The sudden outbreak of Covid-19 may push loan growth recovery for Federal Bank (FB) and increase credit cost in the near term. However, we believe FB will still deliver 1% RoA by FY22e on the back of: (i) strong retail liability franchise (~91% of total deposits is below Rs 20-mn ticket size); (ii) repo-linked savings bank deposit rate should help maintain margin at current levels in a falling rate cycle; (iii) within the corporate portfolio, ~77% of loans are rated ‘A’ & above; and (iv) strong traction in fee income.

Cost/income ratio is likely to remain at 51%/52% over FY21e/FY22e given FB’s increasing focus on productivity enhancement and driving business through non-branch channels such as relationship managers, digital platforms and marketing personnel. We maintain Buy with a revised target price of Rs 72 (earlier Rs130).

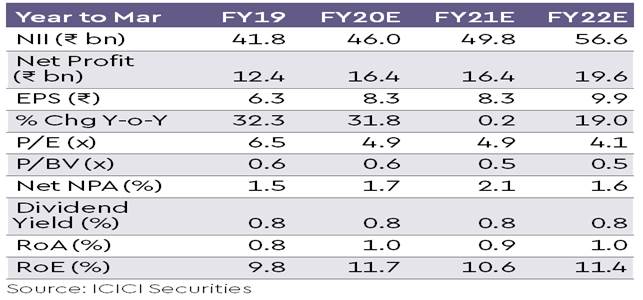

Cut earnings by 7%/24% for FY20e/FY21e after factoring in lower growth and Covid-19 outbreak: Due to slowdown in the economy, FB’s credit growth fell to 13% y-o-y in Dec’19 from 24% y-o-y in Dec’18. With the lockdown extended until 3rd May’20, disbursement in H1FY21e is likely to remain muted while repayments will put further pressure on growth. We are now factoring in a 12% CAGR in loans. We also increase our slippage ratio and credit cost assumptions for FY21e to 2% and 80bps, respectively. As a result, we trim our earnings estimates by 7% and 24% for FY20e and FY21e respectively.

Asset quality performance is likely to be relatively better: We believe FB is well positioned to navigate the current challenges with minimal impact on its asset quality given that its retail+SME portfolio is mostly secured while ~77% of corporate portfolio is rated ‘A’ & above.