Rising distress: Approach 5% mark against 3% for non-farm loans

Within five years of the announcement of the government’s debt relief package for farmers, distress in the agricultural loan segment is building up once again with non-performing assets (NPA) seeing a sharp uptrend. Gross NPAs in the agriculture loan segment are inching up towards 5% compared with close to 3% for non-agriculture loans.

Bankers feel the NPA situation could worsen if the monsoons are weak leading to lower crop yields and agricultural incomes. The Reserve Bank of India governor D Subbarao said at a recent Nabard conference that there had been a 47% growth in agri npas in 2011-12.

Bankers feel the NPA situation could worsen if the monsoons are weak leading to lower crop yields and agricultural incomes. The Reserve Bank of India governor D Subbarao said at a recent Nabard conference that there had been a 47% growth in agri npas in 2011-12.

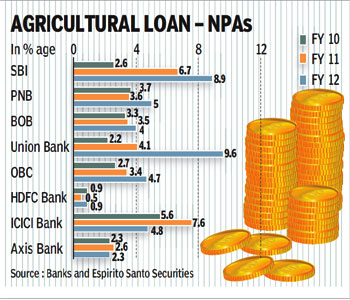

The country’s largest lender State Bank of India (SBI) saw a 72% year-on-year (yoy) jump in farm loan NPAs to R7,778 crore in 2011-12. In percentage terms the npas rose from 6.7% of agri advances to 8.9%. Union Bank also saw a sharp rise in its agri loan NPAs from 4.1% to 9.6% during the same period. Other large public sector lenders like Bank of Baroda (BoB) and Punjab National Bank (PNB) have also seen a rise in their agri sector NPA levels to 5% and 4% respectively, up from 3.6% and 3.5%.

Private sector banks have managed to keep their agri NPAs under check. HDFC Bank saw a small rise in NPA levels from 0.4% in 2010-11 to 0.9% in 2011-12 and ICICI Bank saw NPA levels fall from 7.6% to 4.8% and Axis Bank from 2.6% to 2.3%.

According to Nitesh Ranjan, economist at the Union Bank, public sector banks have seen a much larger rise in agri sector NPAs because they now recognise system-based NPAs. ?Under the manual recognition of NPAs, most PSU lenders did not recognise several agri and small sized accounts as NPAs. But now all accounts that have not seen interest payments for over 90 days and over are classified as NPAs,? said Ranjan.

A senior official from a private sector bank said that under political compuslions, public sector banks are sometimes asked to play a much larger role in the development of the country. ?In this process, they are exposed to a larger number of bad accounts,? he said.

Other bankers point that one major reason for the growing NPAs is the lagged effect of the rapid growth in lending to the farm segment over the last few years. As banks grew their agri loan books aggressively to meet the 18% advances book target, loan quality has suffered. Farm credit has witnessed double-digit growth over the last four years and the farm loan to GDP ratio has now risen to about 60% from about 40% in the early 2000s.

According to a report by Espirito Santo Securities, despite a fast growth in the farm lending, it is only PNB that has consistently met its agriculture sector sub-targets under the priority sector lending norms. BoB has started meeting its targets for the first time only in 2011-12. ?All banks including SBI are finding it difficult to meet meet the farm sector sub-targets because of the lower agri GDP growth,? the report said.

CMD of public sector lender Oriental bank of Commerce SL Bansal attributes the rise in farm sector NPAs to the moral hazard on account of the 2008 bailout package. This has resulted in a bad credit culture, he feels. With important elections coming up in the future, including the 2014 general election, there is an expectation that the farm sector will receive more government support, said Bansal. OBC saw its NPA levels rise from 3.4% in 2010-11 to 4.7% in 2011-12.