Piramal Pharma has received the green light from capital markets regulator Securities and Exchange Board of India (Sebi), to raise up to Rs 1,050 crore through a rights issue of shares. The company, which had submitted its draft papers to Sebi in March, received the observation letter from the regulatory body on July 12, as revealed in the latest update.

Sebi’s observation signifies its approval for public offerings, including initial public offerings (IPOs) and rights issues. As per the draft papers, Piramal Pharma plans to offer fully paid-up equity shares through a rights issue to its existing eligible shareholders, with the aim of raising funds totaling up to Rs 1,050 crore. The proceeds from the rights issue will be utilized to repay debt and for general corporate purposes.

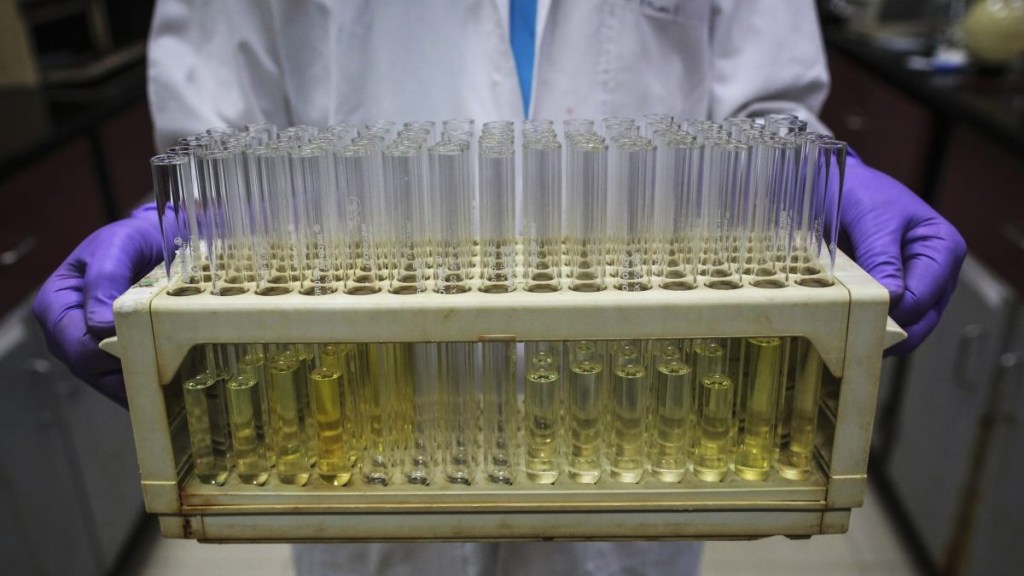

Piramal Pharma has a portfolio of pharma products distributed across domestic and international networks. The company operates under three distinct business verticals. Firstly, Piramal Pharma Solutions serves as an integrated contract development and manufacturing organization (CDMO). Secondly, Piramal Critical Care focuses on complex hospital generics (CHG). The third vertical is India Consumer Healthcare (ICH), which encompasses popular over-the-counter brands such as Little’s, Lacto Calamine, and I-Pill.

This approval for the rights issue will enable Piramal Pharma to bolster its capital base, paving the way for future growth opportunities. By raising funds through the rights issue, the company aims to strengthen its financial position by addressing debt repayment obligations and furthering its general corporate objectives.

(With agency inputs.)