | 2.6 |

| Return on capital employed (%) | 1 | 6.4 | 4 |

| Debt to Equity Ratio (x) | 1.1 | 2 | 0.9 |

Data Source: Equitymaster

So far in 2025, up to 20 December, the stock has fallen from its 52-week high of Rs 138.1, recorded on 20 December 2024, to Rs 89.9, a decline of approximately 34%.

NTPC Green Energy Share Price Since 52-Week High

Data Source: BSE

This can be as in the past few month renewable energy stocks have faced several challenges, including land acquisition, regulatory hurdles, and financial constraints.

Now, the government has given them one more thing to think about. The Indian government is planning to temporarily slowdown the pace of renewable energy tenders till FY27, as India is generating more green power than its ability to absorb.

Going forward, the company is strategically positioned to play a significant role in NTPC’s overall target of achieving 60 GW of renewable energy capacity by 2032.

Conclusion

Penny stocks trading far below their 52-week highs can look tempting, especially when prices seem “cheap.” But with penny stocks, a lower price doesn’t always mean a good opportunity.

Often, the fall reflects real issues in the business, weak fundamentals, poor visibility on earnings, or management concerns, rather than just short-term market noise.

Penny stocks also come with their own set of challenges. Low liquidity, sharp price swings, and limited disclosures make them risky and, at times, prone to sudden moves or manipulation.

For investors, it’s best to focus on companies with strong balance sheets and clear growth prospects.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary