The year 2025 will be remembered for commodities. On one side, things like gold and silver shone brightly, making investors a lot of money. On the other hand, stocks told a more complicated story.

The benchmark Nifty50 rose by a respectable 10.51%, but this headline number hid a reality that many retail investors felt in their portfolios. Large-cap stocks mostly kept the index steady, but mid- and small-cap stocks had a hard time, which hurt many people’s overall returns.

As we move into 2026, traders and investors may look at the stability and opportunity in the first quarter of the new year.

Sometimes it’s better to narrow your focus instead of chasing dozens of stocks in different sectors. And right now, one sector that stands out quietly but strongly is Nifty Oil & Gas.

You should watch Reliance Industries and Petronet LNG Ltd closely in the first quarter of 2026. Let’s take a step back and look at the whole sector before we talk about the stocks.

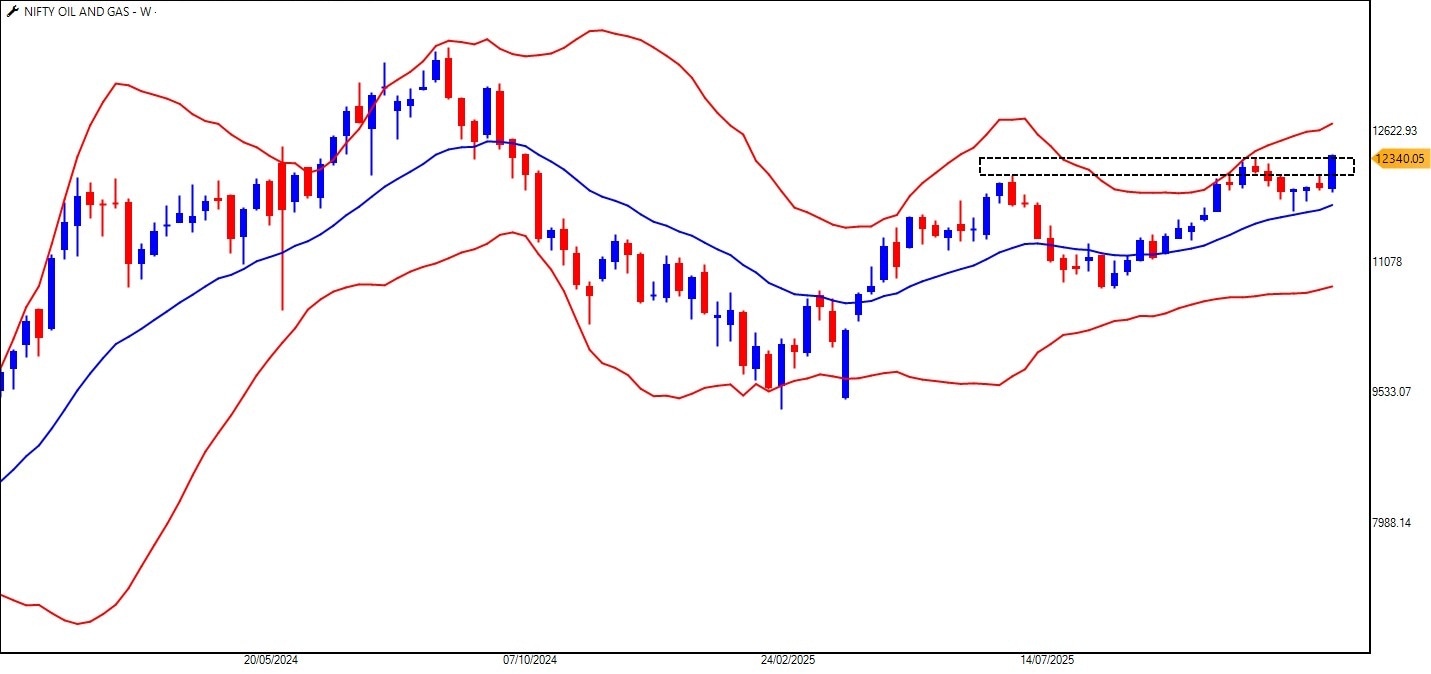

The Sleeping Giant: Decoding the Nifty Oil & Gas Breakout

The Nifty Oil and Gas Index has been sending good signals without making a big deal out of it. The index has broken out of its previous high on the weekly chart, which is a classic sign of a bullish breakout. The sector has crossed a point where sellers used to be in charge, and buyers are now in charge.

Bollinger Bands show another sign that things are getting better. When prices go up and the bands start to widen on the upside, it usually means that momentum is building.

This isn’t a slow crawl; it usually means that a new leg of an uptrend is starting. The index might even go past its all-time high of 13,607 if this trend keeps up.

This leads us to the most important question: who will be in charge of this move?

Heavyweight stocks are very important in any index. In the Oil & Gas index, one stock is very strong.

The 35% Heavyweight: Why Reliance Dictates the Sector’s Pulse

Reliance Industries is not just another company in the Oil & Gas index; it is the engine, with a weight of almost 32.48%. Reliance will almost certainly have to lead the way if the index has to reach new highs.

The strength of Reliance compared to other companies is what makes it interesting. Since October 2025, the stock has outperformed the Nifty50, which means that big investors like it better than the rest of the market. If the overall market stays supportive, this kind of outperformance often keeps going.

Reliance Ind Weekly Chart

Reliance has broken out of a Cup & Handle pattern on the weekly chart.

To the untrained eye, this pattern as a story of patience. The “cup” stands for a long time when prices go down and then back up slowly, getting rid of weak hands. The “handle” is a short break before the stock gets strong enough to go up. A breakout often means that a long-term upward move is about to begin.

After accounting for the split and bonus, Reliance’s previous all-time high is Rs.1,608.80. The structure looks good now that the stock is getting close to this zone again. If the stock moves strongly above this level, it could go into a phase where there is no historical resistance. These kinds of phases are when trends really start to take off.

Reliance could be the leader of the Oil & Gas sector in early 2026 as it has a strong base, a bullish chart structure, and a lot of weight on the index.

Beyond the Hype: Petronet LNG’s Strategic Accumulation Phase

Petronet LNG is the quiet worker, while Reliance is the loud leader. It doesn’t make the news every day, but its chart tells a story that experienced traders trust.

Petronet weekly Chart

During the recent market downturn, Petronet built a strong base above its 2023 highs on the weekly timeframe. There have been several lows around the Rs. 260 level in 2025, which means that selling pressure has eased off.

When a stock won’t go down any more even though people are feeling bad about it, it usually means that strong hands are buying more.

At the start of 2026, breaking out of a 70-week falling trendline is a big technical step forward.

Long-term trendline breakouts after a base has formed are often the first signs that a trend is about to change.

In simple terms, the stock has stopped going down, gotten stronger, and is now trying to go up.

The base formation and trendline breakout together suggest that smart money may get in early. If the momentum keeps up, Petronet could slowly move towards its all-time high of Rs.363 in 2026.

Q1 2026 Strategy: Narrowing Focus to Energy Outperformers

The first three months of a new year are often about setting the tone. The Oil & Gas sector seems ready to give us clarity instead of confusion after a mixed 2025. Petronet LNG has a quieter but possibly more profitable turnaround story, while Reliance Industries is a leader and a big company.

Focussing on just one sector and a few well-structured stocks can make a big difference at times. As 2026 begins, Oil & Gas could probably be the “right place at the right time.”

Disclaimer:

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Brijesh Bhatia is an Independent Research Analyst and is engaged in offering research and recommendation services with SEBI RA Number – INH000022075. He has two decades of experience in India’s financial markets as a trader and technical analyst.

Disclosure: The writer and his dependents do not hold the stocks discussed here.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives and resources, and only after consulting such independent advisors if necessary.