The market’s verdict on LG Electronics India’s IPO (Initial Public Offering) was loud and clear.

Investors wanted in.

The stock listed at Rs 1,715 on BSE and Rs 1,710 on NSE, about 50% above the issue price of Rs 1,140 and stayed firm through its debut week.

That is not common these days. India has seen plenty of hyped listings lose steam within hours of trading. But LG’s wasn’t one of them.

Now comes the hard part.

The question is no longer why the market cheered. It is how long that cheer can last.

Behind every blockbuster listing is a quieter story where expectations must reconcile with operating reality.

From washing machines to wealth creation

For most Indians, LG is not a ticker. It is a sound.

The click of a remote, the hum of a refrigerator, the whoosh of a washing machine.

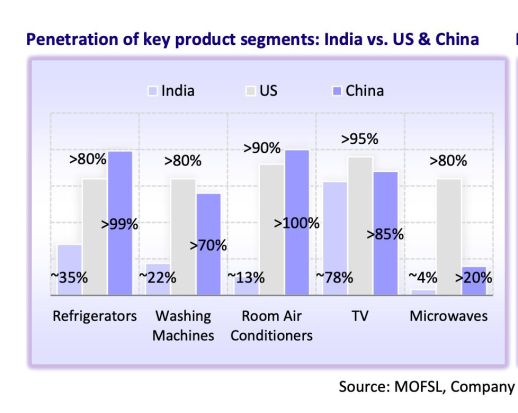

The brand has been part of the middle-class soundtrack for nearly three decades. That familiarity shows up in share. LG leads across categories like televisions, refrigerators, washing machines, inverter ACs and microwaves, with sustained leadership through the past decade.

What made this IPO truly interesting was timing.

India’s consumer durables story is in a higher gear and the overall home appliances and consumer electronics market excluding mobiles is projected to grow at roughly the low-teens CAGR (Compound Annual Growth Rate) into the decade. Rising incomes, urbanization and a clear shift toward premium products are driving that growth.

The India pivot

For LG’s Korean parent, India is not a sideshow.

The local unit’s contribution to global revenue has climbed from 3.5% in 2021 to 4.3% in 2024 — an unmistakable signal that India matters more inside the mothership.

The strategy is not just to sell more in India. It is to build more in India.

LG is adding a large plant at Sri City andhra Pradesh, which, alongside its Pune and Noida facilities, will tighten control over compressors, motors and other components while cutting logistics costs by serving the southern market directly. The aim is full backward integration of AC compressors once the plant stabilises.

That localization push is already visible. Domestic sourcing of raw materials has risen from 45% in FY22 to nearly 54% in FY25, with a glide path toward about 63% over the next four years.

Fewer imports, faster lead times and lower forex sensitivity add up to healthier margins.

Exports are the other lever. The company plans to raise the export share of revenue from around 6% in FY25 to roughly 10% by FY28.

In short, LG wants India to be both a manufacturing base and an export engine.

It’s a bold bet on India as both a workshop and a market. But LG’s ambitions don’t end with compressors and circuit boards. The new factory is about control over costs, over quality and increasingly, over how long a customer stays within its ecosystem.

Because while building locally helps margins, building relationships helps longevity.

The new growth engines: B2B and AMC

A quiet shift is underway inside LG Electronics India. The company isn’t just selling televisions or washing machines anymore. It’s turning those products into gateways for recurring income.

It’s after-sales business, once an overlooked unit, is now becoming a profit engine.

LG plans to grow its AMC (annual maintenance contract) revenue by more than 25% each year for the next few years. A new subscription-based model, Careship, allows customers to sign up for annual service plans at the time of purchase. The company is also experimenting with appliance rentals aimed at younger, urban consumers who prefer access over ownership.

This marks a subtle but powerful shift.

The business that once stopped earning after a sale now wants to get paid every year. The same logic applies to its institutional business.

About 10% of LG India’s revenue today comes from B2B (Business-to-Business) clients, but that share is expected to rise to 14–15% in the next few years. The company is expanding into high-value areas like HVAC (Heating, Ventilation and Air Conditioning) systems, commercial washing machines, LED displays and electronic blackboards. These aren’t the flashy products in your living room, but they come with steadier margins and repeat demand.

Put together, these two pieces, AMC subscriptions and the B2B push together and you get a deeper evolution. LG’s India story is no longer just about selling more appliances. It’s about building relationships that last well beyond the first purchase.

Premium is the new volume

If the B2B and services focus defines LG’s second act, premiumization defines its first.

For years, LG was seen as a safe brand, reliable but not exactly aspirational.

That’s changing fast.

Premium products such as OLED TVs, side-by-side refrigerators and AI-enabled washing machines already make up about 25% of its India revenue, compared to an industry average of 15%.

The company holds a 63% share in OLED TVs, 37% in front-load washing machines and 43% in side-by-side refrigerators. This deliberate move upmarket helps margins and reinforces the brand’s perception of quality. Consumers, especially in cities, aren’t just buying bigger TVs anymore. They’re buying the idea of better.

Think of it as the Asian version of what Apple did with phones. The difference is that here, the battleground is your kitchen and living room.

The numbers tell their own story

This is not a cash-hungry growth story.

Between FY22 and FY25, LG India’s net profit grew at a compounded 22%. Over the next three years, revenue is expected to grow around 9–10% annually, with profits rising roughly 12%.

Operating margins are at 12–13%, but could improve as the company sells more premium products and sources more locally. Return on equity is around 45% and return on capital employed is above 35%.

The balance sheet is almost debt-free. The working-capital cycle is a remarkably lean 13 days.

And this isn’t a company burning cash for growth.

LG has consistently generated free cash flow and maintained one of the cleanest balance sheets in the industry.

At a market capitalization of about Rs 77,000 crore, the company trades at roughly 51 times earnings and that is expensive. But investors aren’t paying for what LG is today. They’re paying for what it could become. The premium reflects more than just optimism. It’s the price of predictability of a company that has spent nearly three decades earning consumer trust and now wants to convert that goodwill into recurring cash flows.

Still, buyer beware.

Even great companies can disappoint when prices get ahead of profits.

India’s consumption party isn’t over

The backdrop is as strong as it gets. India’s home appliances and consumer electronics market, excluding mobiles, is expected to grow at 14% CAGR till 2029. Rising incomes, easy financing, and a steady shift toward better living standards are driving demand across categories. Add to that a GST cut on white goods, improving power supply, affordable EMIs and a growing young workforce, and you have the perfect consumption cocktail.

But big markets attract bigger competition

Yet, here’s the catch.

The same trends that help LG also help everyone else.

Voltas, Havells, Whirlpool and Bluestar are all ramping up. Domestic brands are rising and Chinese players are never far behind. Even Tata is trying to carve its way in through the Voltas-Beko alliance.

LG’s moat is its brand and reach, but moats are expensive to maintain. The company spends about 4.5% of its revenue on advertising and promotion — a cost it cannot cut if it wants to stay top of mind.

There are other risks too: royalty payments to the parent, rising input costs and the impact of heavy capex on free cash flow. Execution will matter. If the new plant scales smoothly, margins expand and localization pays off. If not, those premium valuations could quickly start to look stretched.

The road ahead

LG has already exited clear value traps like mobile phones in India and discontinued low-margin categories like ceiling fans.

The next chapter is not about doing everything.

It’s about doing a few high-value things well.

That looks like premium hardware, service monetization, institutional categories and a tighter local supply chain. If management threads these needles, LG India could move from great white-goods company to tech-consumer hybrid, with hardware as the on-ramp and recurring revenue as the destination.

In conclusion

LG’s listing felt less like discovery and more like validation. Investors are buying into a company that has already shown it can build, distribute and service at national scale and now wants to compound that into stickier, higher-quality cash flows.

The question is not whether LG is a leader. It is. The question is whether leadership in refrigerators and washing machines can morph into leadership in connected, smart, digital, always-on homes of tomorrow.

For now, the stock’s strong debut reflects faith in that possibility. But as with all premium stories, the test comes later, when growth slows, competition rises and the market starts asking, what’s next?

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Manvi Aggarwal has been tracking the stock markets for nearly two decades. She spent about eight years as a financial analyst at a value-style fund, managing money for international investors. That’s where she honed her expertise in deep-dive research, looking beyond the obvious to spot value where others didn’t. Now, she brings that same sharp eye to uncovering overlooked and misunderstood investment opportunities in Indian equities. As a columnist for LiveMint and Equitymaster, she breaks down complex financial trends into actionable insights for investors.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article. The website managers, its employee(s) and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.