Havells has been a compelling story in the electricals and consumer durable space (revenue has increased 5x and PAT 6x over past 10 years). In our view, the outlook also remains exciting, with untapped opportunities in key segments, government focus on electrification, under-penetration in the electrical consumer durable (ECD) and white goods space and, most importantly, HAVL’s strategy of relentless product expansion, focus on B2B, deepening its market reach and strengthening its brand image. We estimate a 22% earnings CAGR over FY19-21F. However, after its sharp outperformance over the past year (HAVL 43% vs 16% for Sensex), we think most positives are adequately priced in and current valuations (57x/47x/38x FY19F/20F/21F P/E) are not undemanding.

Consensus forecasts imply 16% revenue CAGR with margin expansion; we see limited scope for upgrades

Bloomberg consensus estimates a 16% revenue CAGR for FY19-21 along with 80bp improvement in Ebitda margins on an already a strong base of FY19F (24/ 20% y-o-y growth in revenue/Ebitda). While we are broadly aligned with consensus on growth outlook and earnings estimates, we believe that these estimates adequately capture current expectations around various segments and room for any significant surprise is limited.

Read | IndusInd Bank @ 25: Rs 100 invested in this Sensex stock in 1998 would have grown to this much today

Raise TP to Rs 750 but downgrade to Neutral; Crompton preferred pick

We value HAVL at blended 38x FY21F P/E (30x for cable/switchgear, 40x for lighting and 45x for ECD and Lloyd segments). While comparison of HAVL valuations with FMCG names is a stretch, its current valuation is comparable to those of consumer staples names (which trade at an average FY21F P/E of 34x) and consumer discretionary names (which trade at an average FY21F P/E of 40x). With 1% downside to our revised target price of Rs 750, we downgrade to Neutral.

HAVL a compelling story in electricals and consumer durable space

Havells has been a compelling story and a strong wealth creator since its public listing in 1993. It has transformed itself from an industrial to a consumer company with strong focus on brands (Havells, Lloyd, Crabtree, Standard and Promptec), mass premium markets, innovation and strong distribution (nearly 8,000 dealers and 40 branches) across the country.

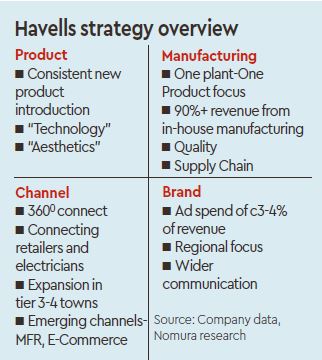

HAVL has set up large-scale manufacturing facilities: Its 13 existing plants are located at Haridwar, Baddi, Sahibabad, Faridabad, Assam, Alwar and Neemrana. Recently in end March-19, it commissioned and started the commercial production of air conditioners at its Ghiloth plant located at Neemrana in Rajasthan. Focus on in-house manufacturing (nearly 90%) and a “one product, one plant” strategy (to drive scale and cost efficiencies) has helped it to remain flexible, report better profitability and remain insulated against wide forex fluctuations.

Also read | Infosys Q4 net profit jumps 13% on-quarter to Rs 4,078 crore; key figures in a nutshell

HAVL spends nearly 0.7-0.8% of its revenue on R&D and 3-4% on advertisement and brand development: These are on a par with the leading companies not only in electrical and consumer durable space, but also with the leaders in the other consumer discretionary segments. We note that HAVL has invested Rs 20 bn in advertisement and promotion over the past 10 years ending FY18.

Revenue has increased 5x and Ebitda a sharp 6x over past 10 years: With strong operating performance across segments, HAVL’s revenue has increased by nearly 5x (17% CAGR) and PAT has increased by an even sharper 6x (19% CAGR). We believe that the outlook for HAVL’s key segments remains exciting, with large untapped opportunities from lower penetration, a high share for the unorganised sector, increasing electrification and HAVL’s strategy of relentless product expansion, deepening market reach and brand strengthening.