Gujarat State Petronet’s (GSPL’s) Q4FY21 Ebitda of Rs 3.4 bn (-3% y-o-y, -13.6% q-o-q) surpassed our and consensus estimates led by 49% y-o-y dip in opex due to low compression cost as volumes dipped.

Key highlights: (i) Current volumes are ~35mmscmd, but June is likely to exit at ~40mmscmd. The shortfall in CGD/power volumes is being compensated by addition of ~4mmscmd Reliance volumes; (ii) the Anjar-Chotila pipeline should be commissioned by Dec 2021, which is likely to augment incremental ~5mmscmd volumes from CY22; (iii) net tariffs fell 13.7% y-o-y as low pressure pipelines due to lower volumes didn’t require compression. Robust Rs 50 bn FCF over FY21-23e and Rs 20 bn in FY21 will help GSPL turn debt free. Retain Buy.

Impressive CGD volumes partly offset weak refining demand in Q4: While GSPL’s volumes declined to 33.8mmscmd (-8% y-o-y, -14% q-o-q), CGD volumes were at an all-time high—up 23% y-o-y. Refining consumer volumes plunged 31% y-o-y and power by 17% as spot LNG prices surged by 163% y-o-y. Q1FY22 may see only a modest recovery to ~37-38mmscmd given Covid-led cutbacks and fairly high spot LNG prices of ~$10/mmbtu.

Plentiful gas supply to drive volumes: Domestic new gas is plentiful—Reliance’s 10mmscmd+ and Vedanta’s 4.2mmscmd+. In addition, capacity expansions are geared to offtake from new LNG terminals and support cross-country pipelines of its subsidiaries for expansion outside Gujarat. GSPL is the sole off-taker for Mundra LNG terminal’s ~9mmscmd volumes (incremental ~5mmscmd). GSPL enjoys the fastest growth amongst pipeline companies – 2x volumes over four-five years.

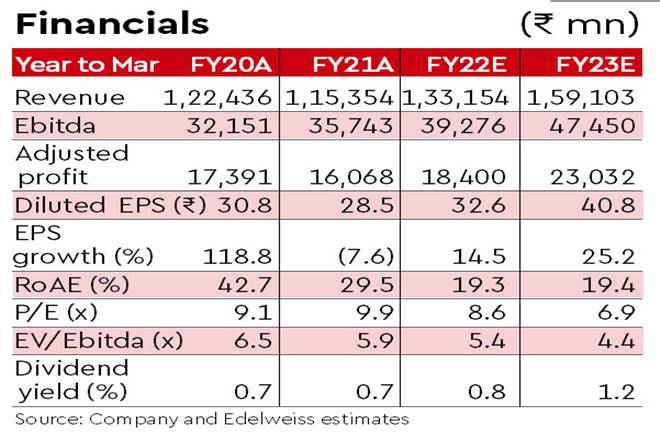

Outlook: Attractive–GSPL is the key beneficiary of additional LNG to be imported in India to bridge the demand-supply gap. Its net debt/equity plunged to 0.1x and OCF remains healthy at Rs 29 bn in FY21. We retain ‘BUY/SO’ with revised TP of Rs 342 (earlier: Rs 278) as we roll over valuations to FY23E and it currently trades at 3.0x PE (ex-Gujarat Gas).