Markets are known to overreact, and investors tend to be finicky due to the volatile nature of the markets. Amidst this, it is nothing short of an achievement for anyone to hold stocks for a decade. But smart investors like Ashish Dhawan are known to pull off this feat with finesse. So, when Dhawan sells stocks that he had held for a long time, it turns heads.

And that is what he did! He has sold two of his favourite stocks, one of which – a global pharma giant he was holding for about 6 years, and the other is a manufacturer of laminates exporting to over 120 countries, which he held for a decade.

Let us try and decode the reasons behind this exit.

Curing the Portfolio – Glenmark Pharmaceuticals Ltd

Glenmark Pharmaceuticals Ltd is a global research-led pharmaceutical company with presence across generics, Specialty and OTC business with operations in over 80 countries.

With a market cap of Rs 52,216 cr, Glenmark Pharmaceuticals Ltd was a part of Warren Buffett of India, Ashish Dhawan’s portfolio since December 2019 as per Trendlyne.com. As of the quarter ending June 2025 his holding was 1.24% which as per the filings for the quarter ending September 2025, fell below 1% meaning a complete or partial exit.

At the same time, HDFC MidCap Fund just bought a 6.2% stake in the company, showing a clear difference of opinion with Dhawan.

The company’s sales went from Rs 10,641 cr in FY20 to Rs 13,322 cr in FY25, which is a compounded growth of 5%.

The EBITDA (earnings before interest, taxes, depreciation, and amortization) climbed from Rs 1,699 cr in FY20 to Rs 2,351 cr in FY25, logging in a compound growth of almost 7%.

When it comes to profits, Glenmark has shown a complete turnaround in FY25, after a bad FY23 and FY24.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Rs Cr | 776 | 970 | 994 | 377 | -1,434 | 1,047 |

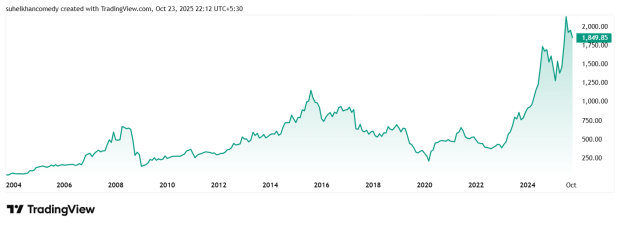

The share price of Glenmark Pharma was Rs 485 in October 2020 and as of closing on 23rd October 2025, it was Rs 1,851, which is a jump of 281%.

The company’s share is trading at a PE of 39x, while the current industry median is 33x. The 10-year median PE for Glenmark Pharma is 18x, which is lower than the industry median of 27x for the same period.

In the latest Annual report, the company’s Chairman & Managing Director, Glenn Saldanha said, “FY 2025 was a year of reset. A bold pivot into a future we are actively building: more focused, more innovative, and more global than ever before. As Glenmark 3.0 is our strategy in motion. A shift from scale to value. From generic to differentiated. From legacy to leadership.”

Beautifying The Portfolio – Greenlam Industries Ltd

Incorporated in 2013, Greenlam Industries Limited is engaged in the business of manufacturing laminates, decorative veneers and allied products through its factories at Behror, Nalagarh, Prantij and Tindivanam having branches and dealers’ network.

With a market cap of Rs 5,690 cr, Greenlam Industries was a part of Dhawan’s holdings at least since December 2015 (since records were available), per Trendlyne.com. However, as per the recent exchange filings for the quarter ending September 2025, the holding has fallen below 1% from the previous quarter’s 3.77% which means Dhawan has partially or fully exited the stock.

As for the financials, the company’s sales grew at a compounded rate of 14% from Rs 1,321 cr in FY20 to Rs 2,569 in FY25.

EBITDA also grew from Rs 179 cr in FY20 to Rs 275 cr in FY25, which is a compounded growth of 9%. The FY25 figure is however lower than the previous financial year’s number of Rs 296 cr.

Greenlam’s net profits could be one reason for the stock losing favour with Ashish Dhawan.

| Year | FY20 | FY21 | FY22 | FY23 | FY24 | FY25 |

| Profits/Rs Cr | 87 | 74 | 91 | 129 | 138 | 68 |

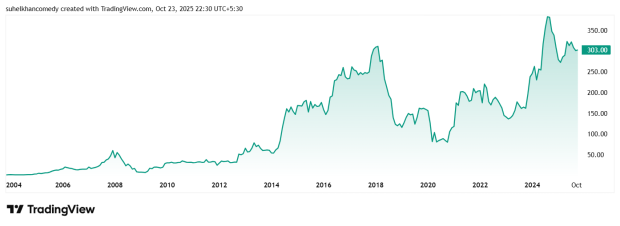

Greenlam’s share price was around Rs 76 in October 2020 which has grown to its current price of Rs 256 as of closing on 24th October 2025. This is a jump of about 240%.

The company’s share is trading at a PE of 194, which is much higher than the current industry median of 45x. The 10-year median PE for the company is 40x and the industry median for the same period is 28x.

According to the August 2025 investor presentation, Greenlam’s capacity build-out is complete and the business is now entering a phase of operating leverage, with significant margin and ROCE improvement potential as utilization ramps up.

Follow The Dhawan Playbook?

What has triggered Ashish Dhawan’s decision to sell off his holdings in two of his favourite stocks? Are these strategic exits or red flags the market is not seeing right now? The answer could very well be in Dhawan’s knack for seeing beyond the usual market noise.

Glenmark seems to be struggling when it comes to profits, although it has shown a turnaround in the last financial year. While Greenlam is also having a tough time sustaining its overall net profits. However, the management of both companies seem quite confident when it comes to the future of the two companies. But whatever be the case, both have fallen out of favour when it comes to Dhawan.

While we might never find out the exact reason or strategy behind these exits, one can always be in the know by adding these stocks to a watchlist and following them in the coming weeks and months. Whether you already own them or plan on adding them to your portfolio, the watchlist seems like a clever idea.

Note: We have relied on data from www.Screener.in and www.trendlyne.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.