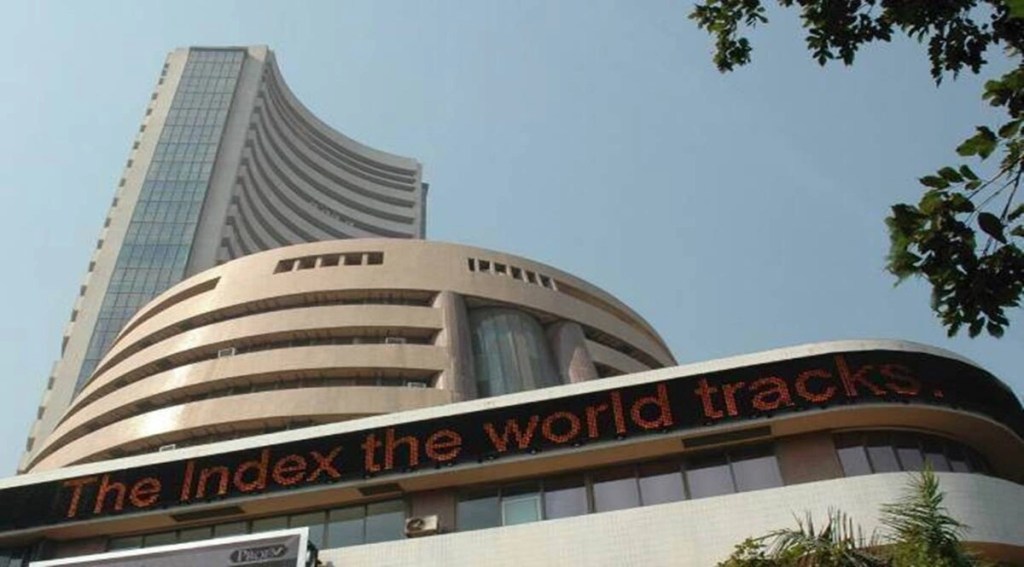

Indian indices recorded their biggest single-day drop in two months on Wednesday, following a crash in the US markets. This was the fourth successive session when the benchmark indices closed in the red.

Besides geopolitical tensions, owing to Russian President Vladimir Putin’s aggressive posturing on Tuesday, investors also remained cautious ahead of the minutes of both the RBI and US Fed policy meets.

The benchmark Sensex crashed 927.74 points or 1.53% to 59,744.98, while the Nifty slumped 272.40 points or 1.53% to 17,554.30. The Bank Nifty, too, plunged 677.70 points to 39,995.90, a fall of 1.67%.

US markets had slumped on Tuesday in what was their worst day in 2023, owing to investor concern over interest rates remaining high for longer than expected. The S&P 500 was down 2%, while the Dow Jones Industrial Average lost 2.06% and the Nasdaq slid 2.5%.

The recent largest single-day fall was on December 23, 2022, when the Sensex fell 981 points or 1.6%.

There was a Rs 3.7-trillion erosion in investor wealth on Wednesday. In the last four sessions, there has been a total wipe-out of `6.8 trillion.

The BSE MidCap and SmallCap indices fell 1.16% and 1.09% respectively, while the LargeCap index shed 1.56%. Among sectoral indices, commodities, power, and utilities lost over 2%, while metals saw a decline of 1.8%.

A total of 884 stocks advanced on the BSE, while 2,592 declined.

A Balasubramanian, MD & CEO, Birla Sun Life Mutual Fund said: “Today’s market fall is linked to global market uncertainty around further interest rate hike possibility and thus creating global volatility. With the recent fall in market including today’s fall, valuations are coming down to reasonable levels.”

“A resurgence of the cold war between the US and Russia has brought apprehension. Although it should be a short-term effect, the fear of sanctions against Russia and its degree of implication on the economy — especially food and oil exports — is adding to the anxiety, said Vinod Nair, head of research at Geojit Financial Services.

According to him, the market is just recovering from the pandemic, and high interest & inflation headwinds. It is presumed that this war will be fought on an economic front, limiting its effect on strong economies like the US and India.

Adani Enterprises and Adani Ports were once again the biggest laggards in the Nifty universe, falling over 11% and 7%, respectively. Barring ITC, which edged up 0.41%, all Sensex stocks closed in the red, with the Bajaj twins falling 2.32% and 2.86%.

All sectoral indices, too, saw a declining trend, with the metals index taking the biggest hit at 2.64%. The financials, along with private and PSU bank indices, also fell over 1.5%.

“The Bank Nifty continued to witness selling pressure from the higher levels. The index is now trading in an oversold territory and if it sustains above 40,000, it could witness a pull-back rally towards 40,600-40,800 levels,” said Kunal Shah, senior technical and derivative analyst at LKP Securities.

FIIs continued their selling spree, offloading `579.82 crore from the markets, though DIIs were net buyers to the tune of `371.56 crore, according to exchange data.

Asian indices also had a rough session, with most closing in the red. Japan’s Nikkei shed 1.34%, while South Korea’s KOSPI lost 1.68%. Hong Kong’s Hang Seng declined 0.5% and Australian shares too, shed 0.3%, while Singapore’s Straits Times index closed flat, down 0.2%.