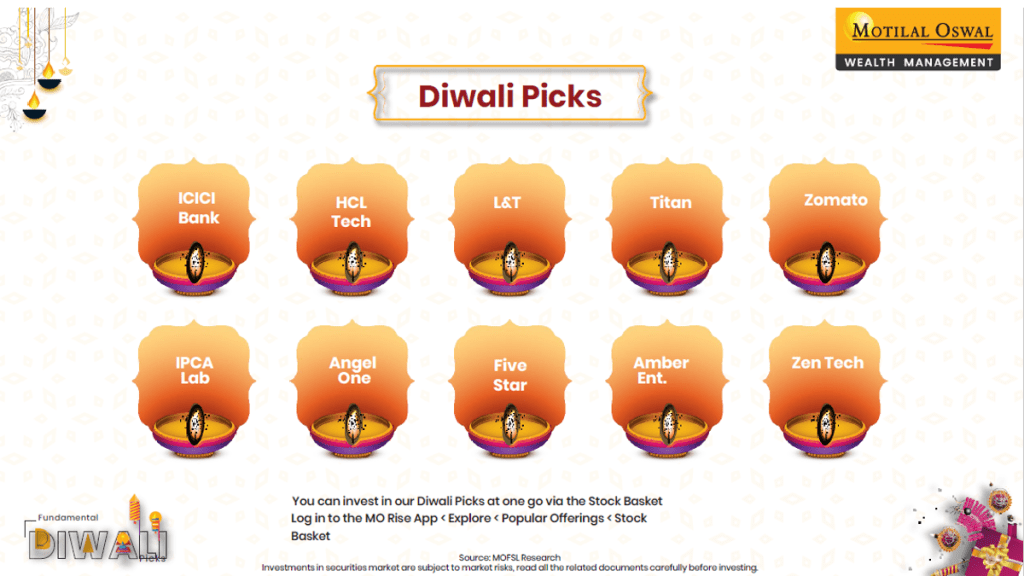

The countdown to Samvat 2081 has begun. If Samvat 2080 was about new highs, breaching new levels, a flurry of domestic buying coupled with primary market euphoria, the mood is quite different for Samvat 2081. So in this situation here is a look at some of the top stock picks by Motilal Oswal and why they are bettering on these counters.

1. L&T: According to Motilal Oswal, L&T “is eyeing opportunities in new areas such as offshore wind projects, where it has already made its foray with an order win of $100m. It is also looking for opportunities in green hydrogen and nuclear projects construction. LT’s RoE stands at14.7% and it has maintained its long term target of 18% RoE. Their target for the stock is at Rs 4250 per share, implying a room for 23% upside.

2. ICICI Bank: The other key counter that features prominently in the Motilal Oswal list is ICICI Bank. One of the couyntry’s largest private sector banks, it posted a steady quarter with 15% YoY growth in net earnings. According to the Motilal Oswal report, ICICI Bank offers a “stable mix of high yielding portfolio and ongoing growth in Business Banking, SME, and secured retail segments are driving broad based growth, helping the bank maintain healthy business diversification.” They have a target price of Rs 1400 for the stock and see upside of 12%.

3. HCL Tech: The next stock in the Motilal Oswal list is HCL Tech. They have a target price of Rs 2300 per share and see scope for 25% upside in the stock. Motilal Oswal report states that, “Its investments in next gen platforms position it well for the GenAI revolution and future recovery in client spending.” Interestingly HCL Tech has revised its FY25 growth guidance to 3.5-5% YoY, supported by strong deal wins and leading position in data/SAP modernization.

4. Titan: Motilal Oswal report pointed out how Titan continues to outperform other brands due to its strong competitive positioning. “Tanishq’s unique brand recall and business moat provide a solid edge. The company plans to open 40 50 Tanishq stores and 70 80 Mia/ Caratlane stores, along with transforming 20 30 stores into larger formats.” They have a price target of Rs 4300 with 29% upside.

5. Zomato: Motilal Oswal has a price target of Rs 330 with 30% upside on Zomato. According to the report, Zomato’s “vision of creating strong brands across food delivery, grocery, and going out could make it a formidable platform that could command a high wallet share from urban consumers. With Blinkit’s growth, Zomato is positioned for robust long term growth. Our estimates imply FY24-27 revenue CAGR of 55%.”

6. IPCA: Motilal Oswal’s pick from the pharma space is IPCA. They have a price target of Rs 1950 with 23% upside. They believe that, “key drivers include better USFDA compliance, synergies from the Unichem acquisition, and improved operational efficiency.” They expect, “strong earnings growth from FY24-27, supported by a 14% CAGR in the domestic

formulation market and a revival of its US generics business.”

7. Angel One: The next one from Motilal Oswal is from the brokerage space. They have a price target of Rs 4100 with 43% upside on Angel One and explained that “Angel One has successfully diversified into credit products and expanded its wealth management services, enhancing its growth potential.”

8. Five Star: Another one from the financial space, Motilal Oswal has a price target of Rs 1000 with 13% upside expectation on Five Star. “The company is expected to maintain premium valuations due to stable asset quality and strong return metrics, supported by management’s focus on operational efficiency and digital collections for sustained profitability and growth,” Motilal Oswal stated.

9. Amber: They have a price target of Rs 7350 with 18% upside on Amber. According to Motilal Oswal, “The company’s strategic focus on diversifying its client base in consumer durables and enhancing its electronics division is set to yield significant revenue increases, projected at a 21% CAGR over FY24 FY27.”

10. Zen Tech: Zen Technologies, according to Motilal Oswal, “stands out in the anti drone market with over 40 indigenously developed products, including training systems & counter drone solutions. The company benefits from backward integration & offers comprehensive services such as after sales support, warranty, & AMC. With 150+ filed patents and nearly 70 granted, ZEN is well equipped to innovate and capture market opportunities.” They have a price target of Rs 1900 with 8% upside.