By Suhel Khan

There is no investor who is not fascinated by how investing legends like Warren Buffett work their magic. And in India, we have our own ‘super investors’ – geniuses who have built impressive track records and solid wealth by spotting winning opportunities before the average investor does. These “Warren Buffetts of India” have a knack for understanding the market and sticking to a disciplined approach. One thing that is particularly interesting is how they often focus on specific sectors that match their long-term vision.

And the one sector you should look at now is the Software and Services sector. From innovative cloud solutions to essential digital infrastructure, this sector is booming. As per trendlyne.com, a website that tracks investments of these Warren Buffets (holdings over 1%), over 45% of its list of such investors are individually invested in this sector. India’s tech prowess is recognized globally, digital transformation is accelerating, and the demand for innovative software solutions is only increasing. Plus, many IT companies generate strong cash flow and have the potential for rapid scaling. That is a powerful combination for investors who prioritize growth and long-term value.

Here are 2 capital efficient stocks from the favourite sector that the Warren Buffetts, that super investor Madhusudan Kela holds.

IRIS Business Services Ltd (IBSL)

With a market cap of Rs 793 cr, IBSL offers Regtech solutions to regulators and enterprises.

As a RegTech SaaS company that helps enterprises, business registers, regulators, central banks, stock exchanges, BFSI, and other organizations meet their regulatory compliance requirements through technology-driven solutions like Artificial Intelligence, Machine Learning, and Robotic Process Automation.

IBSL specialises in solutions related to compliance, data, and analytics, encompassing various aspects of the information supply chain and data reporting standards like XBRL and SDMX

IBSL’s current ROCE (Return on Capital Employed) is 27%, which is higher than the median of 18% when compared to peers in the same category. In simple terms, ROCE means the returns a company makes on the capital it employs. In the case of IBSL, the company is making a profit of Rs 27 on every hundred rupees it is investing as capital.

These profits can be used to pump back into the business to expand or pay back to investors as dividends.

Add to that the fact that the company is almost debt free, so the burden of money flowing out as interest payments is also a worry taken care of.

Coming to the financials, the company’s sales have grown from Rs 40 cr in FY19 to Rs 102 cr in FY24, which is a compounded growth of 21%. Between April 2024 and December 2024, the company has already reported sales of over Rs 91 cr.

Earnings before interest, taxes, depreciation, and amortization (EBITDA) has grown from a loss of Rs 1cr in FY19 to Rs 15 cr in FY24, improving by Rs 16 cr over this period.

In case of the net profits, the company had reported losses of Rs 6 cr in FY19 but has shown a good turn around with profits of Rs 9 cr in FY24.

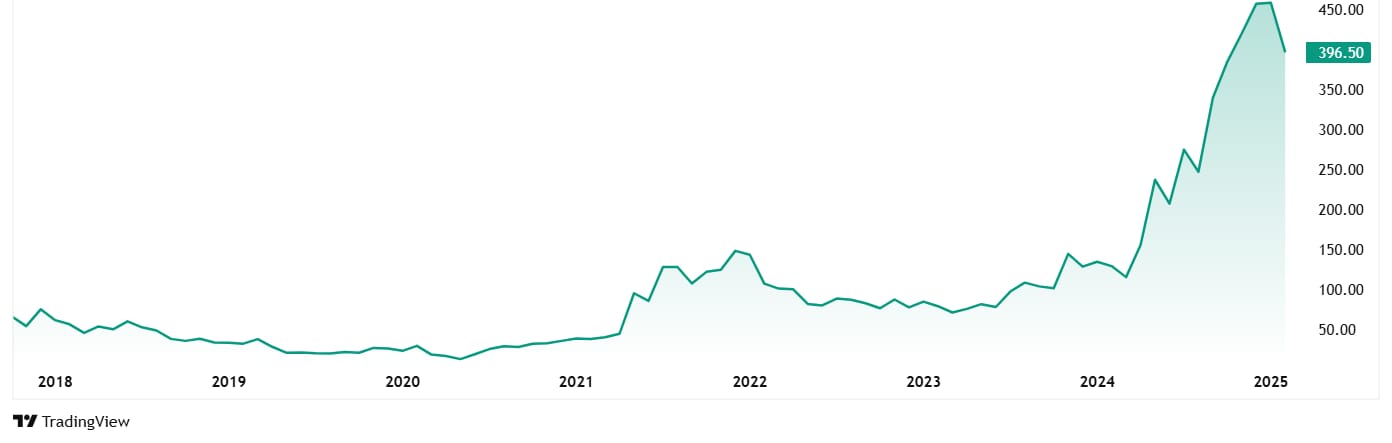

This turnaround reflects on the share price of IBSL as well. It has grown from Rs 22 in February 2020 to its current price of Rs 396 (as on 13th Feb 2025), which is a jump of a staggering 1,700% in just 5 years.

If one would have invested just Rs 100,000 in the company’ shares back in February 2020, it would have grown to around Rs 18,00,000 as of today!

Let us look at the valuations now. The company is currently trading at a price to earnings (PE) multiple of 53x, which is higher than the industry average of 35x. The median PE for the last 10 years for IBSL is 54x, while the industry median for the same period is 26x.

This means that investors are willing to pay a premium to grab shares of the company.

Ace investor Madhusudan Kela has been consistently holding over 5% of shares of IBSL for the past 3 years now. Narayan and Sudha Murthy’s Catamaran Ventures LLP also hold around 1.5% stake in the company.

In the company’s last annual report for FY24, the CEO Swaminathan Subramanian in this address has laid down the path for the company for the next 20 years, saying that in the next 20 years the company will have clients in every country in the world.

Unicommerce eSolutions Ltd (USL)

Unicommerce eSolutions Limited is a SaaS platform that manages e-commerce operations for brands, sellers, and logistics providers, which was incorporated in February 2012.

The company is an integrated eCommerce enablement SaaS platform that provides end-to-end management of e-commerce operations. It serves D2C brands, brand aggregators, offline brands, retailers, marketplaces, logistics players, and SMBs with a comprehensive suite of SaaS products, functioning as the transaction processing layer.

With a market cap of Rs 1,309 cr, USL is India’s largest e-commerce enablement SaaS platform in the transaction processing layer by revenue. It is also the only profitable company among the top 5 players in this industry in India.

USL has a ROCE of 28% currently, which is higher than the median of 18% when compared to peers in the industry.

The company has recorded a compounded sales growth of 32% in the last 5 years as it grew from Rs 26 cr in FY19 to Rs 104 cr in FY24.

EBITDA was Rs 3 cr in FY19 which jumped to Rs 14 cr in FY24, making it a CAGR of 36%.

The profit after Tax grew from Rs 3 cr in FY19 to Rs 13 cr in FY24, which means it grew at a compounded rate of 38%.

The current share price of USL is Rs 128 as on 13th February 2025, which is a 39% drop from its listing price in August 2024 of around Rs 210.

The company’s share is currently trading at a price to earnings (PE) multiple of 75x while the industry average is 35x. The company was recently listed so we do not have the long-term median, but the industry median for the last decade is 26x.

Once again, Madhusudan Kela holds 1.79% stake in USL.

In November 2024, USL bought a 42.7% stake in Shipway, a company that integrates with ecommerce software providers to offer end-to-end automation of the post-purchase experience for D2C brands.

According to MD & CEO, Kapil Makhija, the strategic acquisition of Shipway has strengthened their position as a leading e-commerce enablement platform.

Ready For the Digital Dive?

It is safe to conclude that India’s super investors, the ones we call the “Warren Buffetts of India,” have a clear favourite right now: IT Software and Services. And it is not hard to see why. With the world going digital crazy, this sector offers a potent mix of growth, strong cash flow, and seemingly endless potential. But it is not just the big names grabbing all the attention.

The two companies we looked at today, IRIS Business Services Ltd and Unicommerce eSolutions Ltd, could be called the underdogs as they are quietly demonstrating the kind of capital efficiency and growth that even seasoned investor like Madhusudan Kela is noticing. Their numbers are impressive, their strategies seem sound, and it is clear the market is optimistic about what is to come.

Having these stocks in your watchlist could turn out to be a great idea.

Disclaimer:

Note: We have relied on data from www.Screener.in throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Suhel Khan has been a passionate follower of the markets for over a decade. During this period, He was an integral part of a leading Equity Research organisation based in Mumbai as the Head of Sales & Marketing. Presently, he is spending most of his time dissecting the investments and strategies of the Super Investors of India.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.