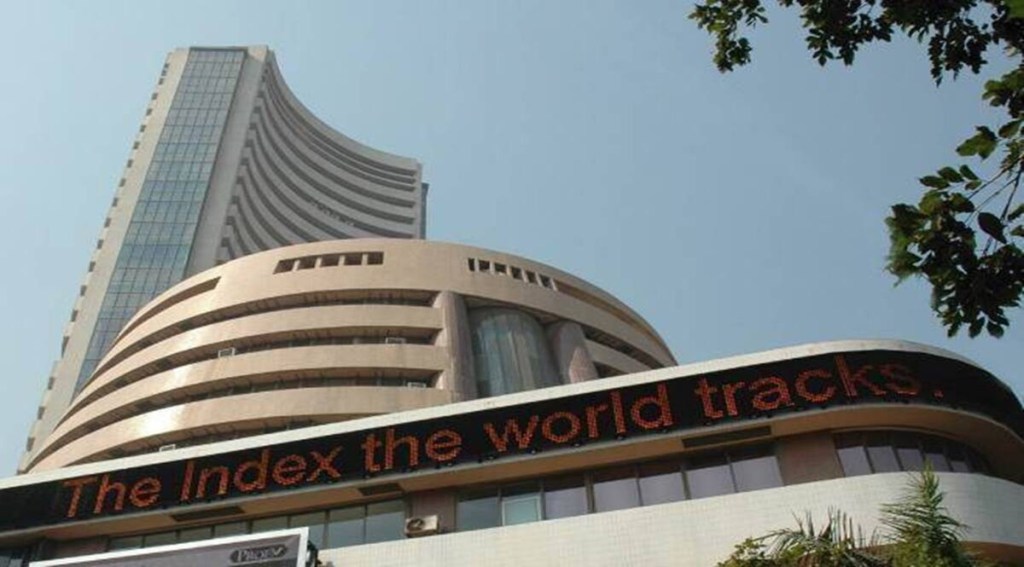

Indian equities gained the most among the Asian indices on Wednesday as the investor appetite for riskier assets made a cautious comeback. Ukraine’s decision of not insisting on the NATO membership fuelled the investor sentiment. More than half of the Sensex gains came from heavyweights such as RIL, HDFC Bank and Infosys.

While the Sensex surged 1,223.24 points to settle at 54,647.33, the broader Nifty50 gained 331.90 points to 16,345.35 points. While both the benchmarks rose over 2% each, the broader indices – BSE midcap and smallcap – mirrored them with gains of 2.4% and 2.2%, respectively. The volatility index, India VIX, cooled off by 4% to 27.5 levels. Barring metals, all sectoral indices compiled by the NSE ended in the green.

European market opened in the green with Euro Stoxx 50 surging as much as 5%. “Investors, globally, remained cautious, after the US banned Russian oil imports. Also, Britain announced that it would phase out import of Russian oil and oil products by the end of 2022. However, hope of the humanitarian route opening up led the European markets surge by 4%,” said Siddhartha Khemka, head – retail research, Motilal Oswal Financial Services.

Brent crude prices softened 3% on Wednesday after hitting $139.13 per barrel at the beginning of the week. The Brent is currently hovering at $124 per barrel. Analysts are of the view that companies, especially those in the specialty chemicals space, are better equipped to handle the current surge in crude prices, given presence in more downstream products, volume-led growth and improved competitiveness versus Chinese peers. “Our analysis indicates that while the correlation between gross margin and crude oil prices is high, the same between absolute gross profit and crude oil prices is very low,” Kotak Institutional Equities wrote in a note on Wednesday.

Meanwhile, foreign portfolio investors continued to offload Indian shares, having sold stock worth $5 billion over the six sessions of March. On Wednesday, FPIs sold equities worth $629 million, against local buying of $428 million, provisional data on the exchanges showed.

The market breadth remained strong with advancing shares outnumbering decliners. The advance decline ratio on the BSE stood at 3.88, the highest since June 2020. “The short-term trend of the Nifty seems to have reversed. The overall positive chart pattern signals a possibility of the Nifty moving towards the important resistance of 16,800 levels in the next few sessions,” said Nagaraj Shetti, technical research analyst at HDFC Securities.