Each day around 2 p.m., my husband calls me with the same familiar line — “Khaana thanda ho gaya.” Naturally, it was cold — I packed it at 8 a.m., and he opened it after half a workday, like an archaeologist digging up leftovers. I did everything. New lunchbox, insulated bag, emotional blackmail — nothing worked.

One afternoon, he groaned and said, “There must be some way to have hot food for lunch without an in-home chef on staff.” That’s when it hit me — I just “Porter-ed” it to him.

Porter is a delivery app that enables you to shift anything — tiffin, parcel, or package — around the city with minimal taps. It’s tiny, quick, and unexpectedly reliable. With that single tap, I had ended what seemed like a daily domestic crisis, and it made me wonder — if one small logistics platform can transform one household so much, think of what a fleet of them is doing for India’s e-commerce galaxy.

A new generation of small-cap logistics firms is quietly fuelling the nation’s online shopping machine — not in ports or warehouses, but in the last few kilometres that determine customer happiness. These companies are lean, technology-enabled, and fixated on speed, scalability, and service.

This feature highlights four such firms — India’s e-commerce backyard muscle. The picks exclusively focus on those with established experience in last-mile and express delivery, and not freight forwarding or bulk movement.

These firms represent the intersection of technology, logistics, and consumption — where every minute and every delivery counts. Unlike broader logistics players, their revenues rise and fall with the pulse of India’s delivery economy — making them the most authentic participants in the country’s unfolding last-mile revolution.

#1 Delhivery

Delhivery provides a full range of Logistics services, including delivery of express parcels and heavy goods, partial-truck and full-truck freight services, warehousing, supply chain solutions, cross-border Express, freight services, and supply chain software. The company also offers value-added services such as e-commerce return services, payment collection and processing, installation & assembly services, and fraud detection.

Delhivery kept gaining traction in its core Express Parcel business in 1QFY26, aided by full-quarter contribution of volumes of Ecom Express and robust e-commerce platform demand. Parcel volumes in Q1 were at 208 million shipments, 14% higher year-on-year and 17% quarter-on-quarter, with management pointing out that the bigger step-up would be apparent from Q2 onwards as all Ecom shipments came onto the Delhivery network.

Approval from the Competition Commission of India in June and fast operational integration of Ecom Express’s client accounts and parcel volumes into Delhivery’s network facilitated faster-than-anticipated transition in customer volumes. Management also noted a “flight to quality” phenomenon, as marketplaces and brands focused on guaranteed delivery in the face of volatility in demand and weather disruptions.

The firm deepened its delivery coverage to 18,857 PIN codes, running 4,500 express delivery hubs, while automation, network use and stable pricing assisted in supporting parcel margins.

With festive-season highs occurring earlier this year, Delhivery is likely to have ended the second quarter with elevated volumes and enhanced profitability, setting the business up for continued gains in India’s fast-growing e-commerce logistics business.

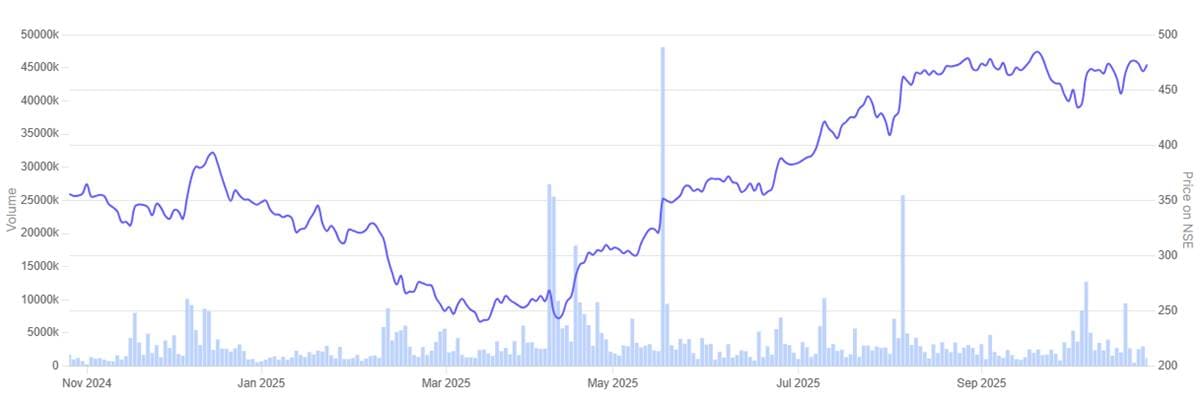

In the past year Delhivery share price is up 33.1%.

Delhivery 1-Year Share Price Chart

#2 Blue Dart Express

Blue Dart Express, incorporated in 1988, is involved in transportation and door-to-door distribution of time-sensitive shipments, through an integrated ground and air transportation network. The company is regarded as South Asia’s leading courier and integrated air express package distribution company.

Blue Dart Express witnessed consistent volume growth from its retail parcel segment in 1QFY26, with management affirming that B2C accounts for its e-commerce or e-tail business.

In the June quarter, B2C revenue increased 20.2% year on year, well ahead of B2B’s 2.4%. The mix has also moved marginally in favour of e-commerce, with B2C now accounting for 29% of revenue, compared with approximately 26% a year ago.

Blue Dart is also increasing capacity to facilitate this transition. It has opened a major integrated facility in Delhi at Bijwasan and has been consolidating and modernizing its ground network in order to meet more parcel loads. Ground B2C and surface B2B, management added, are volume drivers in the future.

While margins eased on account of variance in shipment weight mix and product mix, the company affirms that its focus remains on service differentiation and profitable growth even as competition becomes more fierce in logistics.

With a stable demand coupled with peak-season volumes already driving Q2 performance, Blue Dart stepped into the festive months with a focus on efficiency, network utilisation, and maintaining growth in the high-priority e-commerce segment.

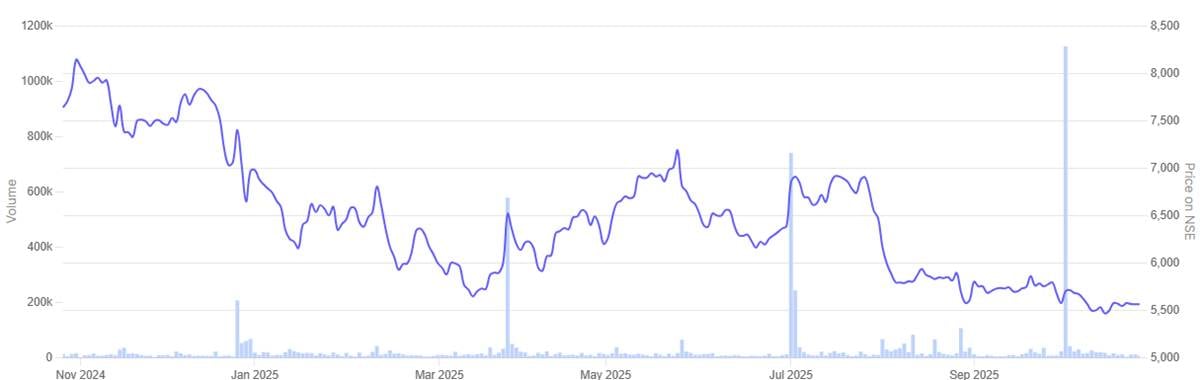

In the past year Blue Dart Express share price tumbled 27.1%.

Blue Dart Express 1-Year Share Price Chart

#3 Allcargo Logistics

Incorporated in 1993, Allcargo Logistics provides integrated logistics solutions and offers specialized logistics services across multimodal transport operations, inland container depot, container freight station operations, contract logistics operations and project and engineering solutions.

Allcargo Logistics flagged better performance in its domestic express operations in FY26, supported by demand from e-commerce and quick commerce businesses, which management stated “continue to grow well” in India’s logistics market.

The turnaround at Gati is going as per the company’s plan, with more selective customer addition and better cost discipline contributing to EBITDA growth despite softer revenues in the June quarter. The express segment experienced a 7% sequential fall in revenue but EBITDA increased by 18% as route optimisation and cost rationalisation initiatives began to yield benefits.

Management reported strong volume momentum at the start of Q2, supported by an early festive-season stocking and renewed strength from major ecommerce accounts. Operating leverage is expected to drive through as utilization picks up and mid-mile efficiency increases with growing parcel loads.

Management acknowledged that growth in its express business has lagged peers. However, they highlighted steps taken to correct this, including appointing a new leadership team and restoring pricing discipline. Resets in cost structure and higher yields should underpin profitability over festive periods, though management remains prudent on the broader macro backdrop.

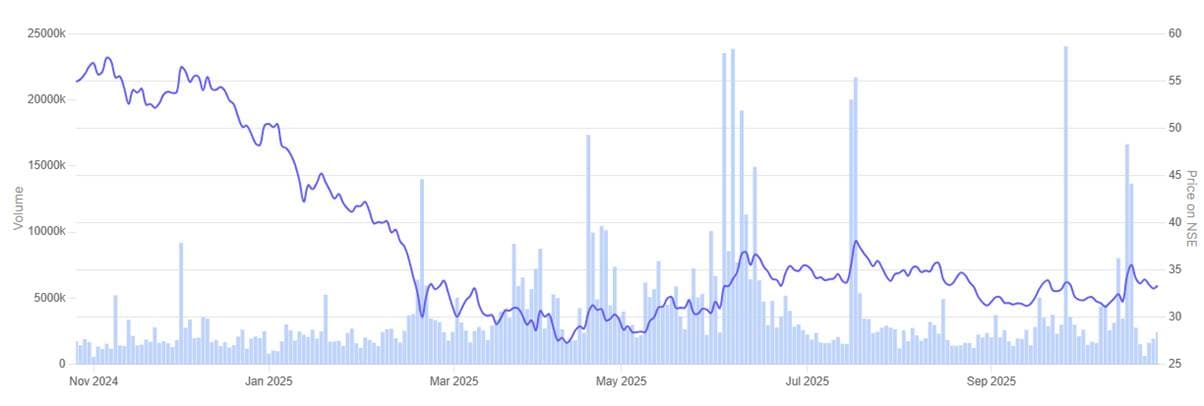

In the past year Allcargo Logistics share price tumbled 39.3%.

Allcargo Logistics 1-Year Share Price Chart

#4 TCI Express

TCI Express is an express cargo logistics company with its own set up across India. It carries distribution through various modes of transport and is specialised in offering time definite solutions.

TCI Express announced that it is positioning for growth in e-commerce and direct-to-consumer, with a standalone unit now being established to grow B2C deliveries, especially last-mile operations. The management stated the company is “refocusing” on e-commerce because market conditions have levelled off and customers are increasingly adopting direct delivery models.

The company kept investing in infrastructure to facilitate this transition. Three new automated sorting centres were opened in Nagpur, Raipur and Indore, aggregating over 2 lakh sq ft, and 10 new branches were opened in Q1 to enhance delivery coverage in high-demand areas.

C2C Express, operating in the emerging consumer segments such as small sellers and D2C brands, achieved more than 14% Q1 FY26 growth. Management anticipates festive-related pick-up during Q2 to facilitate further momentum in these retail-led segments.

Though overall revenue eased because of moderation in underlying industrial demand, stable margins and asset-light business model supported maintaining profitability. The company is also guarded on diverse performance across segments but anticipates improving utilisation and select e-commerce contribution to support progress in the second half of FY26.

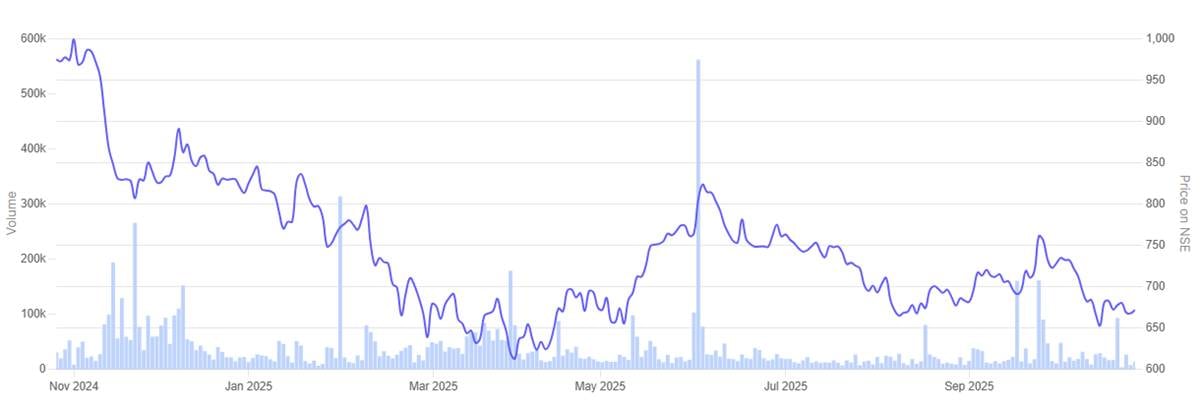

In the past year TCI Express share price tumbled 31%.

TCI Express 1-Year Share Price Chart

Valuations

Let’s now turn to the valuations of the e-commerce logistics companies in focus, using the Enterprise Value to EBITDA multiple as a yardstick.

Valuations of E-Commerce Logistics Companies in India

| Sr No | Company | EV/EBITDA | 10-year EV/EBITDA | ROCE |

| 1 | Delhivery | 15.4 | 19.8 | 2.5% |

| 2 | Blue Dart Express | 40.3 | 39.9 | 16.3% |

| 3 | Allcargo Logistics | 9.5 | 6.7 | 3.8% |

| 4 | TCI Express | 18.3 | 26.2 | 15.8% |

| Industry Median | 12.0 | 13.5% |

Investors are only willing to pay premium, however, where returns on capital are already established. Operators with consistently strong execution and premium service positioning — such as Blue Dart and TCI Express — still enjoy market confidence. Conversely, operators still testing the scalability of their financial model — such as Delhivery and Allcargo Logistics — are valued at more contained multiples for significant exposure to India’s e-commerce expansion.

This divergence indicates how the market has become selective following the re-rating of the logistics sector in the past few years. Potential for growth is no longer sufficient — investors are increasingly seeking proven enhancements in capital productivity, pricing power and network utilisation.

The actual opportunity is to determine which companies can turn scale into long-term margins in the years ahead.

Conclusion

India’s digital retailing boom has placed unprecedented stress on the last mile. Consumers desire speed, brands desire dependability, and the logistics players that win will be those that can repeat this performance every time. The four companies highlighted here are doing more than mere parcel movement — they are driving India’s consumption machine forward, doorstep by doorstep.

But as the industry comes of age, size alone is no longer the differentiator. Investors are rewarding those who combine size with tangible returns and rigorous execution. Meanwhile, still-evolving companies must demonstrate that operating leverage and pricing power can step in quickly enough to support their aspirations.

The peak season provides a critical testing ground. Growing order volumes, higher utilisation, and leaner cost structures will reveal who can really win in India’s changing delivery economy. Investors, thus, must look past headline growth and assess business fundamentals — capital intensity, network building strategies, and management implementation — before making investment choices.

India’s e-commerce hub is growing at a breakneck pace. The question now is straightforward: among these last-mile heroes, who can keep pace with India’s impatient consumers and translate every delivered order into sustainable shareholder value?

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Ekta Sonecha Desai has a passion for writing and a deep interest in the equity markets. Combined with an analytical approach, she likes to dig deep into the world of companies, studying their performance, and uncovering insights that bring value to her readers.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.