One of the main concerns investors have had with Bharti is its lack of free cash flow (FCF) generation, which has limited its ability to create value for shareholders. In this note, we explain the reasons behind Bharti’s historical lack of FCF generation, including factors such as intense competition, high costs of building its spectrum portfolio, rapid adoption of new technologies, regulatory payouts, and the acquisition of its Africa business. However, most of the heavy lifting for these investments is now complete, with the exception of the 5G network rollout. As a result, we believe that Bharti is close to reaching a point where it can potentially generate cash flow equivalent to 10% of its current market capitalisation, which we anticipate will occur within the next two years. We maintain our Buy rating on Bharti and our SoTP-based target price of `960 remains unchanged.

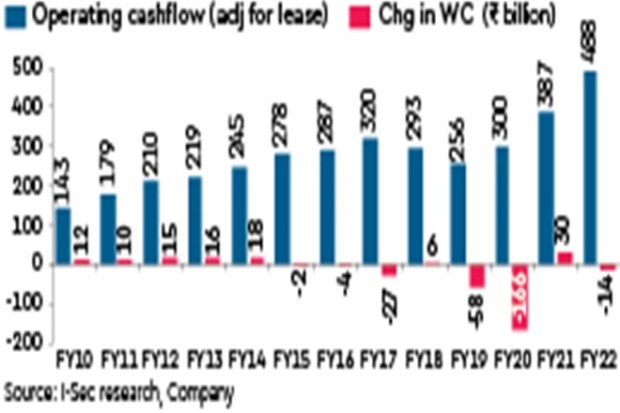

The single-biggest disappointment for Bharti since FY10 has been its inability to generate healthy FCF. It has barely registered any FCF after interest payments, which has capped value creation for shareholders through dividends, buybacks or simple net-debt-reduction, which boost equity value. We analyse the data from FY10 to reckon what went wrong for Bharti.

We remain optimistic on Bharti’s FCF generation. Our confidence in FCF generation emanates from the following factors: (i) India, at worst, will remain a 3-private-player market for the foreseeable future limiting competitive intensity; (ii) telcos will keep playing with tariffs, but we expect ARPUs to grow at least 10% p.a. for the next few years as operators focus on FCF generation vs market share in prepaid 4G/5G segments. Bharti has taken unprecedented tariff hikes in its base voice plans in the past two years moving from Rs 75 to Rs 155 (for 28 days); (iii) network capex likely to peak in FY24, and progressively reduce as 5G coverage layer reaches 75% of the population; and (iv) spectrum investment to be limited; large spectrum renewal expected only in CY30.

Bharti’s cashflow will also benefit from steady growth in non-mobile services including FTTH and enterprise. Dividends from Airtel Africa and Indus will add to India FCF generation. Spectrum moratorium is due to end in FY26 and this will increase cash outflow towards government payment from FY27.

Also read: ICICI Bank mulls raising funds by issuing debt securities on April 22; shares gain marginally

Our estimates suggest FCF generation of >Rs 400bn for Bharti in FY25E, which is 10% of its current market capitalisation. Bharti has set a good precedent of paying dividends in its two related companies—V Indus Towers (erstwhile Bharti Infratel), and Airtel Africa. We remain hopeful of Bharti generously rewarding shareholders from FY25.