ACC’s Q1CY20 Ebitda increased 10% y-o-y to Rs 5.9 bn, above our/consensus estimates, mainly led by lower than expected raw material and power & fuel costs. Cement realisation increased 1.5% q-o-q while volumes including clinker sales declined 11% y-o-y to 6.74mnte – both broadly in line with our estimates. Total cost/te declined by 3.4% y-o-y owing to sharp movement in inventories. Accordingly, blended Ebitda/te increased 24% y-o-y to Rs 870/te. ACC’s expansion projects may get delayed on likely contraction in FY21 demand, in our view.

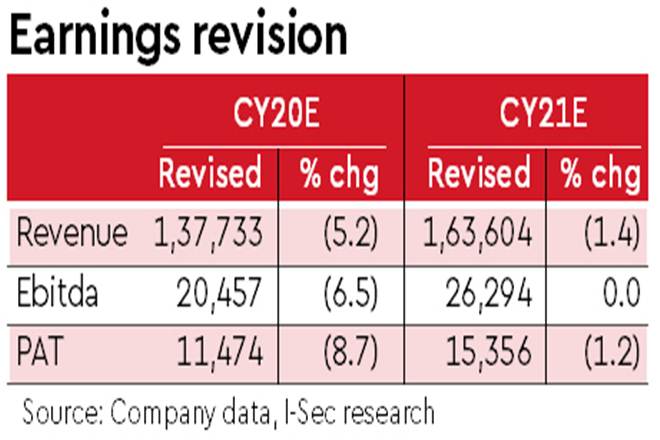

Factoring in the higher impact of COVID-19 lockdown, we reduce our CY20e Ebitda by 7% while broadly maintaining our CY21e estimates. Maintain Buy with the target price unchanged at Rs 1,520/share based on 9x Mar’22e EV/E.

Revenues declined by 11% y-o-y to Rs 34.3 bn: Grey cement realisation increased 1.5% q-o-q/declined by 1.6% y-o-y to Rs 4,576/te. Volumes including clinker declined 11% y-o-y to 6.74mnte owing to COVID-19 lockdown from 24th Mar’20. ACC has resumed operations at various plants w.e.f. 20th Apr’20 in a phased manner. Management expects overall demand to contract in FY21.

Blended Ebitda/te increased by a sharp 24% y-o-y to Rs 870/te: Cement Ebitda increased 11% y-o-y to Rs 5.4 bn with cement Ebitda/te also increasing 24% y-o-y to Rs 798/te. Cement cost/te declined by 5% y-o-y/4% q-o-q to Rs 3,881/te. Raw material (ex-inventory movement) cost/te declined by 16% y-o-y on optimisation of source mix and better supply chain management. Power & fuel cost/te increased 4% y-o-y due to lower sales volumes. PAT increased 31% y-o-y to Rs 3.2 bn (I-Sec: Rs 2.9 bn).

We factor in 1.8% volume CAGR over CY19-CY21E and expect Ebitda to increase marginally to Rs 853/te by CY21e from Rs 835/te in CY19. ACC had net cash of Rs 46 bn as of Dec’19 and is likely to generate OCF/incur capex of Rs 35 bn over CY20-CY21e. Valuation at 6.5x CY21e EV/E is attractive, in our view.