Every sector has those quiet winners that everyone knows, but aren’t discussed much. They are the ones that don’t capture headlines, don’t make dramatic broadcasts, or chase fame.

For years, Sona BLW Precision Forgings (Sona Comstar) was one of them. If you walked past its manufacturing units ten years ago, you probably wouldn’t guess that this modest component maker, known for its components and differential assemblies, would one day become the most watched name in India’s electric mobility supply chain.

But that is how most long-term shifts begin. Not with sparklers, but with slow, almost unseen moves. A hiring decision here. A new R&D line there. An early experiment that few talk about for years.

Sona’s reinvention wasn’t sudden. It wasn’t fashionable. It wasn’t driven by buzzwords. It was built brick by brick; and by the time the EV world realised what had happened, the company had crossed the halfway mark already.

A company searching for a larger identity

If you want to understand Sona’s transformation, then you must go back to the years before electric vehicles became part of everyday conversations.

In the mid-2010s, Sona was a recognized driveline components firm. It was valuable, effective, and technologically sound. But it was also caged into a limited view: a conventional auto parts provider subject to internal combustion engine (ICE) requirement cycles. While revenue growth was steady, it wasn’t exciting.

Margins were healthy, but not distinguished. And while the auto industry was merging globally, Sona stayed a mid-sized expert with a limited narrative around global impact or future-ready technology.

There were three big constraints Sona faced. The risk of product concentration. Components and differential assemblies were consistent businesses, but they fit into the old auto world. A few global Original Equipment Manufacturers accounted for a big part of the volumes.

The global swing to electrification had started, and the company needed to determine if it wanted to be part of that future or play it safe in the legacy automotive space.

Many suppliers hesitated during this period. Some waited for EV penetration to rise. Others stuck to ICE productivity because it was comfy.

Sona didn’t wait. It started planting seeds. Quietly.

The pivot: Betting on precision over volume

Around the late 2010s, when the market still saw electric vehicles as a remote dream, Sona began restructuring its core, not through dramatic risks, but through timely changes that allied engineering depths with EV demand globally.

It decided to invest in precision and motor tech, while most automotive providers were debating EV adoption rates. Sona focused on R&D into high-precision forged components, differential gears for EVs, and motor-attached assemblies.

These were not experimental side-projects; they were considered long-term growth engines.

What’s more, the management realised something: EVs need fewer parts, but each component has better industrial value.

Sona directed its research, product design, and customer discussions towards parts that would give it a larger share of value in an EV model, specifically traction motors, differential assemblies, and accuracy gears for high-torque products.

Export-Led Scaling

The real turning point was its export positioning and stock market listing in 2021. The years between 2021 and 2024 saw Sona supplying parts not only to Indian OEMs, but to some of the world’s fastest-growing EV manufacturers.

These changes went unnoticed as there were no loud statements, no forceful investor marketing, just steady program wins.

The shift in revenue mix

This year, the company’s share of EV-derived revenue had climbed meaningfully, even while ICE components continued providing a stable base.

This is why Sona wasn’t shaken when international EV demand reduced in pockets; its product range was devised to ride a multi-year adoption cycle, not pursue short-term EV headlines.

The Payoff: Margins, moats, and Market Share

Q2FY26 saw its revenue grow 23.4% to ₹1,138 crore compared to ₹922 crore in Q2FY25. Its net profit rose from ₹152 crore in Q2 FY25 to ₹172 crore in Q2FY26, excluding exceptional items.

The operating margin stayed healthy at 25% during the same quarter. The profit grew at a compounded rate of 19% over three years while the average return on equity was 17% for the same period.

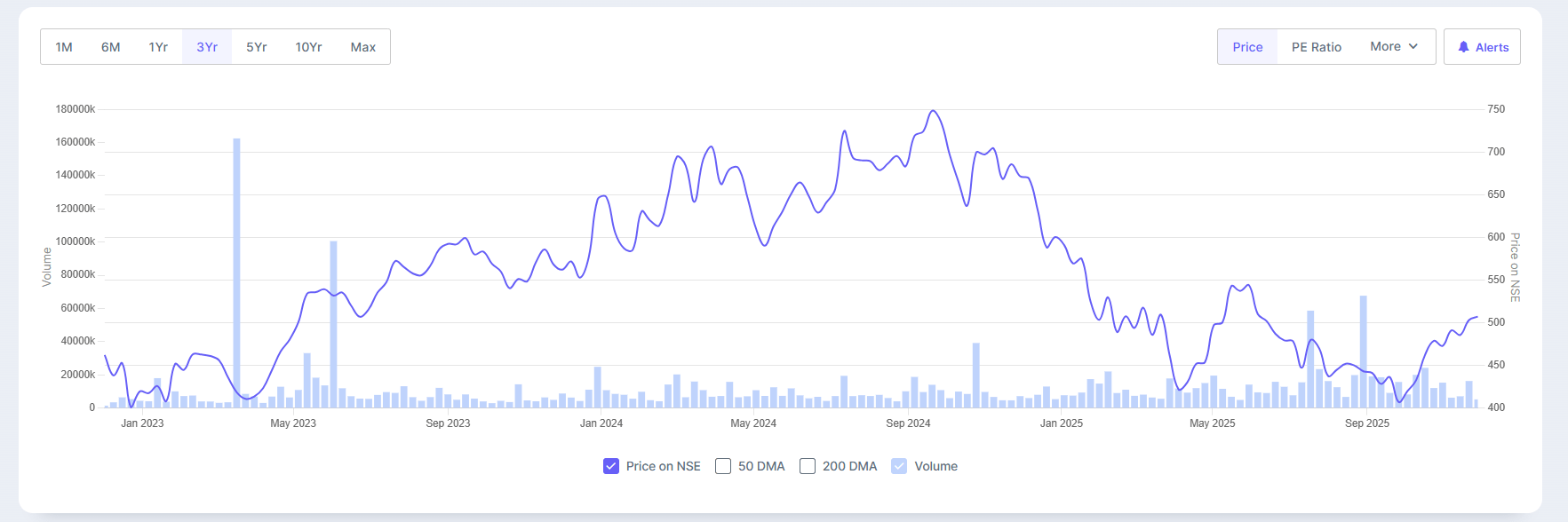

Three-Year Share Price Trend

These numbers tell a clear story. Sona Comstar expanded through engineering-led compounding. The sales revenue has scaled steadily, and profitability has remained steady despite its investments in R&D and capacity growth.

The company is not chasing hypergrowth; it is building a prolonged existence.

Slow, Steady, And Very Deliberate EV Bet

If you analyze Sona’s product mix today, one theme stands out: the company expanded its EV traction parts before the rest of the industry had even identified the chance.

EV traction motors, high-precision differential assemblies, and next-generation gear components are long-sales-cycle businesses. Once a provider is picked for a platform, they often stay collaborators for years, sometimes for the entire model lifecycle.

That is precisely how Sona developed.

Drivers of Growth

It set up global OEM programs. Over five years, Sona quietly collected program wins with international EV manufacturers. It did not believe in under-pricing, but in offering an engineering product depth that few players could match.

The higher content per vehicle focus meantSona’s components have a much higher value per unit than ICE components. This change allowed the company to scale revenue without proportional increases in volume, giving it the operational leverage it needed.

Rather than trying to build everything in-house, Sona decided on Technology partnerships and high-accuracy R&D investments. Which is why its EV product portfolio advanced sooner than many of its national peers.

What’s interesting is how quietly this transformation to a global supplier from India unfolded. Sona’s share of EV-aligned income today shows a shift that began long before the market realised its importance.

The risks: Why it’s not all smooth sailing

Every change story has its weaknesses, and Sona’s progress is not immune to them.

The risk of customer concentration is ever-present. A few global OEMs still make up a large chunk of revenue. This is typical for high-precision providers, but it continues to be an organizational risk.

EV adoption is volatile.Sona may benefit from the long-term EV trends, not its monthly revenue numbers. Even so, a sustained slowdown in EV acceptance in key markets could delay any scaling the company aims for.

High-precision machines and motor line extensions need constant capex. The company must balance expansion investments with margin discipline.

Global sourcing contracts often have cost-down potential on multi-year contract timelines. Sona Comstar has accomplished this well so far, but competitive pricing is a perpetual feature of the automotive supply chain.

While mostly protected, Sona does face imported material price volatility, global commodity cycles, and currency movements.

These risks don’t undermine the long-term story; they simply secure it in common sense.

A slow-burn evolution

The world often celebrates new-age EV OEMs, battery manufacturers, and charging businesses. But the parts that keep EVs running, the components, engines, and precision assemblies, seldom step into the spotlight. Sona Comstar is part of that oft-ignored backbone.

It didn’t become an EV supplier because the market asked for it.

It became one because the company understood that the future of mobility is built on engineering detail, not storyline hype.

It didn’t transform because EVs were fashionable. It changed because it saw an operational opportunity and shifted early.

And it didn’t scale because of lucky timing. It scaled because of constant implementation.

What looks obvious today was not obvious five years ago.

Reinventing before the world notices

If you step back and view Sona’s journey from a distance, it resembles the arc of many quietly ambitious Indian companies: no clatter, no drama, just solid reinvention.

Five years ago, Sona was a respected components supplier.

Today, it’s one of the leading mobility tech companies that sits at the node of global EV value chains, precision engineering, and long-cycle OEM partnerships.

It didn’t chase headlines, yet it found itself on the EV highway.

It didn’t seek attention, yet investors now follow it closely.

It didn’t shout about its strategy, but its numbers did the talking.

The next phase of the company’s story will hang on how global EV adoption steadies, how its new platforms scale, and how well it traverses competition.

But one thing is clear: Sona Comstar’s rise wasn’t an accident. It was a slow-burning change, the kind India is progressively becoming known for.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available have, we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points, and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Archana Chettiar is a writer with over a decade of experience in storytelling and, in particular, investor education. In a previous assignment, at Equentis Wealth Advisory, she led innovation and communication initiatives. Here she focused her writing on stocks and other investment avenues that could empower her readers to make potentially better investment decisions.

Disclosure: The writer and her dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.