Standalone Q1FY22 revenue of Rs 34 bn (-13% q-o-q, +46% y-o-y) came in line with our forecast but was 2% ahead of the Bloomberg consensus estimate, as the higher realisation was offset by lower volume. Ebitda of Rs 10.1 bn (-14% q-o-q, +45% y-o-y) was 2-3% below our forecast and the consensus estimate, driven by higher employee, energy and other expenses. PAT at Rs 6.6 bn (-14% q-o-q, +78% y-o-y) was 6%/11% above our/consensus estimates given lower depreciation (-22% q-o-q) and higher other income (+12% q-o-q).

Higher blended realisation offsets lower volume

Compared with 12%/14%/21 q-o-q decline in volume for peers ACEM/ACC /UTCEM, SRCM’s cement volumes at 6.8mt (+42% y-o-y, 1% below our estimate) declined by 16% q-o-q. Volumes, including clinker sales, at 6.84mt (2% below us) declined 17% q-o-q. SRCM’s blended realisations at Rs 249/bag (vs our estimate of Rs 246/bag) were up 4% q-o-q and 5.5% y-o-y, slightly lower q-o-q compared to large-cap cement peers due to SRCM’s lower presence in South India.

Higher energy costs and lower operating leverage impact per ton Ebitda

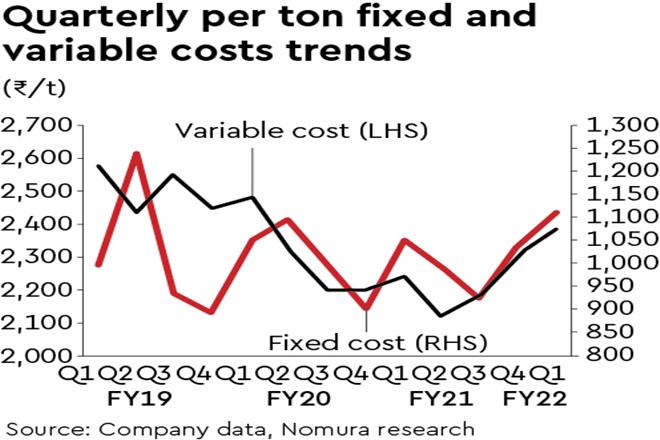

Staff cost was at Rs 2.1 bn (+22% y-o-y, -13% q-o-q), while other expenses stood at Rs 5.5 bn (+58% y-o-y, -10% q-o-q), driven by higher stores, spares and packaging costs. Overall, fixed cost was at Rs 7.6 bn (+46% y-o-y, -11% q-o-q). Further, with lower operating leverage, per unit fixed costs at Rs 1,111 were up 7% q-o-q.

Per unit energy costs were at Rs 953 (+27% q-o-q, +23% y-o-y). Per unit freight costs at Rs 1,216 were up 5% q-o-q. We note the per-unit reported costs are optically higher due to inventory build-up (Rs 0.8 bn, or negative ~Rs 122/t). Overall per unit opex at Rs 3,497 (+6% y-o-y) was up 4% q-o-q. With higher opex offsetting higher realisations, blended per unit Ebitda was at Rs 1,481 (+3% q-o-q, +4% y-o-y). SRCM’s ~Rs 50/t q-o-q rise in Q1 Ebitda/t while decent, was significantly lower than Rs 150-200/t q-o-q rise in blended Ebitda/t for large-cap peers.

Margins likely to be under pressure

With the onset of monsoon, pan-India cement prices have started to correct while input costs continue to rise. We note that pet-coke prices are up by further 21% from end-Jun levels while retail diesel prices remain near all-time highs. Given rising input costs and seasonal decline in prices, we think margins are likely to compress in the next two quarters. We expect SRCM’s per unit Ebitda to moderate to Rs 1,413/t in FY22F (from Rs 1,473/t in FY21 and Rs 1,481/t in Q1FY22).

Valuation methodology: We value SRCM at 17x Mar-23F Ebitda to arrive at our TP of Rs 26,500. We maintain our Reduce rating on the stock with an implied downside of 6%. The stock trades at 18.8x FY23F EV/Ebitda. UltraTech Cement is our preferred pick in the cement space.