The Indian true wireless stereo (TWS), or hearables, market has been witnessing an exponential growth in players in the last one and a half years with more than 40 companies entering the fray. The market for wireless hearing aides grew significantly aided by an array of affordable products targeting gaming, office and online education segments.

“We have seen a phenomenal change in India’s TWS market with the entry of new players and frequent new launches.

More than 40 brands have entered this market since 2020. In the next quarter, we will see the entry of more brands (like Nothing Ear, Dizo and Micromax) across price tiers to grab a larger share of this untapped market,” senior analyst at Counterpoint Research Anshika Jain said.

Some of the new entrants in Q2 2021 were Lava, Aiwa and TCL. Low-cost offerings have provided the necessary boost to this segment. The share of the Rs 1,000-2,000 price band grew to 60% of the overall shipments in Q2 2021 compared to 25% in the same quarter last year, she added.

The market research agency noted that initiatives like the Production-Linked Incentive (PLI) scheme will help further expand this segment.

“Players are looking to make these devices locally to reap the benefits of the government’s PLI scheme. For instance, Mivi launched its first Made-in-India TWS device, DuoPods A25, during the quarter. Mivi is the second brand after pTron to launch a Made-in-India TWS product,” Counterpoint Research associate, Anam Padha said.

Another brand, boAt also decided to shift most of its manufacturing base to India to provide more affordable devices. The latest entrant, Aiwa, is also exploring a similar possibility, which indicates that more brands are likely to follow this path to offer new features at low price points, Padha added.

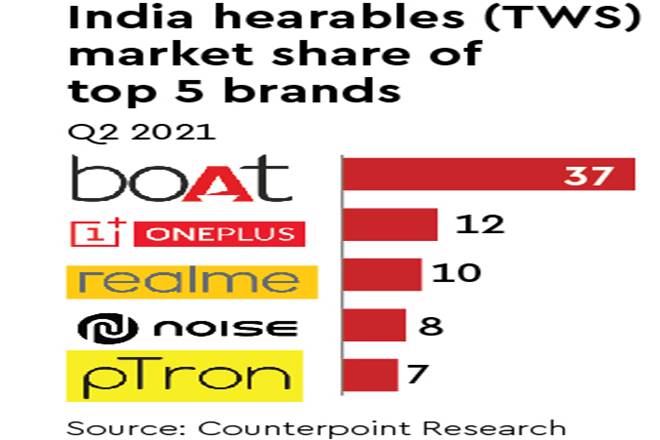

During April-June 2021, India’s TWS market grew 68% Y-o-Y driven by new launches in the affordable price segment along with improved features. boAt topped the charts for the fourth quarter in a row with a 37% share of the total shipments. It was followed by OnePlus, realme, noise and pTron.

“The market’s growth saw some resistance during April due to COVID-19 restrictions, including on e-commerce giants in some parts of the country. However, the other two months of the quarter met the pent-up demand and helped maintain the growth momentum,” Jain said.