Public Sector Enterprises (PSEs) in India play a vital role in the economic and social development of the country.

They contribute significant revenue to the government through dividends and taxes, which helps fund various development programs.

Even in a globalised economy, PSEs remain crucial for national security, economic stability, and long-term infrastructure projects that private enterprises may find financially unviable.

Here are the 5 top PSEs in India. We have ranked them purely based on their market capitalisation. This is not a fundamental analysis nor a recommendation of any kind.

#1 State Bank of India (SBI)

First on the list is SBI with a market capitalisation of Rs 8,035.25 billion (bn) at the time of writing.

SBI is the largest and oldest public sector bank in India. SBI commands roughly one-fourth of the banking market share in India.

The bank is listed on Indian stock exchanges and ranks as a Fortune 500 company, recognised as a systemically important bank in India, often termed “too big to fail.”

SBI offers a wide range of banking and financial services including retail banking, corporate banking, investment banking, wealth management, insurance, mutual funds, and credit cards, mainly through its subsidiaries like SBI Life Insurance, SBI General Insurance, SBI Mutual Fund, and SBI Card.

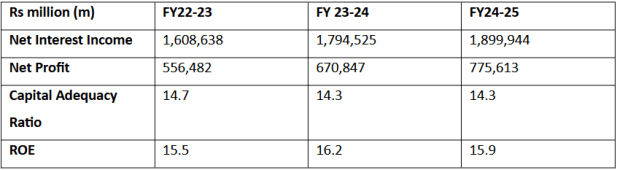

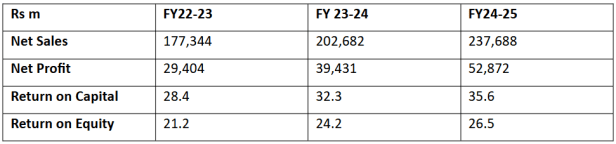

SBI Financial Snapshot (FY23-25)

Moving ahead, SBI has a strong credit pipeline and diversified growth across retail and SME segments. Its asset quality has stabilised over the years.

The bank benefits from structural drivers such as a healthy deposit franchise, ongoing government capital expenditure momentum, and disciplined cost management. These factors underpin its profitability resilience and potential expansion.

Digital and AI-led initiatives are increasing operational efficiency, potentially boosting returns further. The bank also has a comfortable liability situation, which provides a stable base for growth.

However, some challenges include potential pressure on net interest margin (NIM) during the initial phases of a downward interest rate cycle and a slow recovery in loan growth.

Overall, SBI is strategically positioned to benefit from India’s robust economic growth prospects, supported by digital transformation, strong asset quality, and government support.

#2 NTPC

Second on our list is NTPC with a marketcap of Rs 3,310 bn.

NTPC Ltd (formerly National Thermal Power Corporation) is India’s largest integrated power company. It operates a diverse fuel mix including coal-based thermal power plants, combined cycle gas, hydro, solar, and wind energy projects.

NTPC also undertakes consultancy, project management, and turnkey contracts for power projects. It has mining subsidiaries for coal supply and is involved in power trading and rural electrification.

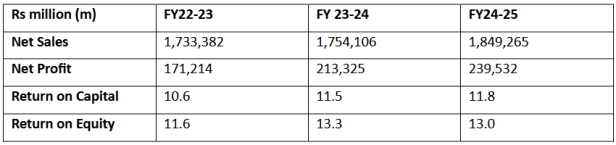

NTPC Financial Snapshot (FY23-25)

Moving ahead, NTPC has ambitious roadmap to install 60 GW of renewable energy capacity by 2032, marking a decisive shift from conventional fuels to clean alternatives.

Centered on an integrated technology strategy, NTPC is blending renewable energy with innovative solutions like battery energy storage systems, green hydrogen, digitalised operations, and infrastructure for electric and hydrogen-based mobility.

The approach aims to provide both scalability and adaptability, fostering a cleaner grid that aligns with India’s development needs while promoting a fair and sustainable energy transition.

Complementing its renewable push, NTPC is foraying into nuclear power through its JV with NPCIL Anu Shakti Vidyut Nigam Ltd, and its wholly owned subsidiary, NTPC Parmanu Urja Nigam Ltd.

On the green hydrogen front, NTPC has commissioned a series of strategically important pilot projects, marking its transition from planning to on-ground execution.

These include the country’s standalone green hydrogen microgrid at Dadri & Greater Noida, hydrogen blending into PNG networks at Kawas, and fuel cell-based mobility deployment in Ladakh.

Overall, NTPC is positioned as a cornerstone in India’s energy sector transformation, balancing expansion in conventional power generation with aggressive renewable energy development, innovation in clean energy, and strategic diversification into nuclear and hydrogen energy.

#3 Hindustan Aeronautics (HAL)

Third on our list is Hindustan Aeronautics with a market capitalisation of Rs 3,170 bn.

The company is the biggest defence PSUe in the country. HAL designs, manufactures, and overhauls aircraft, helicopters, jet engines, and related avionics and systems.

The company plays a key role in developing indigenous aircraft such as the HF-24 Marut fighter-bomber and continues to contribute to India’s defence modernisation with platforms like the Light Combat Aircraft Tejas.

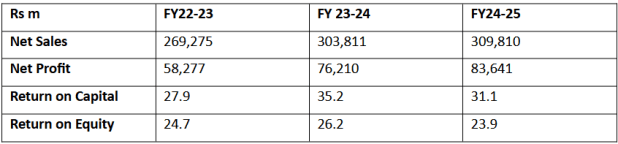

HAL Financial Snapshot (FY23-25)

In alignment with its strategic objectives, the company has outlined a comprehensive capex plan for the next five years, with an estimated investment of Rs 140-150 bn.

This plan prioritises the expansion of manufacturing capacities and the establishment of repair and overhaul (ROH) facilities for various platforms.

Key areas of focus include developing manufacturing infrastructure for the LCA Mk2, GE-414 engines, and Indian multi role helicopter engines.

Additionally, the investment will support facilities dedicated to design and development activities for the IMRH, advanced medium combat aircraft, and other related projects.

HAL is also making rapid strides on the export front. It’s supplying aircraft like H-228 to Guyana, Do-228 to Seychelles and Mauritius, helicopters to Nepal, Maldives, Mauritius, Suriname, and Namibia.

The company has exported ring forgings of super alloys to UK and US, and Su-30 avionics to Malaysia.

As of March 2025, the order book position of the company stood at Rs 1,893.02 bn.

HAL’s future prospects are robust with substantial order inflows, government-backed restructuring plans to enhance efficiency, and strategic initiatives to deepen indigenous manufacturing and technology development.

#4 Oil & Natural Gas Corporation (ONGC)

Fourth on our list is ONGC with a market capitalisation of Rs 3,017.38 bn. ONGC is India’s largest government-owned oil and gas explorer and producer.

The company plays a critical role in India’s energy sector, contributing around 70-71% of the country’s domestic production of crude oil and natural gas.

ONGC is vertically integrated across the entire oil and gas industry, involved in exploration, production, and related oil-field services.

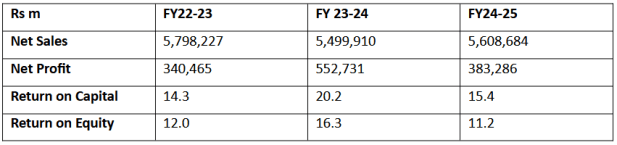

ONGC Financial Snapshot (FY23-25)

Moving forward, ONGC has been successful in new hydrocarbon discoveries across various basins in India and is pushing frontier exploration in deep-water and ultra-deep-water areas.

The company is investing in infrastructure, including drilling new wells, building platforms, pipelines, and gas processing facilities in key areas like KG Basin.

It has also diversified into renewable energy. ONGC aims to develop 1 GW of new renewable capacity in the current year, equally split between solar and wind energy.

ONGC Green Ltd, a subsidiary, has been created to drive this energy transition with ambitions to achieve net zero emissions by 2038.

#5 Bharat Electronics Ltd (BEL)

Finally, we have BEL with market capitalisation of Rs 2,924 bn. The company is a leading aerospace and defence electronics company for Indian armed forces.

BEL caters to a wide range of needs of India’s defence sector, with a core focus on developing advanced electronics equipment, systems, and services for India’s defence sector.

BEL Financial Snapshot (FY23-25)

Moving ahead, BEL is targeting a healthy growth of 15-20% in FY26.

Segments like radar and missile systems, communication and network centric systems, electro optic systems, electronic warfare & avionics systems, anti-submarine warfare & sonar systems, and tank electronics and gun upgrades, will continue to drive the company’s growth in the coming years.

Along with this, the non-defence segment businesses such as rail and metro solutions, civil aviation solutions, homeland security, EVMs and other diversification areas will also contribute to growth.

The company will remain watchful of the challenges brought by the geopolitical situations, emerging technologies, regulatory changes and the evolving customer expectations. It intends to remain agile to effectively navigate them.

BEL is also laying greater emphasis on working closely with DRDO labs, research institutions and academic institutions as well as with niche technology companies and consultants for the development of new products and systems.

Overall, Bharat Electronics is well-positioned for sustained growth due to strong government defence spending, expanding order pipeline, improving profitability, and solid financial position.

Conclusion

PSEs have contributed significantly to industrialisation, infrastructure development, and balanced regional growth, playing a vital role in nation-building since independence.

Challenges remain in governance and efficiency, but reforms and MoU frameworks aim to enhance accountability and financial performance.

To know what’s moving the Indian stock markets today, check out the most recent share market updates here.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.