PSU banking stocks have been experiencing a significant rally over the past few days, driven by optimism surrounding potential reforms in the sector.

According to the Economic Times, the Indian government is looking to raise the foreign investment limit from the existing 20%.

Such a move is expected to inject new momentum into the sector and enhance investor confidence.

Here is a list of 4 top PSU bank stocks in India to have on your watchlist. We have based this on market capitalisation taken from the equitymaster screener.

#1 SBI

First on the list is SBI.

The bank is the largest public sector bank in India in terms of lending and market capitalisation.

SBI offers a wide range of banking products and financial services, including retail banking, corporate banking, investment banking, asset management, insurance through its subsidiaries like SBI General Insurance and SBI Life Insurance, mutual funds, and credit cards through SBI Cards.

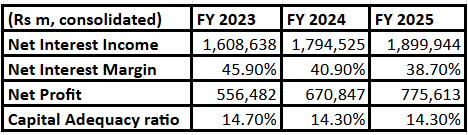

SBI Financial Snapshot (FY23-25)

On the financial front, the bank reported NII of Rs 474,622 million (m) for Q1 FY26 as against Rs 465,417 m YoY. Net profits of the bank were placed at Rs 216,266 m as against Rs 196,808 m YoY.

Moving ahead, the bank recently completed the sale of its 13.18% stake in Yes Bank to Japan’s Sumitomo Mitsui Banking Corporation for Rs 88.89 bn. The sale will boost SBI’s Q2 FY26 bottom line through proceeds likely to enhance treasury income.

State Bank of India has reaffirmed its growth targets of 12% loan growth and 10% deposit growth in the coming financial year, reflecting confidence in expanding its lending and deposit base.

#2 Bank of Baroda

Second on our list is Bank of Baroda.

Bank of Baroda is among the largest and oldest public sector banks in India. The bank offers a diverse range of services including personal banking, corporate banking, international banking, treasury, and rural banking.

Following the merger with Dena Bank and Vijaya Bank in 2019, it became the third-largest lender in India.

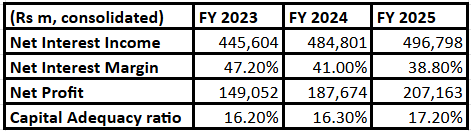

Bank of Baroda Financial Snapshot (FY23-25)

On the financial front the bank reported subdued numbers for the quarter ending 30 June 2025.

The NII for Q1 FY26 was at Rs 125,598 m, against Rs 125,607 m YoY. Net profits dropped to Rs 33,519 m, against Rs 45,805 m YoY.

Moving ahead, the bank is looking at growth that will include aggressive expansion in digital banking, to attract new customers and enhance operational efficiency.

The bank continues to benefit from increased credit demand in retail and MSME segments and ongoing policy-level support for PSU banks and financial inclusion initiatives.

#3 Punjab National Bank (PNB)

Third on our list is PNB.

Punjab National Bank is one of India’s oldest public sector banks. The bank has expanded significantly over the years, through mergers with New Bank of India (1993) and more recently, Oriental Bank of Commerce and United Bank of India (2020).

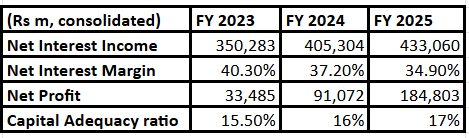

PNB Financial Snapshot (FY23-25)

On the financial front, PNB reported strong operating numbers for Q1 FY26, despite a drop in net profits due to tax adjustments.

The NII for Q1 FY26 was at Rs 107,440 m, against Rs 106,082 m YoY. Net profits dropped to Rs 18,322 m, against Rs 37,162m YoY.

The bank’s net profits fell sharply in Q1 FY26 primarily due to a one-time increase in tax expenses resulting from the bank’s transition to the new tax regime.

Moving ahead, PNB is targeting Rs 30,000 billion (bn) milestone by the end of FY26 through profit-led growth. The bank aims for 11-12% credit growth and 9-10% deposit growth in FY26, with a focus on retail and high-quality corporate loans.

#4 Canara Bank

Next on our list is Canara Bank.

It’s a leading PSU Bank in India. It offers comprehensive banking services including retail and corporate banking, loans, and more.

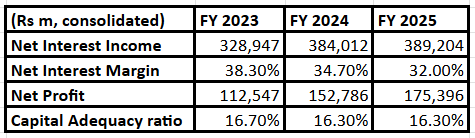

Canara Bank Financial Snapshot (FY23-25)

On the financial front, the bank reported good numbers for the quarter ending 30 June 2025.

Net interest income (NII) for Q1 FY26 was flat at Rs 95,308 m, against Rs 96,388 m YoY. Also, net profits surged to Rs 48,362 m, against Rs 39,772 m YoY.

The stock’s dividend yield is high and has seen increased foreign investor interest.

In fact, Foreign Institutional Investors (FIIs) have hiked their stake with holdings at 11.37% for the quarter ending June 2025, against 10.53% in March 2025 quarter.

Moving ahead, the bank will benefit from a good capital adequacy ratio (16.3%), strong digital adoption, and expanding credit demand in both urban and rural areas.

Conclusion

PSU banks in India are in a good growth phase, focusing on digitalisation and customer trust.

These banks are poised for a sustained recovery and growth period supported by cleaner balance sheets, government capital infusions, favourable regulatory changes, and expanding credit.

Investors should evaluate the company’s fundamentals, corporate governance, and valuations of the stock as key factors when conducting due diligence before making investment decisions.

Disclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here…

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.