Welcome to the latest edition of Hidden Gems Weekly. In recent weeks, we have dug into opportunities across real estate, a Birla lineage packaging company and an engineering gem. This week, we turn to something far less visible, but just as essential to the economy — soda ash, and a company navigating its cycle very differently from the rest.

The problem with commodity companies is not that they lack demand. It is that demand arrives with volatility.

Take soda ash. It sits quietly inside glass, detergents, solar panels and water treatment plants. You don’t see it. You don’t talk about it. But modern manufacturing does not move without it.

In India, soda ash demand grows broadly in line with GDP, with pockets of faster growth emerging as new applications come up.

Yet soda ash companies rarely get rewarded for this predictability.

Prices swing. Imports arrive when global supply loosens. Margins compress just when balance sheets look strongest. Investors tend to lose patience exactly when the cycle is turning.

This is the backdrop against which GHCL is being priced today.

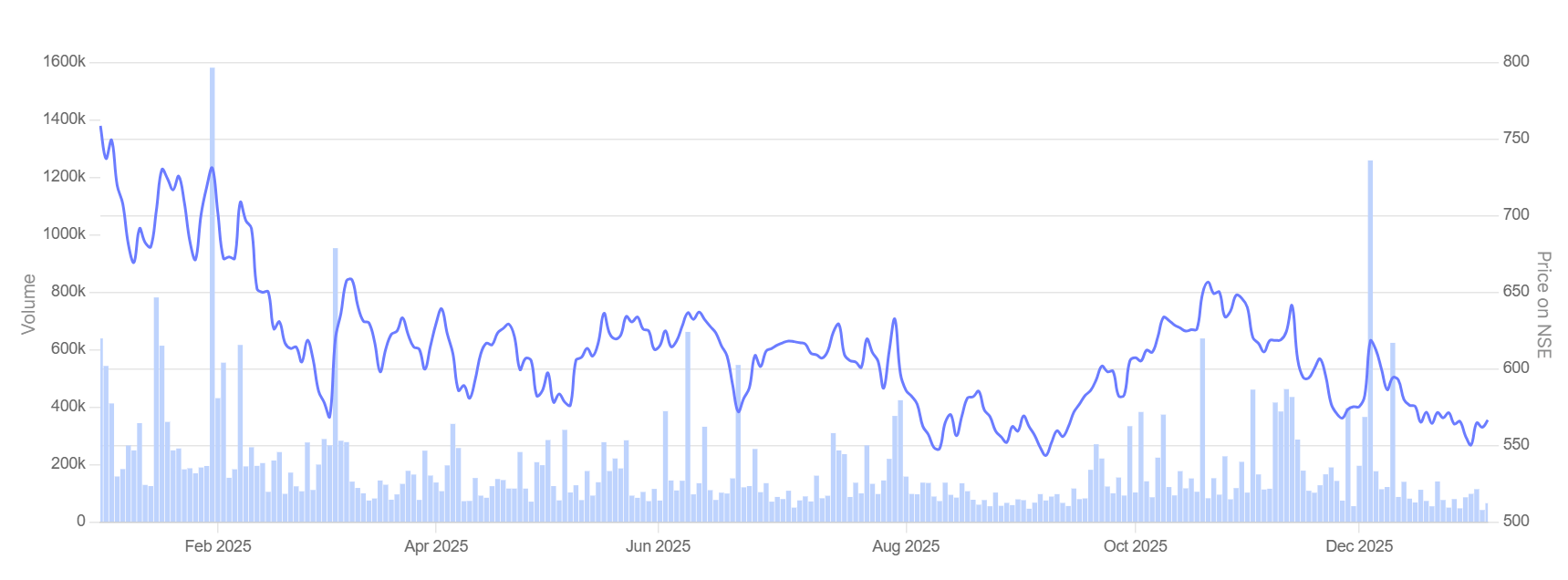

GHCL 1-Year Share Price Chart

The Import Glut: Why FY26 Weakness is Cyclical, Not Structural

On the surface, FY26 has not been kind to GHCL.

Revenue fell in Q2 as realizations dropped, margins compressed and reported numbers disappointed expectations. Cheap imports, running at roughly 85,000 tonnes a month, pushed domestic pricing lower, while China’s weaker demand turned it into an exporter rather than a consumer.

The result was predictable: pressure on earnings and a cautious near-term outlook.

But markets often confuse reported weakness with structural damage. The two are not the same.

GHCL’s soda ash business did not lose relevance in FY26. It lost pricing power but temporarily.

Domestic demand continued to grow around 5%, and management expects this to accelerate as solar glass capacity ramps up over the next few years.

What hurt was not demand but supply distortion, driven by imports priced well below replacement cost.

This matters because supply distortions do not last forever.

The Directorate General of Trade Remedies has already recommended an anti-dumping duty on imports of soda ash. Final clearance is pending, but even the possibility changes the medium-term math. When predatory pricing is removed, efficient producers regain pricing discipline without adding capacity.

The Cost Leader Advantage: Navigating a 22% Margin Floor

GHCL is positioned as one of the more efficient producers in the domestic soda ash industry.

When prices soften, GHCL doesn’t suddenly become efficient. It already is. That difference shows up most clearly at the bottom of the cycle.

The company operates the largest soda ash plant in India at a single location, with tight control over key inputs such as salt and limestone.

Even so, Q2 FY26 captured how deep the current pricing pressure has been. EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation) margins slipped to 22%, a seven-quarter low, reflecting the impact of cheap imports and weak global pricing rather than any deterioration in operating capability.

Management commentary talks about prices. The balance sheet tells you about strength.

At the end of H1 FY26, GHCL reported a net cash surplus of over Rs 1,000 crore. In a business where cash often evaporates just when cycles turn, GHCL has accumulated it the hard way, through operations, not financial engineering.

And management is not sitting on it.

Beyond Soda Ash: The ₹80 Crore High-Margin Diversification Play

Instead of chasing volume growth at the bottom of the cycle, GHCL has chosen a quieter but more durable route: diversification.

Two projects, bromine and vacuum salt, are scheduled to be commissioned between December 2025 and January 2026. Together, they are expected to add Rs 70–80 crore of EBITDA at steady state, with margins in the 40–45% range, materially higher than the core soda ash business.

This is not diversification for the sake of it.

Bromine derivatives have applications across pharmaceuticals, energy storage and specialty chemicals. These markets that care less about global soda ash pricing and more about consistency of supply. Vacuum salt opens up higher-quality industrial and B2B segments, where pricing tends to be stickier.

Over time, this changes the earnings mix. GHCL stops being a single-cycle commodity company and starts behaving like a portfolio of related chemical assets, anchored by soda ash but not hostage to it.

The real change, however, is not visible in quarterly numbers.

The company has a greenfield soda ash expansion planned, though it is moving more slowly than expected. That delay has frustrated investors.

But it has also prevented capital from being deployed at the wrong point in the cycle. When capacity finally comes on stream, it is likely to meet structurally higher domestic demand, from solar glass, water treatment and environmental compliance, rather than short-term pricing spikes.

Meanwhile, shareholders are being paid to wait.

GHCL has announced a Rs 300 crore buyback through the tender route. Buybacks matter most when they are done from surplus cash, not borrowed money. In this case, they improve capital efficiency and signal management’s confidence in long-term cash generation rather than near-term earnings optics.

The buyback price has been set at Rs 725, which is at about a 28% premium to the current price. In effect, shareholders are not just being paid to wait so to speak. Some are being paid handsomely (if they get to participate in the buyback).

Capital Discipline: Why the Board Chose Buybacks Over Reckless Expansion

One reason GHCL has avoided the usual cycle-time mistakes lies in how the company is run.

The board reflects a promoter-led structure, but one that is firmly professional in its day-to-day decision-making.

Independent directors form a meaningful majority, and key committees are chaired by non-executive members. This matters in cyclical businesses, where the biggest risk is not demand but timing. Expanding too early, borrowing too much, or chasing volumes when prices are already turning matter.

Over the years, GHCL’s capital allocation has been marked by restraint.

Capacity has been added selectively, diversification has been funded without stretching the balance sheet, and surplus cash has been returned to shareholders rather than deployed simply for the sake of growth. In downcycles, governance does not show up as growth. It shows up as what a company chooses not to do.

Where valuation fits in

At current levels, GHCL trades at about 9x trailing earnings, broadly in line with its long-term median multiple. This is not a distressed valuation, but neither does it reflect peak-cycle optimism.

Historically, GHCL’s valuation compresses when margins are under pressure and expands only after pricing visibility improves. That pattern is visible again today.

The stock is being valued largely on depressed near-term earnings, with limited credit for surplus cash, diversification-led EBITDA uplift or a normalisation in soda ash pricing.

For investors, this framing matters. The valuation is not betting on a sharp turnaround. It is pricing in caution on margins, on timing and on the cycle itself.

Commodity cycles do not announce their turning points. They reveal them only in hindsight.

GHCL sits at one such junction: a business with steady domestic demand, temporary pricing stress, surplus cash and a changing earnings mix. For investors willing to look past one or two weak quarters, that combination which is not near-term numbers, may end up doing the heavy lifting.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Manvi Aggarwal has been tracking the stock markets for nearly two decades. She spent about eight years as a financial analyst at a value-style fund, managing money for international investors. That’s where she honed her expertise in deep-dive research, looking beyond the obvious to spot value where others didn’t. Now, she brings that same sharp eye to uncovering overlooked and misunderstood investment opportunities in Indian equities. As a columnist for LiveMint and Equitymaster, she breaks down complex financial trends into actionable insights for investors.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article. The website managers, its employee(s) and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.