Benchmark indices felt the heat of the escalating Iran-Israel clash on Thursday, with foreign portfolio investors (FPIs) pulling out almost $2 billion in a single trading session. The worry that China may take fund flows away from India and the markets regulator’s tighter norms for index derivatives trading further dampened the mood.

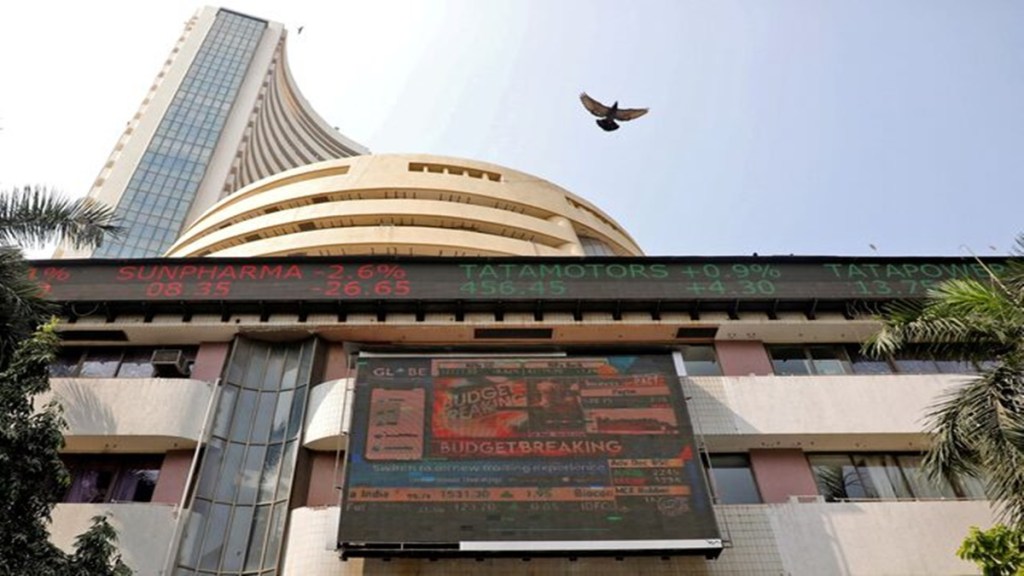

The Sensex crashed 1,769 points or 2.1% to 82,497.10 on Thursday, and the broader Nifty slid 547 points or 2.1% to 25,250.10. Both the benchmarks closed at their lowest levels in three weeks. This was the fourth consecutive session of losses for the benchmark indices.

The decline in the broader markets was largely in line with the benchmarks despite their richer valuation. The BSE Midcap index fell 2.2%, while the BSE Smallcap index ended 1.8% lower.

According to provisional data, FPIs sold shares of Rs 15,200 crore, while domestic institutional investors (DIIs) bought Rs 12,900-crore shares. The sharp fall in the market despite aggressive buying by the DIIs indicated likely panic selling by retail investors.

The broad-based selling, which led to all sector indices closing in the red, wiped out Rs 9.8 lakh crore of investor wealth. This marked the worst day for Indian equities in nearly two months. Not surprisingly, the market’s fear gauge India VIX, which indicates the expected volatility in the next 30 days, jumped 10%.

“Most of the wars are seemingly regionalised, but all of this can move quickly to a global conflict. There are two sides to it all. If it de-escalates, we should be okay. But if it escalates, you should be ready for some more volatility,” said Kenneth Andrade, founder and chief investment officer at Oldbridge Capital Management.

Investors are worried over the widening of conflict in West Asia after almost a year of war between the Hamas and Israel. The deepening conflict raised concerns over a widespread regional crisis and its impact on crude oil prices. The Brent crude oil has risen over 4% this week to $75.6 per barrel.

A Balasubramanian, MD & CEO of Aditya Birla Sun Life AMC, said: “A combination of global and domestic factors had an impact on the markets today. On the global front, geopolitical tensions between Israel and Iran had a major role to play. This also led to a rise in crude oil prices which added pressure on India. The other factor is the surprise up move in other emerging markets like China. This along with the recent announcement to curb speculation in the derivatives market led to market volatility.”

However, he believes that the correction is a buying opportunity from a long-term view, given India’s growth story.

Andrade, too, was positive on domestic growth and corporate performance. “From a standpoint of corporate financial health, we currently have the best of all worlds. So, I don’t think it should be a sell-off to that extent. If we just step back to the year 2020, when the corporate India was closed for almost four months during the pandemic, corporates tightened their belt and more than survived. So, the stress test has already taken place,” he said.

Sensex is up 14% so far in FY25 even after accounting for Thursday’s decline, while the BSE Smallcap and the BSE Midcap indices have surged around 31% each.