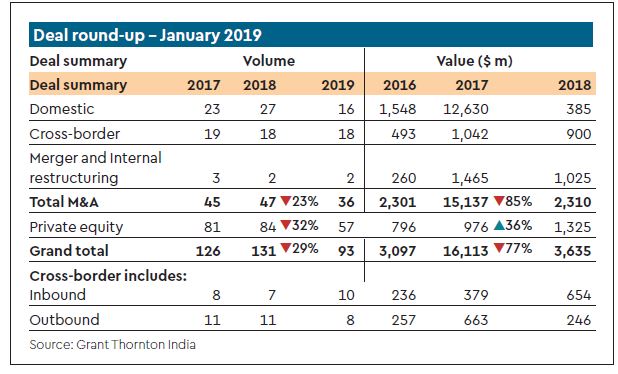

Private Equity investments witnessed a 36% growth in January 2019 despite a fall in the investment volumes on account of increased follow-on investment rounds compared to the same period last year, according to a dealtracker report by Grant Thornton.

Compared to December 2018, the private equity (PE) deal value in January 2019 fell by 39% primarily on account of Swiggy’s $1 billion funding. Excluding this deal, the investment values remained on a par with level of investment values recorded in December 2018, the report said.

ALSO READ: Reliance Industries Chairman Mukesh Ambani breaks into global top 10 rich list; check top 3

PE deal activity in January 2019 recorded four deals estimated and valued over $100 million each, capturing 58% of the total PE deal values. The month saw 18 investments in the ‘Series A and above funding round’ constituting 56% of the total disclosed funding series volumes.

“In line with the trends in the last four years, the month was dominated by investments in start-ups, which contributed to more than half of the total investment volumes valuing at $158 million. FinTech segment got significant attention from investors with seven deals, followed by travel and logistics space with six deals together capturing 47% of the volumes within the start-up sector,” Grant Thornton said.

E-commerce and start-up sectors saw maximum investments (13 deals of 18 deals) in the ‘Series A and above funding round’, constituting 41% of the total disclosed funding series volumes.