By Devam Sardana and Satish Chandra

The Indian derivatives market has come a long way since the introduction of equity derivatives in June 2000. It has undergone a meteoric rise in recent years, transforming from a niche segment to a behemoth that eclipses the nation’s GDP. According to a report from Axis Securities, Equity derivatives now account for a staggering 99.6% of market volumes, totalling over $4.3 trillion per day. This unprecedented growth has raised alarm bells so much that SEBI now views it as a macro issue of systemic risk and no longer as a matter of just investor protection.

What led us here?

The surge in India’s derivatives market is a confluence of several interconnected factors. These drivers have propelled the market to unprecedented heights, but they have also necessitated a robust regulatory framework to mitigate risks.

- Introduction of weekly expiring contracts: Weekly index derivatives contracts on Bank Nifty were launched by NSE in May 2016. After its success, NSE launched the same for the benchmark Nifty 50 in Feb 2019 and went on to introduce other indices catering to the growing appetite for short-term trading strategies and risk management tools. The expiry date of all such weekly contracts was on a single day of the week till 2022. After the reintroduction of weekly index derivatives contracts on BSE in May 2023, there has been shuffling by exchanges in terms of choosing expiry dates of the contract – to the extent that as of now there is an expiry of weekly index derivatives contracts on all five trading days of the week.

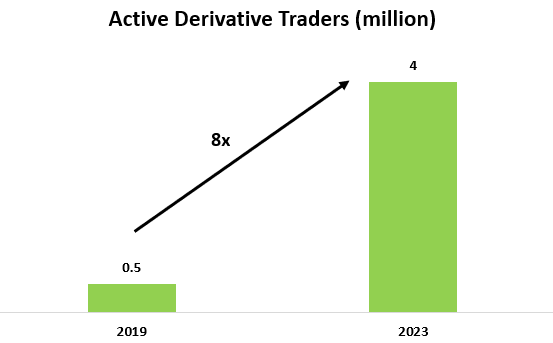

- Ease of Trading: The rise of online trading platforms and widespread smartphone use has made derivatives trading more accessible. New contract structures and leverage options, along with user-friendly trading apps, have transformed the industry. Consequently, the number of active derivatives traders has soared from under half a million in 2019 to over 4 million now, an eightfold increase. In contrast, the cash market has seen its participants grow from around 3 million in 2019 to 11 million today.

- Changing investor psyche: Derivatives trading has become popular among a younger, tech-savvy crowd attracted by the potential for high returns and the convenience of online platforms. According to Axis MF Research, the average age of equity retail investors had come down from 41 years in FY19 to 35 years in FY22, while it’s 29 years for digital discount broker users, with half of new traders being under 25. This shift has increased market volatility due to the impulsive nature of these new, younger traders.

- Explosive Growth: Derivatives market turnover in India has greatly exceeded cash market turnover. The introduction of shorter options expiry periods has likely led to more speculation bets, as weekly options are cheaper than monthly ones, allowing buyers to gain full exposure by paying only 0.5-5% of the same. As per index data and a recent SEBI paper, retail trading is mostly speculative, with an average holding period of less than 30 minutes.

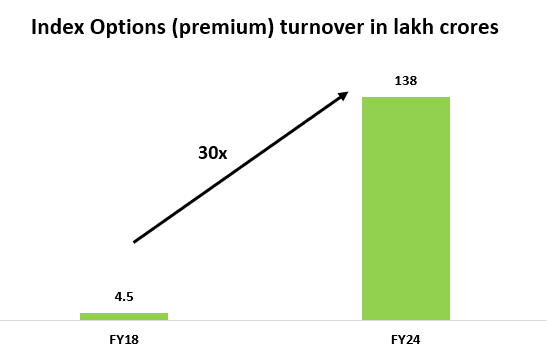

A recent SEBI report shows that the growth in the derivatives market is primarily driven by index options, with India accounting for 30-50% of global exchange-traded derivatives. Index options turnover increased from Rs 4.5 lakh crore in FY18 to Rs 138 lakh crore in FY24.

In FY18, individual investors put only Rs 2 out of every Rs 100 into index options By FY24, this rose to Rs 41.

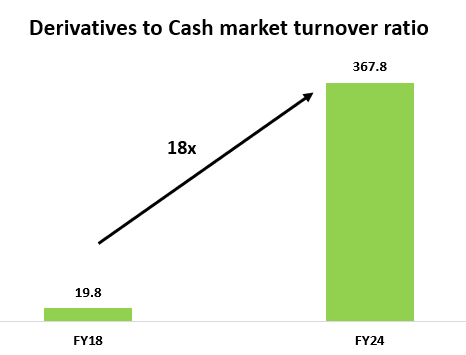

The notional turnover in derivatives surged from Rs 1,650 lakh crore in FY18 to Rs 79,927 lakh crore in FY24, with the ratio of derivatives to cash market turnover increasing from 19.8 to 367.8. Expiry days see significant trading activity and volatility, with the last half-hour being particularly volatile due to speculative activity and position squaring. Data from July 2024 revealed that the notional turnover on expiry day constituted a significant percentage of the turnover in the last five days before expiry across various indices (e.g., SENSEX: 96%, BANKEX: 97%).

The Regulator’s Dilemma: Balancing Growth and Risk

The concentration of trading activity in derivatives raises concerns about systemic risk. A significant market event, such as a sharp decline in asset prices, could trigger a chain reaction, impacting not just the derivatives market but the broader economy.

Surging retail activity in the derivatives market has caught the attention of regulators for some time now. They have published various studies on the market impact of such activity forcing the brokerage platforms to highlight the risks associated with derivates trading and take measures to educate users on the associated transaction costs and brokerage charges.

Very small retail traders make up ~77% of the overall F&O base:

The increasing involvement of individual retail investors in the derivatives market has raised concerns about their protection. A SEBI study from January 2023 found that 89% of individual traders in the equity futures and options (F&O) segment lost money. In FY24, 9.25 million individual traders and proprietorship firms traded in index derivatives, losing a total of ₹51,689 crore. The 2024 study also showed that 85% of these traders suffered net losses, with transaction costs worsening their financial problems.

A recent SEBI consultation paper has proposed several measures to tackle the problem. Those are rationalisation of strike price for options, removal of calendar spread benefit on expiry day, upfront collection of options premium, intraday monitoring of position limits, setting a minimum contract size, rationalisation of weekly index products and increase in margin near contract expiry. SEBI has also directed that market infrastructure institution (MII) charges collected from end-clients by brokers must match the amounts received by MIIs, to ensure fairness and transparency and will be effective from October 1, 2024.

SEBI aims to reduce speculative trading and improve market stability by adjusting strike prices and increasing margin requirements near expiry. These steps are designed to protect retail investors, promote long-term investments, and ensure strong risk management. Continued regulatory oversight will be crucial for the market growth and protection of all participants.

A cautionary tale of over-regulation: South Korea and China experiences

Global experiences from the past, with markets like South Korea and China, where authorities imposed similar curbs had a ripple effect on market sentiment with volumes severely impacted eventually depriving the options markets of liquidity.

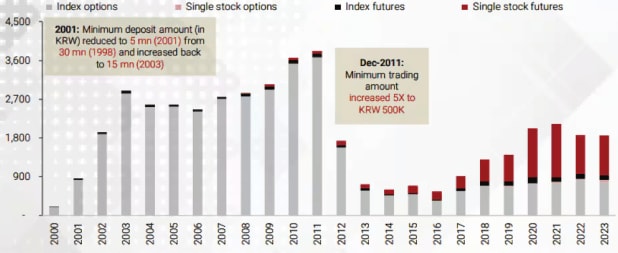

Before the 2011 reforms, South Korea’s derivatives market was among the most active in the world. By 2010, the Korea Exchange (KRX) had become a global leader in derivatives trading, with its flagship KOSPI 200 options being the most heavily traded equity options globally. Retail investors dominated trading, often engaging in highly speculative activities, which contributed to extreme volatility.

Worried over the financial stability risks, South Korea’s market regulator Financial Services Commission (FSC) introduced curbs like position limits, raising margin requirements, transaction taxes etc in 2011.

The most immediate and noticeable impact of these regulatory measures was a steep decline in trading volumes. The average daily trading volume of KOSPI 200 options, which had exceeded 10 million contracts in 2010, plunged by over 80% to around 2 million contracts by the end of 2011. KOSPI 200 futures also saw a drop of around 40% in trading volume.

According to a report by Kotak Institutional Equities, the options market’s trading volume today is only about one-third of what it was in 2011, even after more than a decade. Additionally, the overall derivatives trading volume remains at just half of its previous levels.

Korea’s derivatives trading volume fell sharply from its peak in 2011 but recovered to an extent after 2015 with increased trading of single stock futures. The changes also resulted in a shift in the composition of the derivatives market. Foreigners’ share doubled accounting for 50.4% of derivatives trading in 2018, up from 25.7% in 2011. Over the same period, the share of retail investors nearly halved from 25.6% to 13.5% while institutional investors also witnessed a decline from 48.7% to 36.1%.

In response, the Financial Services Commission (FSC) introduced deregulatory measures in 2019 by easing margin requirements, lowering minimum deposit requirements for retail investors and facilitating the development and listing of new derivative products etc. This is effectively reversing/diluting some of the earlier measures taken in 2011 to shore up market confidence.

In 2015, China implemented stringent regulatory reforms in its stock index futures market as part of an effort to stabilize the financial system amid a dramatic stock market crash. While these measures were designed to curb excessive speculation and prevent further market declines, they had significant negative consequences, leading to a sharp reduction in market liquidity, driving out key investors, and causing long-term damage to China’s financial market credibility.

China’s stock index futures market, particularly the China Financial Futures Exchange (CFFEX), had experienced rapid growth prior to 2015. However, the stock market crash in mid-2015 prompted the government to take drastic action.

China Securities Regulatory Commission (CSRC) significantly raised margin requirements (from 10% to 40%) on CSI 300 Index futures, introduced stringent position limits, drastically reducing the number of contracts that could be held by individual investors (for instance, non-hedging accounts were restricted to holding no more than 10 contracts, down from previous limits of 1,200) and imposed punitive trading rules that penalized “abnormal trading behaviour,” including frequent trading and high volumes. Traders found guilty of such behaviours faced severe penalties, including trading suspensions. This created a chilling effect, discouraging many from participating in the market due to fear of regulatory reprisals. The transaction fees for index futures were raised to punitive levels—more than twentyfold in some cases. This made trading index futures uneconomical for many participants, especially high-frequency traders who were crucial to providing liquidity in the market.

The immediate effect of these regulatory measures was a catastrophic drop in trading volumes. Before the reforms, the daily trading volume of CSI 300 Index futures averaged over 1.5 million contracts. Following the reforms, volumes plummeted by more than 99%, with daily volumes falling to as low as 1,000 contracts. The liquidity crisis that ensued further exacerbated market problems. With so few contracts being traded, bid-ask spreads widened dramatically, making it costly and difficult for market participants to execute trades.

The impact of the 2015 reforms went beyond the derivatives market, affecting the broader financial ecosystem. The resulting loss of confidence among both domestic and international investors dealt a blow to China’s ambitions of becoming a global financial hub.

Moreover, the measures had unintended consequences for other segments of the financial markets. The restrictions on futures trading meant that investors were unable to hedge effectively, leading to increased risk in the cash market. This contributed to greater market instability, as investors who would have used futures to protect their portfolios were left exposed to price fluctuations.

Conclusion

The Indian derivatives market has witnessed significant growth, driven by innovation and rising investor participation. However, this growth has also brought about challenges, particularly in terms of speculative activity and market stability. SEBI’s proposed regulatory measures have initiated a high-level discussion among various stakeholders to address these challenges and whether these are enough to ensure a balanced and stable market environment is to be seen.

Market participants have mixed reactions; some support the measures, while others warn that implementing all changes simultaneously could severely reduce trading volumes by 30-40% and affect stock exchange earnings by 15-30%. These changes could also have a significant impact on discount brokers’ profits.

To avoid market disruption, a phased implementation is recommended following broader consultations with all stakeholders. While the proposals are intended to protect investors and reduce speculative trading, they could result in significant market adjustments.

(Disclaimer: Devam Sardana and Satish Chandra are the Business Head and Research Analyst at Lemonn, respectively. Views, recommendations, data presented, and opinions expressed are personal and do not reflect the official position or policy of Financial Express Online. Readers are advised to consult qualified financial advisors before making any investment decisions. Reproducing this content without permission is prohibited.)