By Asmita Dey

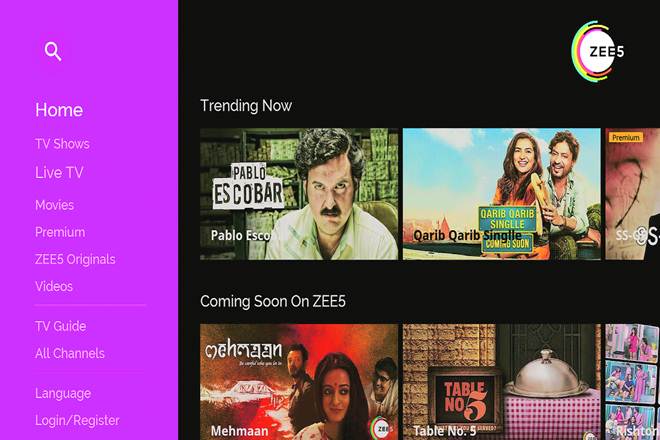

Even as the country’s over-the-top (OTT) market is seeing intense competition with the number of players operating in the segment growing by the day, entry of global majors, and distribution tie-ups with telecom operators increasing, homegrown Zee Entertainment’s OTT venture Zee5 is not worried. Its India CEO, Tarun Katial, says that the OTT’s rich assortment of Hindi and regional content gives it an edge over competitors.

“We do original and premium content in Tamil, Telugu, Marathi, Bengali, Hindi, Malayalam and even Kannada now. Nobody has this kind of depth of content. Our ability to work with premium story tellers across these markets, our ability to have a great movie library across these markets, our wide spread of content creators and teams in these markets… all this gives us a fair amount of edge. Our legacy of creating content and original content in so many languages in India with our TV channels is unparalleled,” Katial told FE in a phone interview.

A recent survey by the Boston Consulting Group noted that over 40% of consumers showed preference for content in regional languages.

Although global OTT players like Netflix and Amazon Prime which are slowly catching the fancy of the domestic viewers, are also increasingly getting into local content, analysts feel that ZEE5 may have an edge here because of its high recall value when it comes to regional content.

“While I understand that Amazon and Netflix are getting into the country, you must understand that our consumers are unique and their behaviours are differentiated between markets and our understanding is deep on that. Zee’s 25 years of legacy in being able to talk to these consumers and understand their triggers and barriers comes to great use here,” Katial said.

Although competitors should not be taken lightly, Katial said he is ‘happy to have them (Netflix and Amazon) around’ as it brings about an entire creation of an ecosystem of content.

Netflix which entered the local original series space in India with Sacred Games, thereafter producing slew of original content like Ghoul and the recent original movie Rajma Chawal, plans to release at least 10 original shows and movies annually in India. The global player also boasts of a significant regional content library. Amazon Prime, which already has original Telugu series GangStars in its kitty, recently announced a content library in Kannada, as the sixth regional language to have a dedicated content library.

The number of players in the domestic OTT market has witnessed a 3.5 times increase in the last six years growing from just 9 players in 2012 to 32 in 2018. Investment for original content by OTT players is increasing at a fast clip. In addition to live sports rights, the nature of shows produced is also evolving — tent-pole properties built for OTT are at a cost per hour of three to four times cost of traditional TV content, according to the BCG report.

Giving ZEE5 which claims to be India’s second most popular OTT platform a tough fight is largest player Hotstar. With exclusive partnership with Star, Indian Premier League, HBO Originals, analysts at Bank of America Merrill Lynch say that it offers the most diverse content.

ZEE5’s marketing strategy is very sharp, Katial said. “We talk to younxg Indians who speak the Indian language and consume the Indian content. He is a millennial who is proud about India, made in India stories about Indian content”.

The OTT platform that brought Karenjit Kaur, America Mappillai and Kallachirippu, among others, for audience has already garnered close to 41 million monthly active users as of September and Katial hopes this number will substantially grow when the December quarter results of the group are declared. ZEE, which no longer views itself as a TV broadcasting company but a content player, asserted that its digital platform is set to become the biggest producer of digital content in India given its original content pipeline. From 29 originals currently, ZEE5 aims to take the number to over 90 by next year.

ZEE5’s next tent-pole property Rangbaaz launches this month end. “We are having a very high grade marketing campaign rolling out almost as we speak as of today into most markets in the country,” Katial said.

In its second quarter earnings call, the management of ZEE Entertainment Enterprises said in five years, it expects ZEE5 to contribute 30% of the company’s overall topline. The company believes ZEE5 will break even in its fifth year of operation.

“The killer app in India is going to be exclusive and original content,” said Jehil Thakkar, head, media and entertainment, partner, Deloitte. “We have over 30 OTT apps in the country today. That is a battle for real estate on the phone. Why should a consumer download your app and keep it on and use it?

“They will only do that if you have original and exclusive content. Clearly, there is a significant opportunity in regional content because a quality library does not quite exist in most cases. If you want to win over small town rural India, the game has to be regional”.

Though the share prices of Zee Entertainment closed up 0.55% at `465.15 on the Bombay Stock Exchange on Wednesday, a day back it fell 7.97% to close at `462.60. Analysts attributed Tuesday’s fall to a downgrade of the stock by BofA Merrill Lynch to underperform citing expensive valuation amid slowing growth.