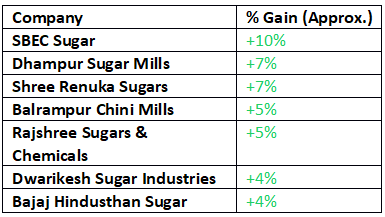

Sugar stocks turned extra sweet in today’s session, with several names surging sharply.

Why are Sugar Stocks Rising?

Sugar stocks are on a roll after the Centre approved exports of 1.5 million tonnes (MT) of sugar for the 2025–26 season, which began in October. According to the Food Ministry, this move aims to support the industry amid weak domestic earnings and improve cash flows for millers.

In another boost, the government has scrapped the 50% export duty on molasses, a key by-product of sugar production, to encourage outbound shipments.

With the export window now open and sentiment turning positive across the sector, here are top 4 sugar stocks to add to your watchlist.

#1 Shree Renuka Sugars

First on the list is Shree Renuka Sugars.

It is one of the largest integrated sugar and ethanol companies in India, with an expanding presence in agribusiness and bio-energy.

The company’s operations cover the entire value chain — from sugarcane crushing and raw sugar refining to ethanol production, power cogeneration, and branded consumer retail.

With six advanced sugar mills (many equipped with cogeneration and distillery units) and two of India’s largest port-based refineries, Shree Renuka caters to both domestic and international markets.

Its flagship brand, Madhur, is India’s #1 packaged sugar brand, with a 33% market share in the branded segment.

Known for purity and hygiene, Madhur has built a strong presence across urban and semi-urban India through an extensive distribution network.

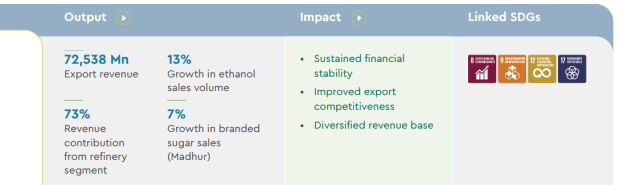

In FY25, the company reported export revenue of Rs 72,538 million (m).

With the government approving 1.5 MT of sugar exports for the 2025–26 season and removing export duties on molasses, Shree Renuka Sugars is well-positioned to capitalise on export demand.

The company aims to expand its multi-feedstock distillation capacity to de-risk operations and support India’s higher ethanol blending targets.

#2 Bajaj Hindustan Sugar

Next on the list is Bajaj Hindustan Sugar.

Bajaj Hindustan Sugar Ltd operates across four segments — Sugar, Distillery, Power, and Others. It’s involved in the production of sugar, industrial alcohol, and power generation from bagasse, a by-product of sugarcane.

Bajaj Hindustan produces sugar in various grades and sizes, catering to both industrial and consumer requirements.

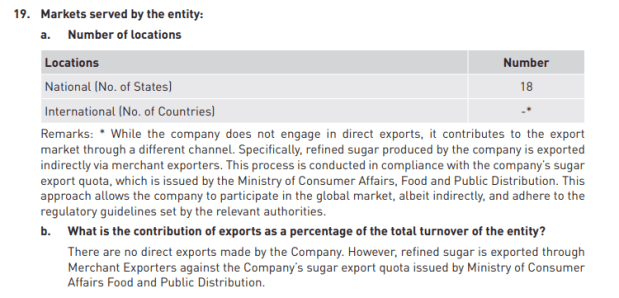

While the company does not directly export sugar, its refined sugar is exported through merchant exporters under the export quota issued by the Ministry of Consumer Affairs, Food, and Public Distribution.

Bajaj Hindustan Sugar is one stock to watch as export activity picks up and market sentiment for the sector strengthens.

Going forward, the company plans to expand its market reach.

#3 Dalmia Bharat Sugar

Next on the list is Dalmia Bharat Sugar.

The company is a part of the Dalmia Bharat Group. It’s among the youngest and largest sugar companies in India.

The company operates five sugar manufacturing units across Maharashtra and Uttar Pradesh, along with five cogeneration power plants having a total installed capacity of 126 MW.

Over the years, Dalmia Bharat Sugar has established partnerships with leading FMCG majors such as Coca-Cola, PepsiCo, Mondelez, Perfetti, Britannia, and Walmart India, serving as a trusted supplier.

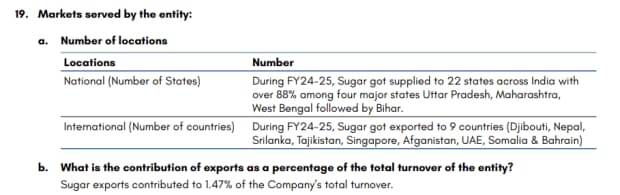

In FY25, the company exported sugar to nine countries—including Djibouti, Nepal, Sri Lanka, Tajikistan, Singapore, Afghanistan, UAE, Somalia, and Bahrain—with exports contributing 1.47% of total turnover.

Dalmia Bharat Sugar continues to strengthen its global presence and diversify revenue streams.

Going forward, the company plans to scale its capacity, diversify its feedstock base, expand green energy output, and modernise its workforce.

#4 Dwarikesh Sugar Industries

Next on the list is Dwarikesh Sugar Industries.

Dwarikesh Sugar Industries Ltd was established by Shri G. R. Morarka in 1993. Over 30 years, the company has grown into a leading player in India’s sugar industry. It has built a diverse product portfolio, including sugar, ethanol, and co-generated power.

The company operates three manufacturing units in central Uttar Pradesh. The Dwarikesh Nagar and Dwarikesh Puram plants are located 45 km apart in Bijnor district, while the Dwarikesh Dham plant is situated in Bareilly district.

While Dwarikesh Sugar does not directly export sugar, its refined sugar is exported through merchant exporters under the government’s export quota system.

Dwarikesh Sugar Industries is a stock to watch, given its strong integrated operations, efficient manufacturing base, and growing ethanol segment that aligns well with India’s biofuel goals.

Going forward, the company plans to adopt innovative cascading methods to process biomass fractions, enabling it to reduce disposal costs, enhance energy yield, lower greenhouse gas emissions, and expand its product portfolio.

Conclusion

Despite the export approval, the sector is not out of the woods.

The lack of a revision in ethanol prices, rising sugarcane procurement costs, and lower sugar recovery rates continue to weigh on margins.

These structural challenges could offset near-term gains from the export relaxation. Apart from these factors, most sugar stocks had corrected sharply after subdued second-quarter results.

While the government’s move to allow higher exports may provide a short-term boost, it remains to be seen whether this momentum can translate into a sustained recovery for the sector.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Happy investing.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.